Online Loans For Bad Credit provides an essential insight into the financial solutions available to individuals facing credit challenges. These loans are specifically designed to assist those who may have been overlooked by traditional lending institutions, offering a much-needed lifeline in times of financial strain. With the rise of online lending platforms, accessing these loans has become increasingly convenient, allowing borrowers to find suitable options tailored to their unique circumstances.

This guide will delve into the various types of online loans available for individuals with bad credit, Artikel the eligibility criteria, and explore the application process. By understanding these key elements, borrowers can make informed decisions and navigate the lending landscape with confidence.

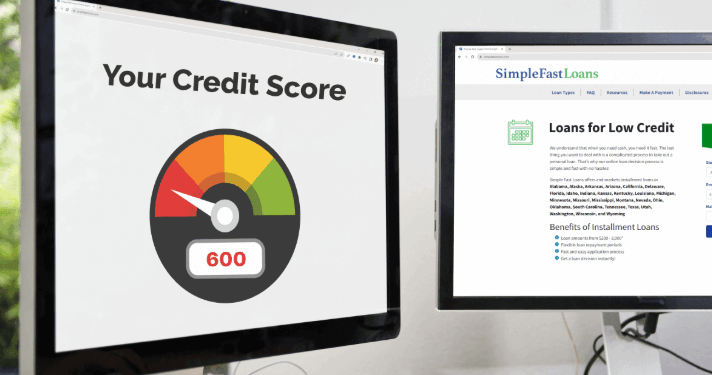

Understanding Online Loans for Bad Credit

Source: creditninja.com

Online loans for bad credit are financial products designed to assist individuals whose credit histories may not meet the standards set by traditional lending institutions. These loans aim to provide access to funds for those in need, regardless of their credit score. The rise of online lending platforms has revolutionized the borrowing process, making it more accessible, faster, and often more convenient for borrowers with less-than-ideal credit histories.Various types of loans are available for individuals with bad credit, catering to different financial needs.

These may include personal loans, payday loans, and secured loans, each with distinct features and requirements. Understanding these options is crucial for borrowers to find a solution that best fits their financial situation.

Types of Online Loans for Bad Credit

The following types of loans are commonly offered to individuals with bad credit, each serving unique purposes and catering to different financial circumstances:

- Personal Loans: These are unsecured loans that can be used for various purposes, such as debt consolidation, medical expenses, or unexpected bills. They typically have higher interest rates due to the increased risk associated with lending to individuals with bad credit.

- Payday Loans: Short-term, high-cost loans designed to cover immediate expenses until the borrower receives their next paycheck. While they are accessible, they often come with extremely high interest rates and should be approached with caution.

- Secured Loans: Loans that require collateral, such as a vehicle or savings account, to back the loan. This type of loan may be easier to obtain for those with bad credit since the lender can reclaim the collateral if the borrower fails to repay.

- Title Loans: A type of secured loan where the borrower uses their vehicle as collateral. While this allows for quick access to funds, it also carries the risk of losing the vehicle if repayments are not made.

- Installment Loans: These loans allow borrowers to receive a lump sum upfront and repay it over time through fixed monthly payments. They can be beneficial for those needing larger amounts of money and who prefer structured repayment plans.

The importance of online lending platforms cannot be overstated when it comes to accessing loans for bad credit. These platforms operate without the traditional banking barriers and can offer a streamlined application process, often with quick approval times. Additionally, many online lenders utilize advanced algorithms to assess risk, enabling them to provide loans to individuals who may otherwise be denied by traditional banks.

“Online lending platforms have democratized access to credit, allowing individuals with bad credit to secure loans in a more efficient and less stigmatized manner.”

Overall, online loans for bad credit represent a critical resource for individuals facing financial challenges. Understanding the types of loans available and the role of online lenders helps borrowers navigate their options and make informed financial decisions.

Eligibility Criteria for Bad Credit Loans

Obtaining a loan with bad credit may seem challenging, but understanding the eligibility criteria can make the process smoother. Lenders typically have specific requirements that applicants must meet to qualify for loans designed for individuals with poor credit history. Recognizing these criteria is crucial for anyone seeking financial assistance, as it helps in preparing the necessary documentation and improving the chances of approval.Lenders evaluate bad credit applications through various factors to determine an applicant’s overall creditworthiness.

