Home Loans are a pivotal element in the journey of homeownership, serving as the financial cornerstone for many individuals and families. This guide delves into the multifaceted world of home loans, exploring their various types, the application process, and the factors that influence approval. Understanding these elements is essential for making informed decisions and navigating the complexities of the real estate market.

From the intricacies of interest rates to the nuances of repayment options, each aspect plays a critical role in ensuring that prospective homeowners can secure the financing they need. With a clear understanding of home loans, borrowers can better position themselves for success in their quest for the perfect home.

Overview of Home Loans

Home loans, also known as mortgages, are financial products that allow individuals to borrow funds to purchase residential property. The primary purpose of a home loan is to enable homeownership, offering a pathway for people to achieve their dream of owning a home while spreading the repayment over an extended period. With various types of home loans available, borrowers can select options that best fit their financial situation and homeownership goals.A comprehensive understanding of home loans is essential for prospective buyers, as it informs them about their options and the implications of their financial commitments.

Home loans typically fall into several categories, each designed to cater to different needs and circumstances. The most common types of home loans include fixed-rate mortgages, adjustable-rate mortgages (ARMs), interest-only mortgages, and government-backed loans such as FHA and VA loans.

Types of Home Loans

The diversity of home loan options allows consumers to align their financing with their unique financial situations and long-term objectives. Each type of loan has distinct characteristics that can affect both monthly payments and overall costs. Below are some of the prominent types of home loans available in the market:

- Fixed-Rate Mortgages: These loans maintain the same interest rate throughout the duration of the loan, providing borrowers with predictable monthly payments. This stability is advantageous for long-term budgeting.

- Adjustable-Rate Mortgages (ARMs): ARMs typically start with a lower initial interest rate that can fluctuate over time based on market conditions. While they may offer lower initial payments, they can become more expensive if interest rates rise.

- Interest-Only Mortgages: Borrowers pay only the interest for a specified period, after which they begin repaying the principal. This option may be appealing to those who expect their income to increase or plan to sell before the principal payments commence.

- Government-Backed Loans: These include FHA loans, which are designed for low-to-moderate-income borrowers, and VA loans, which cater to veterans and active-duty military personnel. Both types often require lower down payments and have favorable terms.

Understanding the various home loan types helps borrowers make informed decisions that align with their financial capabilities and housing aspirations.

Importance of Interest Rates in Home Loans

Interest rates play a critical role in determining the total cost of a home loan, influencing both monthly payments and the overall financial burden of borrowing. The interest rate is essentially the cost of borrowing money, expressed as a percentage of the loan amount. Several factors can affect interest rates, including economic conditions, inflation, and the credit profile of the borrower.

A lower interest rate can significantly decrease the total cost of the mortgage, thus making it more affordable over the life of the loan. For instance, a $300,000 loan with a 4% interest rate will incur far less interest over 30 years than a similar loan with a 6% interest rate.

“The interest rate can be one of the most significant factors in determining the total amount paid over the lifespan of a home loan.”

It is essential for borrowers to shop around and compare different lenders to secure the best interest rates available to them. This practice can lead to substantial savings and enhance overall financial wellness when investing in real estate.

The Home Loan Application Process

The home loan application process is a critical step in achieving your goal of homeownership. Understanding the intricacies involved can significantly streamline the experience and minimize potential obstacles. This segment Artikels the essential steps, necessary documentation, and common challenges associated with applying for a home loan.

Steps Involved in Applying for a Home Loan

The home loan application process typically involves several sequential steps that guide applicants from initial considerations to final approval. The following steps are crucial for a smooth experience:

- Pre-approval: Begin by contacting lenders to obtain pre-approval, which assesses your creditworthiness and provides a budget range.

- Application Submission: Fill out a comprehensive loan application form that captures your personal and financial information.

- Documentation Collection: Gather all necessary documents (detailed in the next section) to support your application.

- Loan Processing: Once submitted, the lender processes your application, verifying your information and assessing risk.

- Underwriting: A designated underwriter reviews your application and supporting documents to determine eligibility and finalize loan terms.

- Closing: If approved, the final step involves signing the loan agreement and completing the transaction, allowing you to obtain your new home.

Necessary Documentation for a Home Loan Application

To facilitate a seamless application process, specific documentation is crucial. This documentation enables lenders to assess your financial situation and determine the level of risk involved in granting the loan. The following documents are typically required:

Essential documentation includes:

- Proof of Identity: Valid government-issued identification, such as a passport or driver’s license.

