Fixed Home Equity Loan Rates are a pivotal element in home financing, offering homeowners the opportunity to leverage their property’s equity while benefiting from the stability of fixed repayment terms. Understanding these rates is essential not only for securing favorable loan conditions but also for making informed financial decisions that align with one’s long-term goals.

These loans differ significantly from variable-rate options, providing predictability in budgeting and repayment. As we delve deeper into this subject, we will explore the factors influencing these rates, the pros and cons of various financing options, and strategies for obtaining the most competitive rates available in today’s market.

Overview of Fixed Home Equity Loan Rates

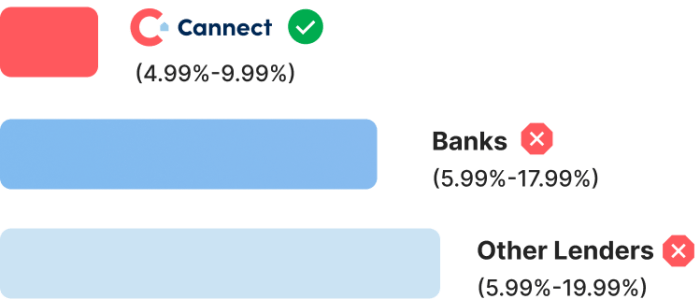

Source: cannect.ca

Fixed home equity loan rates play a crucial role in home financing, offering homeowners the opportunity to leverage the equity built in their properties. These loans provide a stable interest rate throughout the life of the loan, allowing for predictable monthly payments, which is particularly beneficial for budgeting purposes. Understanding the nature of fixed home equity loan rates is essential for homeowners looking to tap into their home equity without exposing themselves to the fluctuations typical of variable-rate loans.The process of obtaining a fixed home equity loan typically involves several key steps.

Initially, homeowners must assess their equity, which is the difference between the current market value of their home and any outstanding mortgage balances. Next, they will need to research and compare loan offers from various lenders to find the most competitive rates and terms. After selecting a lender, the application process commences, requiring financial documentation and a credit assessment. Once approved, homeowners can access a lump sum of cash, which can be used for various purposes, including home renovations, debt consolidation, or educational expenses.

Differences Between Fixed Rates and Variable Rates

Understanding the differences between fixed rates and variable rates is essential for homeowners to make informed decisions regarding home equity loans. Fixed rates offer stability and predictability, as the interest rate remains the same throughout the term of the loan. In contrast, variable rates fluctuate with market conditions, which can result in varying monthly payments over time. The following points highlight the key differences between fixed and variable rates:

- Interest Rate Stability: Fixed rates provide consistent payments, while variable rates can change, potentially increasing overall costs.

- Market Sensitivity: Variable rates are influenced by the economy and interest rate trends, making them less predictable.

- Loan Terms: Fixed loans may offer terms ranging from five to thirty years, while variable loans can have shorter terms that adjust more frequently.

- Overall Cost: In some cases, fixed rates may result in higher initial interest rates, but they guard against future rate increases, providing long-term cost savings.

“Fixed home equity loans are designed to offer financial predictability, while variable loans carry inherent risks tied to market fluctuations.”

Factors Influencing Fixed Home Equity Loan Rates

Fixed home equity loan rates are influenced by a multitude of economic factors, creditworthiness of borrowers, and specific loan characteristics. Understanding how these elements interact can provide clarity for potential borrowers seeking to navigate the lending landscape effectively.

Economic Factors Affecting Fixed Home Equity Loan Rates

Several economic indicators play a vital role in determining fixed home equity loan rates. Key factors include:

- Interest Rates: The overall interest rate environment, influenced by central bank policies and inflation rates, directly impacts home equity loan rates. When the Federal Reserve raises rates, borrowing costs typically increase, leading to higher fixed rates.

- Economic Growth: A robust economy often results in increased consumer confidence and higher demand for loans, which can push rates up. Conversely, during economic downturns, lenders may lower rates to stimulate borrowing.

- Housing Market Conditions: The state of the housing market, including home prices and sales volume, affects the risk perceived by lenders. A declining market may lead to increased rates as lenders hedge against potential losses.

Impact of Borrower Credit Scores on Rates

Credit scores serve as a critical indicator of a borrower’s creditworthiness and significantly affect the rates offered for fixed home equity loans. Higher credit scores typically correlate with more favorable loan terms.

- Excellent Credit (750+): Borrowers with excellent credit often receive the most competitive rates, reflecting their low risk to lenders.

