Car Insurance Michigan serves as a vital pillar for drivers across the state, weaving a complex tapestry of regulations, coverage options, and economic factors. With its unique no-fault insurance system, Michigan stands apart, offering a blend of mandatory requirements and diverse coverage types that cater to various needs. Understanding this landscape is crucial for navigating the intricacies of insurance premiums, claims processes, and the evolving legislative framework.

This overview will delve into the fundamental aspects of car insurance in Michigan, highlighting essential coverage requirements, the types of insurance available, and the key factors influencing rates. As we journey through these topics, we will uncover valuable insights that empower drivers to make informed choices about their insurance needs.

Overview of Car Insurance in Michigan

Source: cheapcarinsuranceco.com

Car insurance in Michigan is governed by a unique set of regulations tailored to meet the needs of its residents. Understanding these regulations is crucial for individuals looking to navigate the complexities of car insurance in the state. This overview provides insights into the basic framework of vehicle insurance requirements and the significance of the no-fault system, which distinguishes Michigan from other states.The Michigan car insurance framework requires drivers to adhere to specific coverage mandates that are designed to protect both drivers and passengers in the event of an accident.

The law emphasizes the importance of having adequate insurance to cover medical expenses, property damage, and other liabilities arising from vehicular incidents.

Mandatory Coverage Requirements for Drivers

In Michigan, all drivers must carry specific types of insurance coverage. These requirements are essential to ensure that both drivers and their passengers are protected. The following are the mandatory coverage components:

- Personal Injury Protection (PIP): This coverage pays for medical expenses and rehabilitation costs for you and your passengers, regardless of who is at fault in an accident. It also covers lost wages and replacement services.

- Property Protection Insurance (PPI): PPI covers damage to another person’s property, such as their vehicle or home, caused by your vehicle. This is crucial, especially in urban areas where property damage is more common.

- Residual Bodily Injury and Property Damage Liability (BI/PD): While Michigan’s no-fault system reduces the need for this coverage, it is still required to cover injury and property damage claims that exceed PIP limits, particularly in cases where you are found at fault.

The combination of these coverages ensures comprehensive protection while driving in Michigan, aligning with state mandates to safeguard motorists and pedestrians alike.

Significance of the No-Fault Insurance System

Michigan operates under a no-fault insurance system, which significantly influences how claims are processed after an accident. This system is designed to streamline compensation for medical costs and lost wages, minimizing the need for litigation over liability disputes. Under this system, the following points are particularly notable:

- Immediate Benefits: No-fault insurance allows injured parties to receive compensation for their medical bills and lost income without having to demonstrate fault. This facilitates quicker recovery and financial assistance for those affected by accidents.

- Reduced Litigation: By limiting the ability to sue for damages unless severe injury is involved, the no-fault system contributes to a decrease in court cases related to car accidents, which can overwhelm the legal system.

- Increased Premiums: While the no-fault system provides several benefits, it has also led to discussions about rising insurance premiums in Michigan, prompting lawmakers to consider reforms to ensure affordability for all drivers.

Overall, the no-fault insurance system not only impacts how drivers handle accidents but also shapes the broader landscape of car insurance in Michigan, making it a pivotal aspect of the state’s vehicular regulations.

Types of Car Insurance Coverage Available

Source: carinsurance.com

Car insurance in Michigan encompasses a variety of coverage options designed to protect drivers from financial loss due to accidents, theft, or other incidents. Understanding these coverage types is crucial for selecting a policy that suits individual needs and complies with state requirements.In Michigan, drivers must be aware of the different types of car insurance coverage available, including liability, collision, comprehensive, and uninsured motorist coverage.

Each of these coverage types serves distinct purposes and can significantly affect your financial protection on the road.

Coverage Types Overview

The following table provides a comparison of the main types of car insurance coverage available in Michigan, showcasing their key features and differences:

| Coverage Type | Description | Situations Where Necessary |

|---|---|---|

| Liability Coverage | Covers damages to another person’s vehicle or medical expenses if you are at fault in an accident. | In an accident where you are responsible for damages or injuries to another party. |

| Collision Coverage | Covers damages to your vehicle resulting from a collision with another vehicle or object. | When you hit another vehicle or object, such as a tree or pole. |

| Comprehensive Coverage | Protects against non-collision-related damages to your vehicle, including theft, vandalism, and natural disasters. | If your car is stolen or damaged by a natural disaster, such as a hailstorm. |

| Uninsured Motorist Coverage | Provides protection if you are involved in an accident with a driver who has no insurance. | When you are hit by a driver who is uninsured or underinsured. |

Understanding these coverage types helps drivers make informed decisions regarding their car insurance policies, ensuring adequate protection for themselves and others on the road. Each coverage type plays a pivotal role in mitigating risks associated with vehicle ownership and driving in Michigan.