- Proof of Income: Recent pay stubs, tax returns, and W-2 forms to verify your earnings.

- Credit History: A credit report to assess your creditworthiness and financial responsibility.

- Employment Verification: A letter from your employer confirming your position and salary.

- Asset Statements: Bank statements and investment account statements demonstrating your financial reserves.

- Property Information: Details about the property being purchased, including the purchase agreement and disclosures.

Common Challenges in the Home Loan Application Process

Several challenges may arise during the home loan application process, potentially hindering progress. Recognizing these challenges and understanding how to address them can significantly enhance your chances of a successful outcome.

Challenges and their solutions include:

- Low Credit Scores: If your credit score is below the acceptable threshold, consider improving it by paying down debts and ensuring timely payments.

- Insufficient Income: If your income does not meet lender requirements, explore additional income sources or co-borrowers to strengthen your application.

- Incomplete Documentation: Avoid delays by preparing all necessary documents in advance. Create a checklist to ensure nothing is overlooked.

- High Debt-to-Income Ratio: If your debts exceed acceptable levels, look into consolidating debts or increasing income before applying.

Factors Influencing Home Loan Approval

Source: financialexpress.com

When applying for a home loan, several critical factors play a significant role in determining whether your application will be approved by lenders. Understanding these criteria is essential for prospective homeowners to enhance their chances of securing financing. Lenders meticulously evaluate various aspects of an applicant’s financial profile, ensuring they mitigate risks associated with lending money for home purchases.

Key Criteria for Loan Evaluation

Lenders typically assess multiple factors when evaluating home loan applications. The following criteria are central to the decision-making process:

- Credit Score: A pivotal factor, the credit score reflects an individual’s creditworthiness based on their credit history. Scores generally range from 300 to 850, with higher scores indicating lower risk for lenders.

- Debt-to-Income Ratio (DTI): This ratio compares an applicant’s total monthly debt payments to their gross monthly income. Lenders prefer a DTI of 43% or lower, although some may allow higher ratios based on compensating factors.

- Employment History: A stable employment record can positively influence loan approval. Lenders usually seek at least two years of consistent employment in the same field.

- Down Payment Amount: The size of the down payment affects both loan approval and the interest rate. Larger down payments may signal financial stability and reduce the lender’s risk.

Significance of Credit Scores and Financial History

Credit scores and financial history are integral to the home loan approval process. A higher credit score typically results in more favorable loan terms, including lower interest rates. Lenders utilize credit scores to gauge how well applicants manage their debts and financial obligations.

The importance of maintaining a good credit score cannot be overstated; it is often the first impression lenders have of a borrower.

Financial history encompasses not only credit scores but also other factors such as payment history, credit utilization, and types of credit accounts held. Lenders review this history to assess risk levels and determine the likelihood of timely payments. A clean financial history can significantly enhance the chances of loan approval.

Impact of Down Payments on Loan Approval

The amount of down payment made on a home can greatly influence the likelihood of loan approval. A down payment represents the initial cash payment toward the home’s purchase price, and it carries several implications:

- Lower Loan-to-Value (LTV) Ratio: A higher down payment reduces the LTV ratio, which is calculated as the loan amount divided by the appraised property value. A lower LTV can improve the chances of approval.

- Reduced Monthly Payments: A larger down payment decreases the loan amount, leading to lower monthly mortgage payments and a more manageable debt load.

- Avoiding Private Mortgage Insurance (PMI): In many cases, a down payment of 20% or more allows borrowers to forgo PMI, which can make monthly payments more affordable and attractive to lenders.

Overall, the amount put down not only influences approval odds but also the financial health of the mortgage throughout its term. Lenders view significant down payments as indicative of a borrower’s commitment and financial discipline, which can enhance the application’s appeal.

Types of Interest Rates on Home Loans

Understanding the different types of interest rates on home loans is essential for making informed borrowing decisions. The two primary types of interest rates are fixed-rate mortgages and adjustable-rate mortgages (ARMs). Each type comes with unique features and benefits, catering to varying financial situations and preferences.