While credit scores play a significant role, they are not the sole basis for approval. Other elements, such as income level, existing debt, employment status, and financial history, contribute to the decision-making process. These considerations help lenders assess whether the borrower can manage the loan repayment alongside their existing financial obligations.

Common Eligibility Requirements

Several common requirements are consistently observed among lenders when processing applications for bad credit loans. Understanding these can assist applicants in preparing to meet the necessary conditions effectively.

- Minimum Credit Score: Most lenders set a minimum credit score requirement, which may vary depending on the institution. Some may accept scores as low as 580, while others might require a score of 620 or higher.

- Stable Income: A consistent source of income is crucial, as it demonstrates the ability to repay the loan. Lenders often seek proof of steady employment or alternative sources of income, such as social security or disability benefits.

- Debt-to-Income Ratio: This ratio compares monthly debt payments to monthly income. Lenders typically prefer a ratio lower than 40%, indicating that the borrower has sufficient income to cover existing debts and new loan repayments.

- Residency Status: Applicants must be residents of the country where they are applying for the loan and provide proof of residence, such as utility bills or rental agreements.

- Age and Identification: Borrowers must be at least 18 years old, and valid identification, such as a driver’s license or passport, is required to verify identity.

“Understanding the criteria set by lenders allows applicants to better prepare their financial profile for loan consideration.”

Factors Influencing Loan Eligibility

In addition to the common requirements, several critical factors play a significant role in evaluating bad credit applications. Lenders analyze these elements to gauge the risk associated with lending to a particular borrower.

- Income Stability: A higher and consistent income increases the likelihood of approval. Lenders assess not only the amount but the source of income, with full-time employment being preferable.

- Existing Debt Obligations: The total amount of existing debt impacts eligibility. High levels of debt may signal that a borrower is over-leveraged, which might lead to rejection.

- Credit History: Lenders will review the applicant’s credit report for patterns of repayment, defaults, or bankruptcies, which can affect their decision regardless of the credit score.

- Loan Purpose: The intended use of the loan can also impact eligibility. Lenders may be more inclined to approve loans that are for consolidating debt or necessary expenditures rather than discretionary spending.

“Lenders take a holistic view of an applicant’s financial profile, considering both income and existing obligations before making a lending decision.”

Pros and Cons of Online Loans for Bad Credit

Online loans for individuals with bad credit offer a unique financial opportunity in a challenging situation. These loans provide access to funds that may not be available through traditional financial channels, enabling borrowers to address urgent financial needs. However, understanding the benefits and drawbacks is crucial for making informed decisions.

Advantages of Online Loans Compared to Traditional Loans

When considering loans for bad credit, it is essential to evaluate how online loans stack up against traditional loans. Below is a comparative table highlighting the advantages of online loans.

| Criteria | Online Loans | Traditional Loans |

|---|---|---|

| Application Process | Fast, often completed online within minutes. | Lengthy, often requiring in-person visits and paperwork. |

| Approval Rates | Higher approval rates for bad credit borrowers. | Stricter credit checks and lower approval rates. |

| Funding Speed | Funds may be available within hours to a few days. | May take weeks to receive funds. |

| Accessibility | Accessible 24/7 from anywhere with internet access. | Limited to business hours and locations. |

| Loan Amounts | Variety of loan sizes to suit individual needs. | Tends to offer fewer options for smaller amounts. |

Potential Downsides of Online Loans for Bad Credit

While online loans present several advantages, borrowers must also be aware of the potential downsides. These risks include higher interest rates, predatory lending practices, and the possibility of falling into a cycle of debt. Higher interest rates are often associated with online loans for bad credit due to the perceived risk lenders take on. Borrowers with poor credit histories may be charged interests that are significantly higher than those offered to borrowers with good credit.

This can result in increased monthly payments and total repayment amounts.

It is essential for potential borrowers to carefully review loan terms and conditions, as well as to shop around for the best rates available.

Additionally, some online lenders may engage in predatory lending, which can include hidden fees, unclear loan terms, or aggressive collection practices. Therefore, borrowers should ensure they are dealing with reputable lenders by conducting thorough research and reading customer reviews.