Factors Affecting Car Insurance Rates in Michigan

Car insurance rates in Michigan are influenced by a variety of factors that insurers consider when determining premiums. Understanding these elements can help drivers make informed choices and potentially lower their insurance costs. Rates vary widely based on individual circumstances, making it essential to grasp the key aspects that contribute to premium calculations.Several determinants come into play when assessing car insurance rates in Michigan, including age, driving history, and credit score.

Insurers analyze these factors to evaluate risk levels associated with policyholders. Each of these elements not only influences the likelihood of filing a claim but also reflects the overall financial responsibility of the driver.

Age and Driving Experience

Age is a significant factor in determining car insurance rates. Younger drivers, particularly those aged 16 to 25, tend to face higher premiums due to their inexperience on the road. Statistical data reveals that this demographic is more likely to be involved in accidents, resulting in higher costs for insurers. Conversely, drivers aged 30 and above usually benefit from lower rates, as they have established a proven track record of safe driving.

Driving History

A driver’s history is another crucial aspect that impacts insurance premiums. Insurers evaluate past driving behavior, including the number of accidents, traffic violations, and claims made. A clean driving record generally leads to lower premiums, while incidents such as speeding tickets or at-fault accidents can significantly increase rates. Statistics show that drivers with one or more claims within the past three years can see their premiums rise by an average of 20% or more.

Credit Score Influence

Credit scores are increasingly being used by insurers as a measure of risk. A higher credit score often correlates with lower premiums, as individuals with good credit are viewed as more responsible and less likely to file claims. Conversely, drivers with poor credit scores may face significantly higher rates. Research indicates that individuals with excellent credit can save up to 30% on their car insurance compared to those with poor credit ratings.

Demographic Statistics

Demographic factors, including gender and location within Michigan, also play a role in determining insurance rates. For instance, urban areas tend to have higher rates due to increased traffic and higher accident rates compared to rural locations. Additionally, female drivers generally enjoy lower premiums compared to male drivers, primarily due to statistical data demonstrating that women are less likely to engage in risky driving behaviors.

| Demographic Factor | Average Insurance Rate |

|---|---|

| Young Drivers (16-25) | Approximately $3,000 annually |

| Middle-Aged Drivers (30-50) | Approximately $1,200 annually |

| Drivers with Good Credit | Approximately $800 annually |

| Urban Drivers | Approximately $2,500 annually |

In conclusion, understanding the interplay of age, driving history, credit score, and demographic factors can empower Michigan drivers to make informed decisions regarding their car insurance coverage, potentially leading to more favorable rates.

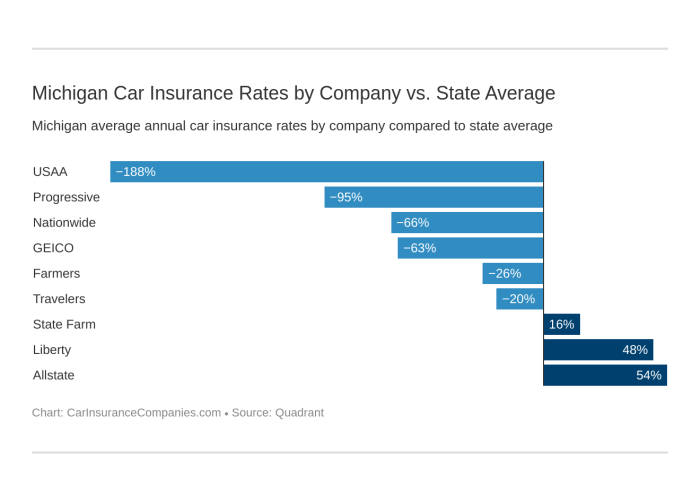

Finding the Right Car Insurance Provider

Choosing the right car insurance provider is a pivotal step toward ensuring your peace of mind while driving in Michigan. With numerous options available, it is essential to conduct thorough research to find an insurance company that aligns with your specific needs and circumstances. A well-informed decision can save you both money and hassle in the long run.Researching and comparing car insurance providers in Michigan involves several methods that can help you identify the best fit for your needs.