Fixed-Rate Mortgages vs. Adjustable-Rate Mortgages

Fixed-rate mortgages offer a stable interest rate over the life of the loan, typically ranging from 15 to 30 years. This means that borrowers have predictable monthly payments, making it easier to budget and plan for the long term. On the other hand, adjustable-rate mortgages (ARMs) have interest rates that can fluctuate based on market conditions, usually starting with a lower initial rate for a specified period before adjusting periodically.The following scenarios illustrate when each type of interest rate may be beneficial:

- Fixed-Rate Mortgages: Ideal for borrowers who plan to stay in their homes long-term. For instance, a family purchasing their first home may prefer a fixed-rate mortgage to ensure stability in their monthly payments over the years.

- Adjustable-Rate Mortgages: Suitable for individuals who expect to move or refinance within a few years. For example, a young professional may choose an ARM for its lower initial rates, anticipating a job relocation before the first adjustment occurs.

Interest rates on home loans are influenced by various factors, including economic conditions, inflation, and monetary policy set by central banks. Market fluctuations can affect both fixed and adjustable rates; for instance, if inflation rises, lenders may increase rates to mitigate risk.The following key points highlight how interest rates are determined and can change over time:

- Economic Indicators: Metrics such as the unemployment rate and GDP growth influence interest rates. A robust economy typically leads to higher rates.

- Central Bank Policies: Decisions made by central banks regarding interest rates directly impact mortgage rates. For example, if the Federal Reserve raises rates to combat inflation, mortgage rates often follow suit.

- Market Demand: The supply and demand for mortgage-backed securities can cause fluctuations in interest rates. High demand for these securities usually results in lower rates for borrowers.

In summary, understanding the differences between fixed and adjustable rates, along with the factors that influence them, is crucial for prospective homebuyers. Making an informed decision can lead to significant long-term savings on mortgage payments and overall financial health.

Home Loan Repayment Options

Source: realestatediary.org

The repayment of a home loan is a critical aspect of home ownership that significantly impacts an individual’s long-term financial health. Understanding various repayment options allows borrowers to choose a plan that aligns with their financial capabilities and future goals. By selecting the right repayment strategy, homeowners can manage their finances effectively while ensuring a smooth and timely loan repayment process.The options for home loan repayments vary widely, each with distinct features and implications for long-term finances.

Selecting the right repayment plan can lead to substantial savings on interest payments and help borrowers pay off their loans more efficiently. Therefore, a thorough understanding of these options is essential for making an informed choice.

Types of Home Loan Repayment Options

There are several common repayment options available for home loans, each designed to cater to different financial situations and preferences. Understanding these options is crucial for effective financial planning.

- Standard Repayment Plan: This is the most common method where the borrower makes fixed monthly payments over the loan term. This plan provides predictability and allows for easier budgeting, but it may not allow for early repayment without penalties.

- Interest-Only Payments: In this scenario, the borrower pays only the interest for a specified period, which can be attractive for those looking for lower initial payments. However, once the interest-only period ends, the borrower must start paying off the principal, which can lead to higher payments later on.

- Graduated Repayment Plan: This plan starts with lower payments that increase over time. It is ideal for borrowers expecting their incomes to rise. While it offers immediate affordability, it may result in higher overall interest costs.

- Bi-Weekly Payments: Instead of making monthly payments, borrowers can choose to pay half of their monthly payment every two weeks. This method results in one extra payment per year, which can significantly reduce the loan principal and interest paid over time.

- Flexible Repayment Plans: Some lenders offer plans that allow borrowers to adjust their payment amounts or skip payments in certain months. This flexibility can be beneficial in times of financial difficulty, but it is essential to understand the potential costs associated with such options.

Implications of Different Repayment Plans

The choice of repayment plan can have a profound effect on a borrower’s financial future. Each option carries specific advantages and disadvantages that can influence total repayment amounts and overall financial wellbeing.

Choosing a repayment plan impacts not only monthly cash flow but also long-term financial obligations and interest paid over the life of the loan.

For example, a standard repayment plan offers predictability but may not be suitable for those who expect fluctuations in income. Conversely, an interest-only payment plan might appeal to those looking for short-term relief, but it risks ballooning payments in the future. Understanding these implications ensures that borrowers choose wisely according to their financial circumstances.

Tips for Managing Home Loan Repayments Effectively

Managing home loan repayments involves strategic planning and disciplined financial habits. Adopting effective strategies can help borrowers stay on track and avoid potential pitfalls.Effective management of home loan repayments includes the following tips:

- Establish a Budget: Create a detailed budget that includes all expenses, income, and loan repayments to ensure all financial obligations can be met.