Interest Rates for Online Loans for Bad Credit Compared to Other Types of Loans

Interest rates for online loans aimed at bad credit borrowers tend to be higher than those for traditional loans. This disparity can be attributed to several factors, including the higher risk associated with lending to individuals with poor credit histories. Typically, online lenders may charge interest rates ranging from 6% to 36%, depending on the lender and the borrower’s credit profile.

In contrast, traditional loans often have lower rates, sometimes starting at around 3% to 5% for individuals with good credit.It is essential for borrowers to calculate the total cost of the loan, factoring in interest rates, fees, and the repayment term. A clear understanding of these elements will help in making a more informed borrowing decision, ensuring that the loan taken out aligns with the borrower’s financial capacity and goals.

The Application Process for Online Loans

Source: money.com

Applying for an online loan can be a straightforward process, particularly for individuals with bad credit who may face various challenges in securing financial assistance. Understanding the steps involved in the application process is vital for enhancing the chances of securing a loan successfully. This section Artikels the complete application process, providing essential tips to help applicants navigate through it effectively.

Step-by-Step Process for Applying for an Online Loan

The application process for online loans typically involves several key steps. Understanding each step can streamline the experience and minimize potential delays. The following steps Artikel the typical process:

- Research Lenders: Begin by researching lenders who offer loans for individuals with bad credit. Look for reputable online lenders with transparent terms and positive customer reviews.

- Pre-qualification: Many lenders provide a pre-qualification process that allows you to see potential loan offers without affecting your credit score. This step helps you compare options.

- Gather Documentation: Compile necessary documentation such as proof of identity, income verification, bank statements, and any other required financial information to support your application.

- Complete the Application Form: Fill out the lender’s application form accurately. Be prepared to provide details about your employment, income, and financial situation.

- Submit the Application: Once the application form and required documents are completed, submit them through the lender’s online platform. Ensure you have reviewed everything for accuracy.

- Review Loan Offers: After submitting your application, review any loan offers you receive. Pay close attention to the interest rates, repayment terms, and any fees associated with the loan.

- Accept the Loan Offer: If the terms are agreeable, accept the loan offer. Follow the lender’s instructions for finalizing the loan agreement.

- Receive Funds: Once the loan is approved and the agreement is signed, the lender will typically disburse the funds to your bank account within a few business days.

Gathering Necessary Documentation for Loan Applications

Preparing the required documentation is a crucial part of the loan application process. Having all necessary documents organized can significantly improve the efficiency of your application. Here are key documents typically required:

Essential documentation may include identity verification, proof of income, and bank statements.

- Proof of Identity: A government-issued ID such as a driver’s license or passport is often required to verify your identity.

- Income Verification: This can include recent pay stubs, tax returns, or bank statements that demonstrate consistent income.

- Credit History: While lenders may conduct their own credit checks, being aware of your credit history can help you understand your position.

- Bank Statements: Providing recent bank statements can illustrate your financial stability and ability to repay the loan.

Improving Chances of Approval During the Application Process

Several strategies can enhance the likelihood of loan approval for individuals with bad credit. Being proactive and strategic can make a difference in the outcome of your application.

Improving your financial profile and choosing the right lender can significantly influence loan approval.

Some effective strategies include:

- Improve Your Credit Score: If possible, take steps to improve your credit score prior to applying, such as paying down debts or correcting inaccuracies on your credit report.

- Consider a Co-signer: Having a co-signer with better credit can improve your chances of approval as it reassures lenders of repayment.

- Borrow a Smaller Amount: Requesting a smaller loan amount can make it more manageable for lenders to approve your application.

- Demonstrate Stable Income: Showing stable employment and a steady income can reassure lenders of your ability to repay the loan.

Alternative Options to Online Bad Credit Loans

When seeking financial solutions with bad credit, it is essential to explore various options beyond online loans. These alternatives can provide individuals with different pathways to secure funding and improve their overall financial situation. By understanding the available choices, borrowers can make informed decisions that best suit their needs and circumstances.One significant alternative to online loans for bad credit is personal loans from credit unions.

Credit unions typically offer lower interest rates and more flexible lending criteria compared to traditional banks, making them a viable option for individuals with poor credit histories. Engaging with a credit union can often lead to personalized service, as they typically have a vested interest in their members’ financial well-being.