Start by leveraging online resources, such as comparison websites that allow you to see multiple quotes side by side. Additionally, consulting customer reviews and ratings can provide insight into the experiences of other policyholders. Local insurance agents can also be invaluable sources of information, offering personalized guidance and recommendations based on their knowledge of the Michigan market.

Criteria for Selecting a Reliable Insurance Company

Identifying a trustworthy car insurance provider involves evaluating various criteria. The following points are essential for making an informed choice:

- Financial Stability: Investigate the company’s financial health through ratings from agencies like A.M. Best or Standard & Poor’s.

- Coverage Options: Ensure the provider offers a range of coverage options to meet your specific needs, including liability, collision, and comprehensive coverage.

- Policy Customization: Look for companies that allow you to tailor your policy to fit your budget and coverage requirements.

- Pricing Transparency: Choose a company that provides clear and straightforward pricing without hidden fees.

- Discounts: Check for available discounts that can lower your premiums, such as safe driver or multi-policy discounts.

- Customer Service: Evaluate the accessibility and helpfulness of their customer service, especially in times of need.

- Claims Process: Understand how easy it is to file a claim and the efficiency of the process.

The importance of customer service and claims handling cannot be overstated in the selection process. A provider with excellent customer service is essential for addressing your inquiries promptly and effectively. Moreover, the claims handling process is critical; you want a company that processes claims fairly and quickly.

“A reliable insurance company not only provides coverage but also supports you during challenging times.”

Understanding the provider’s claims handling process can provide reassurance that you will receive the support you need when it matters most. The right car insurance provider will not only meet your coverage needs but also offer peace of mind through exceptional service and reliable claims support.

Discounts and Savings Opportunities

In the competitive landscape of car insurance in Michigan, many providers offer a variety of discounts that can significantly reduce premium costs. These savings opportunities are designed to reward responsible behavior and help policyholders save money while maintaining adequate coverage. Understanding these discounts can empower consumers to make informed decisions regarding their insurance policies.Insurance companies typically provide several types of discounts, each aimed at specific categories of drivers.

By taking advantage of these offerings, policyholders can lower their overall expenses without compromising the quality of their coverage.

Available Discounts on Car Insurance

There are numerous discounts available for car insurance in Michigan, which can lead to substantial savings. Below is a summary of common discounts and their eligibility criteria:

- Safe Driver Discount: This discount is available for drivers who maintain a clean driving record, free from accidents and violations for a specified period, typically three to five years.

- Multi-Policy Discount: Policyholders who purchase multiple types of insurance (such as home and auto from the same provider) can qualify for this discount, often resulting in a percentage reduction on their premiums.

- Good Student Discount: Students who maintain a GPA of 3.0 or higher are eligible for this discount, which acknowledges their responsible behavior both academically and behind the wheel.

The importance of understanding these discounts cannot be overstated, as they present an excellent opportunity for drivers to save significantly on their insurance costs.

Potential Savings from Discounts

The following table illustrates the potential savings that drivers in Michigan could experience by taking advantage of various discount programs offered by insurance providers:

| Discount Type | Potential Savings | Eligibility Criteria |

|---|---|---|

| Safe Driver Discount | Up to 20% | No accidents or violations for 3-5 years |

| Multi-Policy Discount | Up to 15% | Purchase multiple policies (e.g., auto and home) |

| Good Student Discount | Up to 10% | GPA of 3.0 or higher; must be a full-time student |

| Bundling Discount | Up to 25% | Combine auto insurance with other types of insurance |

These discounts not only help in reducing premiums but also encourage safe driving habits and responsible choices among policyholders. The realization of these savings can contribute significantly to the overall cost-effectiveness of car insurance in Michigan. By exploring these discounts, drivers can ensure they are making the most of their insurance options while minimizing expenses.

Common Claims and How to File Them

In Michigan, drivers often encounter various situations that necessitate filing car insurance claims. Understanding the common types of claims and the process involved in filing them is crucial for drivers to ensure they receive the coverage they need in a timely manner. This section provides an overview of the most frequent claims made by Michigan drivers, along with a detailed guide on how to effectively file those claims.

Common Types of Claims Filed by Michigan Drivers

Insurance claims can arise from several circumstances, with the most common types including:

- Collision Claims: These claims arise when a vehicle is damaged due to a collision with another vehicle or object, such as a tree or a pole.