- Set Up Automatic Payments: Enroll in automatic payment plans to avoid late payments and potential penalties while ensuring consistency in repayments.

- Build an Emergency Fund: Set aside funds to accommodate unexpected expenses that may impact repayment ability, ensuring financial stability.

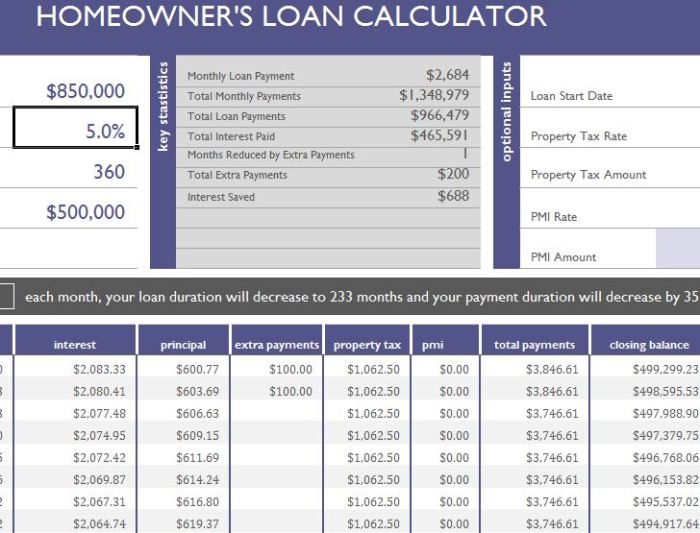

- Make Extra Payments: Whenever possible, make additional payments towards the principal. This can significantly reduce the total interest paid and shorten the loan duration.

- Review Loan Terms Regularly: Periodically reassess the loan terms and conditions to ensure they still align with financial goals, and consider refinancing if better options become available.

Refinancing Home Loans

Source: myexceltemplates.com

Refinancing a home loan involves replacing an existing mortgage with a new one, typically under different terms. This process can be beneficial in a variety of situations, such as obtaining a lower interest rate, changing loan types, or accessing home equity for other financial needs.Refinancing can be an advantageous financial strategy when interest rates decline, or when a borrower’s credit score improves significantly.

It may also be considered when one seeks to consolidate debt or switch from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage, thereby enhancing financial stability.

Step-by-Step Guide to Refinancing a Home Loan

Understanding the refinancing process is crucial for homeowners looking to improve their financial situation. The following steps Artikel how to successfully refinance a home loan:

1. Evaluate Your Current Loan

Assess the terms of your current mortgage, including the interest rate, remaining balance, and monthly payments. This evaluation will help determine potential benefits of refinancing.

2. Determine Your Goals

Identify what you want to achieve through refinancing, whether it’s securing a lower interest rate, reducing monthly payments, or accessing equity.

3. Research Lenders

Investigate various lenders to compare interest rates and terms. It’s advisable to consider banks, credit unions, and online lenders.

4. Check Your Credit Score

Since credit scores significantly influence loan terms, obtain your credit report and ensure it’s free from inaccuracies. A higher score may qualify you for better rates.

5. Gather Financial Documents

Prepare necessary documentation, including income verification, tax returns, and bank statements, as lenders will require this information for the application process.

6. Submit the Application

Fill out and submit the refinance application with your chosen lender. This will initiate the underwriting process.

7. Lock in Your Rate

If the terms are favorable, consider locking in your interest rate to protect against fluctuations during the closing process.

8. Close on the Loan

After approval, you’ll finalize the refinancing at a closing meeting, where you’ll sign documents and pay any closing costs.

Potential Risks and Rewards of Refinancing

Refinancing comes with both benefits and potential downsides that should be carefully considered.The rewards of refinancing can include:

- Lower Monthly Payments: A reduced interest rate can lead to significant savings on monthly mortgage payments.

- Shorter Loan Term: Refinancing to a shorter term can help pay off the loan faster, resulting in less interest paid overall.

- Access to Home Equity: Borrowers may extract equity from their home to fund renovations or consolidate higher-interest debt.

- Switching Loan Types: Changing from an ARM to a fixed-rate mortgage can provide payment stability.