Comparison of Online Loans for Bad Credit and Personal Loans from Credit Unions

The differences between online loans for bad credit and personal loans from credit unions can significantly impact borrowers’ experiences. Below are key points to consider when evaluating these options:

- Interest Rates: Credit unions generally offer lower interest rates compared to many online lenders, leading to potential savings over the loan term.

- Approval Process: Credit unions may provide a more comprehensive evaluation of a borrower’s financial situation, which can be beneficial for those with bad credit.

- Loan Terms: Credit unions often provide more flexible repayment terms, allowing borrowers to select a plan that fits their budget.

- Membership Requirements: Access to credit unions may require membership eligibility, which can involve specific criteria, unlike many online lenders.

Another alternative financing option to consider is peer-to-peer lending. This approach connects borrowers directly with individual investors through online platforms. Borrowers can present their financial needs, and investors can choose to fund their loans based on the perceived risk and potential return. Peer-to-peer lending can offer favorable interest rates and is often more accessible to those with bad credit.

Overview of Other Financing Options

Apart from personal loans from credit unions and peer-to-peer lending, other financing options such as secured loans can be appealing for individuals with bad credit. Secured loans involve pledging collateral, such as a vehicle or savings account, to secure the loan. This collateral reduces the lender’s risk, often resulting in lower interest rates and easier approval processes. Additionally, government assistance programs can provide crucial support for individuals facing financial difficulties due to bad credit.

These programs may offer grants, subsidized loans, or even financial counseling. Here are some notable government initiatives:

- Low-Income Home Energy Assistance Program (LIHEAP): This program assists low-income households in paying energy bills, which can alleviate financial strain.

- Supplemental Nutrition Assistance Program (SNAP): Providing food assistance to eligible individuals can help free up funds for other expenses.

- Federal Housing Administration (FHA) Loans: These loans assist borrowers with bad credit in obtaining home financing, as they are backed by the government and have more lenient credit requirements.

In summary, exploring these alternative options to online loans for bad credit can empower borrowers to make informed financial decisions. By comparing personal loans from credit unions, understanding peer-to-peer lending, considering secured loans, and utilizing available government programs, individuals can find the most suitable financing solutions for their unique situations.

Tips for Managing Loans Responsibly

Source: bankrate.com

Managing loans responsibly is critical for anyone, especially for individuals with bad credit. Understanding effective strategies can prevent financial pitfalls and pave the way to a stable financial future. This section provides essential tips aimed at helping borrowers maintain control over their online loans, ensuring they meet their repayment obligations without falling into a cycle of debt.

Strategies for Managing Repayments

Establishing a structured repayment plan is vital for managing online loans effectively. Creating a budget that includes loan repayments can significantly reduce financial strain. This involves assessing all income sources and expenses to determine how much can be allocated towards loan repayment without jeopardizing other financial commitments.

- Create a budget: Track your income and expenses to identify areas where you can cut back, allowing more funds to be allocated to loan repayments.

- Set up automatic payments: Automating repayments can ensure that payments are made on time, thereby avoiding late fees and potential damage to your credit score.

- Communicate with lenders: If you’re facing challenges in making payments, reach out to your lender to discuss options. They may offer flexible repayment plans or deferments.

Avoiding a Debt Cycle

Falling into a debt cycle is a common pitfall for individuals using online loans for bad credit. To avoid this, it’s important to prioritize paying off existing debts before taking on new ones. Each decision regarding borrowing should be carefully weighed against potential long-term consequences.

- Limit additional borrowing: Resist the temptation to take out more loans to cover existing debts, as this can lead to a spiraling debt cycle.

- Prioritize high-interest debts: Focus on paying off loans with the highest interest rates first, as this will save money in the long run and reduce financial pressure.

- Utilize financial counseling: Seeking advice from a financial counselor can provide personalized strategies for managing debts effectively and avoiding future borrowing.

Improving Credit Scores Post-Loan Acquisition

Improving credit scores involves responsible management of borrowed funds and can significantly impact future borrowing opportunities. After acquiring a loan, it is essential to maintain good financial habits that positively influence creditworthiness.