- Comprehensive Claims: This type of claim is filed for damage to a vehicle caused by non-collision events, such as theft, vandalism, or natural disasters.

- Liability Claims: Often filed when the driver is at fault in an accident that causes injury or property damage to another party.

- No-Fault Claims: Michigan’s no-fault insurance system allows drivers to file claims for medical expenses and lost wages regardless of who caused the accident.

Step-by-Step Process of Filing a Car Insurance Claim

Filing a car insurance claim in Michigan involves several important steps. Adhering to this process helps ensure that claims are handled efficiently:

- Contact Your Insurance Company: Notify your insurer as soon as possible after an accident. Most companies have a dedicated claims hotline.

- Provide Necessary Information: Be prepared to give details about the accident, including date, time, location, and parties involved.

- Document the Incident: Gather evidence such as photographs of the accident scene, vehicle damage, and any relevant witness statements.

- Complete Claim Forms: Fill out the necessary claim forms provided by your insurer, ensuring all information is accurate and comprehensive.

- Follow Up: Stay in contact with your insurer to track the progress of your claim and provide any additional information they may require.

Documenting an Accident for Claims Purposes

Proper documentation is vital in supporting your claim and ensuring that you receive appropriate compensation. Effective documentation includes:

- Photographs: Take clear pictures of all vehicles involved, as well as the accident scene. Highlight any damage and relevant roadway conditions.

- Police Report: If applicable, obtain a copy of the police report, as this can serve as an official account of the accident.

- Witness Information: Collect contact information from any witnesses present at the scene to corroborate your account of events.

- Medical Records: Keep records of any medical treatment received as a result of the accident, as these will be essential for personal injury claims.

“Accurate and thorough documentation can significantly impact the outcome of your insurance claim.”

Understanding the No-Fault Insurance System

Source: carinsurancecompanies.com

The no-fault insurance system is a unique feature of Michigan’s auto insurance landscape, designed to streamline the process of obtaining compensation after an accident. Under this system, drivers can receive benefits for their injuries and damages without needing to determine fault or blame for the accident. This approach aims to reduce litigation and expedite the claims process, ultimately providing quicker access to necessary medical care and financial support.In Michigan, the no-fault system requires drivers to purchase Personal Injury Protection (PIP), which covers medical expenses, rehabilitation costs, and lost wages resulting from an accident, regardless of who is at fault.

Additionally, property damage coverage and liability insurance are also required. This system is distinct from traditional liability-based insurance models, which often require proving fault to receive compensation.

Benefits and Drawbacks of the No-Fault System

The no-fault insurance system offers several advantages and a few disadvantages for drivers in Michigan. Understanding these can help policyholders make informed decisions regarding their auto insurance.The benefits of the no-fault system include:

- Faster Claims Processing: Victims do not need to establish fault, meaning claims can be settled more quickly, allowing for immediate access to medical care and other necessary services.

- Comprehensive Coverage: PIP provides extensive coverage for medical bills and rehabilitation, which can help ensure that drivers receive the necessary care without incurring significant out-of-pocket expenses.

- Reduced Litigation: The system minimizes the need for lawsuits, which can be time-consuming and expensive, thereby decreasing the overall legal costs associated with accidents.

Conversely, the drawbacks include:

- Higher Premiums: The extensive coverage provided by PIP can lead to higher insurance premiums compared to states with traditional liability insurance models.

- Limited Recovery for Non-Economic Damages: Under the no-fault system, recovery for pain and suffering and other non-economic damages is often restricted, which may not fully compensate individuals for their experiences following an accident.

- Complexity in Coverage Options: Michigan’s no-fault law includes various options and limits, which can be confusing for drivers trying to determine the best level of coverage for their needs.

Comparison with Traditional Liability-Based Insurance Models

The no-fault system differs significantly from traditional liability insurance models in several key aspects, influencing how drivers approach their coverage options and claims.In traditional liability-based insurance:

- Fault Determination: Compensation is contingent upon establishing who is at fault for the accident, which can lead to disputes among insurance companies and delays in claims processing.

- Limited Coverage: Drivers typically purchase liability coverage to protect against claims made by others, with their own injuries covered by separate health insurance policies, leading to potential gaps in coverage.

- Increased Legal Involvement: Disputes over fault and the amount owed often result in litigation, increasing costs and extending the time it takes to resolve claims.