However, refinancing also carries potential risks, such as:

- Closing Costs: Refinancing typically incurs closing costs, which can offset short-term savings unless the homeowner stays in the property long enough.

- Extended Loan Term: Opting for a new 30-year mortgage, even at a lower rate, can lead to paying more interest over the loan’s life.

- Impact on Credit Score: A new loan application can temporarily lower credit scores due to hard inquiries.

- Market Fluctuations: Rates can rise before the refinancing process is complete, potentially negating any anticipated savings.

In summary, while refinancing can be a beneficial financial decision, it requires careful consideration of both immediate and long-term impacts.

First-Time Homebuyer Programs

First-time homebuyer programs are designed to assist individuals and families in overcoming the financial barriers associated with purchasing their first home. These programs often provide various forms of support, including down payment assistance, favorable loan terms, and educational resources about the homebuying process. They aim to make homeownership more accessible and attainable for those entering the market for the first time.Several assistance programs are available for first-time homebuyers, each with unique benefits and eligibility requirements.

Understanding these options can help prospective buyers make informed decisions. Below are notable programs, along with their eligibility criteria and financial support features.

Types of First-Time Homebuyer Programs

Each program offers distinct benefits, and understanding the differences is crucial for first-time buyers. Below is a comparison of various major initiatives:

- Federal Housing Administration (FHA) Loans: FHA loans allow for lower down payments (as low as 3.5%) and are accessible to buyers with less-than-perfect credit. The mortgage insurance premiums may increase overall costs.

- USDA Rural Development Loans: These loans are aimed at low-to-moderate-income homebuyers in rural areas. They often require no down payment and have lower mortgage insurance costs. Eligibility typically depends on income level and location.

- VA Loans: Available to veterans and active-duty military members, VA loans require no down payment, do not require private mortgage insurance (PMI), and feature competitive interest rates. Eligibility is determined by service history and creditworthiness.

- State and Local First-Time Homebuyer Programs: Many states and municipalities provide specific programs, often including down payment assistance and grants. Eligibility criteria vary widely based on location, income level, and home price limits.

Understanding the financial support provided by these programs is vital. Below is a brief overview of their benefits:

| Program | Down Payment Requirement | Credit Score Requirement | Special Benefits |

|---|---|---|---|

| FHA Loans | 3.5% | 580+ | Lower mortgage rates for lower credit scores |

| USDA Loans | 0% | 640+ | No down payment, lower mortgage insurance |

| VA Loans | 0% | No minimum required | No PMI, competitive interest rates |

| State Programs | Varies | Varies | Grants and low-interest loans |

“First-time homebuyer programs provide essential pathways to homeownership, enabling individuals to make informed choices and secure their financial future.”

Impact of Economic Factors on Home Loans

The influence of economic factors on home loans is significant, as these elements dictate not only the rates offered by lenders but also the overall availability of loans. Understanding the interplay between economic indicators and home loans can help potential borrowers navigate the complexities of home financing. This relationship is particularly prominent in how inflation, interest rates, and economic downturns affect the mortgage landscape.

Influence of Economic Indicators on Home Loan Rates

Various economic indicators, such as employment rates, Gross Domestic Product (GDP), and consumer confidence, play a critical role in determining the rates and availability of home loans. When the economy is strong and these indicators are positive, lenders may offer more favorable loan terms. Conversely, during economic uncertainty, lenders often tighten their lending criteria, making it more challenging for borrowers to secure a mortgage.Inflation is a key driver of interest rates, which can significantly impact home loan costs.

When inflation rises, central banks typically respond by increasing interest rates to control spending and stabilize the economy. This results in higher mortgage rates for consumers. For instance, if inflation rises to 4%, the Federal Reserve may increase the benchmark interest rate to curb inflation, leading to an increase in home loan rates. Borrowers may find themselves facing higher monthly payments, which can limit their purchasing power in the housing market.

Relationship Between Inflation and Home Loan Interest Rates

Inflation directly affects the purchasing power of consumers and the cost of borrowing. As inflation increases, lenders anticipate a decrease in money value over time, prompting them to raise interest rates to compensate for the expected loss. Higher interest rates mean higher monthly payments for borrowers.Consider an example where the inflation rate rises from 2% to 5%. In this scenario, if the initial interest rate on a home loan is 3%, lenders may increase the rate to 5% or more in response to inflation, making it significantly more expensive for potential homeowners.