- Timely payments: Consistently making payments on time is one of the most effective ways to enhance your credit score. Each on-time payment contributes positively to your credit history.

- Keep credit utilization low: If applicable, maintain a low ratio of credit used compared to the total credit available, as high utilization can negatively affect your score.

- Review credit reports: Regularly checking your credit report for errors or discrepancies allows you to address issues that may be adversely affecting your credit score.

Resources for Further Assistance

Accessing financial resources when facing bad credit challenges is crucial for navigating the landscape of loans and improving one’s financial health. Understanding where to find reputable lenders, credit counseling services, and helpful online tools can empower individuals to make informed decisions.

Reputable Online Lenders for Bad Credit

Several online lenders specialize in providing loans to individuals with bad credit. These lenders offer varying terms, interest rates, and loan amounts tailored to meet diverse financial needs. Selecting a reputable lender is essential to ensure transparency and fair lending practices. Below is a list of some well-regarded online lenders:

- Avant

-Offers personal loans up to $35,000 with quick approval times and flexible repayment options. - BadCreditLoans.com

-A platform connecting borrowers to a network of lenders willing to work with bad credit scores. - LendingPoint

-Provides personal loans based on income and credit history, focusing on borrowers with lower credit scores. - Upstart

-Uses alternative data for loan approval, considering education and job history along with credit scores. - OneMain Financial

-Offers secured and unsecured personal loans with a commitment to transparent lending practices.

Credit Counseling Services for Bad Credit Issues

Credit counseling services can play a vital role in helping individuals manage their debt and improve their credit score. These organizations provide guidance, support, and financial education to empower borrowers. Below are some reputable credit counseling services:

- National Foundation for Credit Counseling (NFCC)

-A well-established nonprofit organization providing credit counseling and financial education. - Credit.org

-Offers credit counseling, debt management plans, and financial education resources. - Consumer Credit Counseling Service (CCCS)

-Provides free or low-cost services to help individuals manage their credit and debts. - GreenPath Financial Wellness

-Offers counseling services focusing on budgeting, debt management, and improving credit scores. - Money Management International (MMI)

-A nonprofit credit counseling agency providing a range of financial services and education.

Online Tools and Calculators for Loan Affordability

Utilizing online tools and calculators can assist borrowers in assessing their loan affordability and understanding their financial capacity. These resources help individuals make informed decisions before taking on new debt. Below are some valuable online tools:

- Loan Calculator

-This tool allows borrowers to input loan amounts, interest rates, and repayment terms to calculate monthly payments. - Debt-to-Income Ratio Calculator

-Measures the ratio of an individual’s total monthly debt payments compared to their gross monthly income, helping to determine borrowing capacity. - Budgeting Apps

-Applications such as Mint or YNAB (You Need A Budget) assist users in tracking expenses, managing budgets, and planning for loan repayments. - Credit Score Simulator

-This tool helps borrowers understand how different actions, like paying down debt or applying for new credit, can impact their credit score. - Interest Rate Comparison Tool

-A resource that enables users to compare interest rates from multiple lenders to find the best loan offers available.

Closing Notes

In summary, Online Loans For Bad Credit present both opportunities and challenges for borrowers seeking financial relief. By understanding the pros and cons, eligibility requirements, and effective management strategies, individuals can responsibly utilize these loans to improve their financial situation. As we conclude this discussion, it is crucial to remember that informed decision-making and responsible borrowing play vital roles in achieving financial stability.

FAQ Section

What is the typical interest rate for online loans for bad credit?

The interest rates for online loans for bad credit can vary significantly but often range from 6% to 36%, depending on the lender and the borrower’s credit profile.

How long does it take to receive my funds after approval?

Once approved, borrowers can typically expect to receive their funds within one to three business days, depending on the lender’s processing times.

Can I improve my credit score while repaying an online loan?

Yes, making timely repayments on an online loan can positively impact your credit score over time, demonstrating responsible borrowing behavior.

Are there any hidden fees associated with online loans for bad credit?

Some lenders may charge origination fees, late payment fees, or prepayment penalties, so it is essential to review the loan agreement carefully before signing.

Is it possible to refinance an online loan for bad credit?

Yes, refinancing an online loan for bad credit is possible and may help borrowers secure better terms or lower interest rates, provided they have improved their credit score.