The no-fault system aims to eliminate many of these issues, providing drivers with a more straightforward method of obtaining compensation. However, it also introduces complexities and potential financial burdens, making it imperative for Michigan drivers to understand their options and make informed insurance choices.

Changes and Trends in Car Insurance Legislation

Recent developments in car insurance legislation in Michigan have significantly impacted both consumers and providers. The introduction of new laws has not only altered the landscape of insurance offerings but has also influenced the costs associated with vehicle coverage. Staying informed about these changes is crucial for individuals and businesses alike to navigate their insurance needs effectively.The Michigan car insurance market has seen several notable legislative changes in recent years.

One of the most significant reforms was the implementation of the no-fault insurance law in 2020, which aimed to provide more affordable options for drivers while maintaining essential coverage. This shift allowed consumers to choose their level of Personal Injury Protection (PIP) coverage, which directly affects their premiums. The changes have prompted many drivers to reassess their insurance policies, leading to a more competitive marketplace.

Recent Legislative Changes

The evolution of car insurance regulations in Michigan has included crucial adjustments that affect consumers directly. Key changes include:

- Choice of PIP Coverage: Drivers can now choose from various coverage levels, ranging from unlimited to a $50,000 cap. This flexibility allows consumers to tailor their policies to their budgetary needs.

- Price Comparison Tools: New regulations mandate that insurers provide clear comparisons of rates and coverage options, enabling consumers to make informed decisions.

- Mandated Discounts: Insurance companies are required to offer specific discounts for drivers who meet certain criteria, such as those who complete defensive driving courses or maintain a good driving record.

- Out-of-Pocket Medical Cost Limits: The law has established caps on out-of-pocket medical expenses for injured drivers, providing additional financial protection.

Impact on Consumers and Providers

The legislative changes have had profound implications for both consumers and insurance providers. For consumers, the ability to select their PIP coverage has led to substantial savings on premiums. Many drivers have reported reductions in their overall insurance costs, making car ownership more financially accessible. Insurance providers, on the other hand, are adjusting to the need for competitive pricing in a dynamic market.

The requirement to offer clearer price comparisons has prompted many companies to enhance their customer service and technological capabilities, ensuring they attract and retain policyholders effectively.

Predictions for Future Trends

As the landscape of car insurance continues to evolve, several trends are expected to shape the future of policies in Michigan. Analysts forecast that technology will play an increasingly significant role in both the pricing and management of car insurance. Examples of future trends may include:

- Telematics Insurance: The use of devices that monitor driving behavior is likely to become more prevalent, allowing insurers to offer personalized premiums based on individual driving habits.

- Increased Use of Artificial Intelligence: AI tools may be employed for claim processing and risk assessment, streamlining operations for providers.

- Health Insurance Integration: Future policies may see a merging of health and car insurance, allowing for comprehensive coverage that addresses both medical and vehicle-related incidents.

- Enhanced Consumer Education: As the market continues to evolve, insurance companies will likely invest more in educating consumers about their choices and the specifics of their coverage.

The insurance market in Michigan is poised for continued transformation, driven by consumer demand for more flexibility and transparency.

Ultimate Conclusion

In conclusion, navigating the realm of car insurance in Michigan is both a necessity and a responsibility for all drivers. By grasping the nuances of coverage types, understanding the implications of no-fault legislation, and being aware of available discounts, individuals can not only protect themselves but also enjoy potential savings. As the landscape of car insurance continues to evolve, staying informed will ensure that drivers are well-prepared for the road ahead.

Detailed FAQs

What is the minimum car insurance requirement in Michigan?

The minimum requirement includes Personal Injury Protection (PIP), Property Protection Insurance (PPI), and residual liability coverage for bodily injury and property damage.

How does the no-fault system work?

The no-fault system allows drivers to seek compensation for accident-related injuries from their own insurance company, regardless of who is at fault, simplifying the claims process.

What should I do if I am involved in an accident?

Immediately check for injuries, report the accident to the police, document the scene, and contact your insurance provider to initiate the claims process.

Are there discounts for safe drivers in Michigan?

Yes, many insurance providers offer discounts for maintaining a clean driving record, completing defensive driving courses, or having no at-fault accidents.

How can I lower my car insurance premiums?

You can lower your premiums by shopping around for quotes, increasing your deductible, bundling policies, and taking advantage of available discounts.