This relationship underscores the importance of monitoring inflation trends for anyone considering a home loan.

Effects of Economic Downturns on Home Loan Applications

Economic downturns can lead to a decrease in home loan applications due to increased unemployment and lower consumer confidence. During financial crises, lenders may tighten their requirements for credit scores and down payments, making it harder for potential buyers to qualify for a mortgage. For example, during the 2008 financial crisis, many lenders implemented strict lending standards, resulting in a dramatic decline in mortgage approvals.Additionally, in a recession, many individuals may delay purchasing homes, fearing job instability and financial uncertainty.

This reduced demand can lead to further tightening of lending criteria, creating a challenging environment for first-time homebuyers and those looking to refinance existing loans. The interplay of these economic factors emphasizes the importance of staying informed about the broader economic landscape when considering home financing options.

Legal Aspects of Home Loans

Understanding the legal aspects of home loans is essential for potential borrowers to navigate the complexities of securing financing for a property. Home loans involve significant financial commitments, and being informed about legal considerations can help borrowers avoid pitfalls and ensure they are protected throughout the process.One of the most important elements of home loans is the loan agreement. This document Artikels the terms and conditions, rights, and obligations of both the borrower and the lender.

A clear comprehension of these details is vital to prevent misunderstandings or disputes in the future.

Understanding Loan Agreements and Terms

The loan agreement is a legally binding contract, and it is critical to review it carefully before signing. Key components of a loan agreement include:

- Loan Amount: This is the principal amount that the borrower receives from the lender.

- Interest Rate: The rate at which interest will accrue on the unpaid balance, which can be fixed or variable.

- Repayment Schedule: This specifies the frequency and amount of payments due, including details on principal and interest.

- Fees and Closing Costs: All costs associated with securing the loan, which may include origination fees, appraisal fees, and title insurance.

- Prepayment Penalties: Any fees incurred if the borrower pays off the loan early.

It is advisable for borrowers to seek legal counsel or financial advice to fully understand the implications of these terms. Failing to grasp the nuances of the loan agreement can lead to severe financial consequences.

Consumer Protection Laws Related to Home Loans

Consumer protection laws play a critical role in safeguarding borrowers from unfair practices in the home loan process. Among these laws are:

- Truth in Lending Act (TILA): This legislation requires lenders to disclose vital information such as the annual percentage rate (APR) and total costs of the loan, enabling borrowers to make informed decisions.

- Real Estate Settlement Procedures Act (RESPA): This law mandates transparency in the closing process, ensuring borrowers receive accurate information regarding closing costs and prohibiting kickbacks or referral fees.

- Equal Credit Opportunity Act (ECOA): This law prohibits discrimination against borrowers based on race, color, religion, national origin, sex, marital status, or age, ensuring equal access to credit.

- Fair Housing Act: Aimed at preventing discrimination in housing-related transactions, this act protects consumers in their quest for housing finance.

Awareness of these laws empowers borrowers to recognize their rights and seek recourse in the event of violations. Engaging with reputable lenders who adhere to these regulations can enhance the overall lending experience.

“Understanding your legal rights and obligations as a borrower is crucial for a successful home loan experience.”

Conclusion

In conclusion, navigating the landscape of home loans requires careful consideration and a thorough understanding of the various components involved. By familiarizing oneself with the types of loans available, the application process, and the factors affecting approval, individuals can approach the home-buying process with confidence. Ultimately, being well-informed empowers borrowers to make decisions that align with their financial goals and pave the way for a successful homeownership experience.

Essential Questionnaire

What is the difference between a mortgage and a home loan?

A mortgage is a type of home loan specifically used to purchase real estate, where the property serves as collateral for the loan.

Can I get a home loan with bad credit?

While securing a home loan with bad credit is challenging, some lenders offer options such as FHA loans that cater to borrowers with lower credit scores.

How does a down payment affect my loan?

A larger down payment can reduce your loan amount, lower monthly payments, and may improve your chances of loan approval by demonstrating financial stability.

What is private mortgage insurance (PMI)?

PMI is insurance that protects lenders if a borrower defaults on a loan, often required when the down payment is less than 20% of the home’s value.

How long does it take to get approved for a home loan?

The approval process typically takes anywhere from a few days to several weeks, depending on the lender and the completeness of your application.