- Good Credit (700-749): Those in this range may still secure reasonable rates, though not as low as those with excellent credit.

- Fair Credit (650-699): Borrowers may face higher rates as they are perceived as riskier, impacting affordability.

- Poor Credit (below 650): Individuals with poor credit often encounter the highest rates or may be denied altogether, as lenders seek to mitigate potential losses.

Role of Loan-to-Value Ratios in Rate Determination

The loan-to-value (LTV) ratio is a crucial metric used by lenders to evaluate risk when extending fixed home equity loans. It represents the loan amount relative to the appraised value of the property.

- Lower LTV Ratios: A lower LTV indicates that the borrower has significant equity in their home, minimizing lender risk and often resulting in lower rates.

- Higher LTV Ratios: A higher LTV signifies that the borrower has less equity, increasing perceived risk for the lender, which typically leads to higher rates.

- Standard LTV Thresholds: Many lenders prefer LTV ratios below 80%. Loans exceeding this threshold may incur higher rates or private mortgage insurance, adding to the overall cost.

Understanding the interplay between economic factors, borrower credit scores, and LTV ratios is essential for securing favorable fixed home equity loan rates.

Benefits of Choosing Fixed Home Equity Loan Rates

Choosing a fixed home equity loan rate can provide numerous advantages for homeowners. These distinct benefits offer a sense of stability and reassurance amid the fluctuating nature of interest rates in the broader economy. By understanding these benefits, homeowners can make informed decisions that best suit their financial needs and long-term goals.One of the primary advantages of fixed home equity loan rates is the predictability they provide in loan repayments.

With a fixed rate, homeowners can accurately forecast their monthly payments, which remains consistent throughout the life of the loan. This predictability is essential for effective financial planning and can significantly alleviate stress associated with fluctuating interest rates that come with variable loans.

Predictability in Fixed Home Equity Loan Repayments

The clarity that fixed home equity loan repayments offer can simplify personal finance management for homeowners. Knowing the exact amount due each month allows individuals to plan their budgets effectively, ensuring that they can allocate funds appropriately for other expenditures.For instance, a homeowner with a fixed rate of 4.5% on a $50,000 loan will have a consistent monthly payment of approximately $1,000 over a 5-year term.

This consistency enables the homeowner to save for future goals, such as college tuition for children or retirement, without the worry of increased payments due to rising interest rates.

Assistance in Budgeting for Homeowners

Fixed home equity loan rates play a crucial role in assisting homeowners with budgeting. Since the payments remain constant, individuals can integrate these expenses into their monthly financial plans without concern for potential rate hikes.For instance, if a homeowner anticipates a rise in living costs, having a fixed loan payment means that they can adjust their budget elsewhere to accommodate these changes without worrying about fluctuating interest rates.

This stability can support homeowners in maintaining a balanced financial life and achieving their long-term objectives.

Situations Where Fixed Rates are Preferable to Variable Rates

There are specific scenarios where fixed rates are generally more advantageous than variable rates. Homeowners who plan to stay in their homes for an extended period may find fixed rates particularly beneficial, as they can lock in lower rates for the duration of the loan.Another example includes homeowners who are risk-averse and prefer the certainty of fixed payments over the potential volatility of variable rates.

In the current economic climate, where interest rates are gradually rising, a fixed rate can protect against future increases, thereby securing a better financial position over time.In summary, the benefits of choosing fixed home equity loan rates encompass predictability in repayments, assistance in budgeting, and suitability for specific financial situations, making them an attractive option for many homeowners seeking stability in their financial commitments.

Comparing Fixed Home Equity Loan Rates with Alternatives

When considering financing options, it is essential to evaluate different alternatives to fixed home equity loans. This comparison allows homeowners to make informed decisions that suit their financial needs. Fixed home equity loans, often used for major expenses or debt consolidation, can be measured against personal loans and home equity lines of credit (HELOCs) to understand their advantages and disadvantages.

Comparison of Fixed Home Equity Loan Rates to Personal Loan Rates

Fixed home equity loans typically offer lower interest rates compared to personal loans. Personal loans are usually unsecured, meaning they do not require collateral, leading lenders to charge higher rates to mitigate risk. Borrowers with strong credit profiles may qualify for competitive rates on personal loans, but these rates often remain higher than those available for fixed home equity loans.For instance, as of October 2023, fixed home equity loan rates ranged from 4% to 8%, while personal loan rates spanned from 6% to 15%.

Borrowers should note that personal loans typically have shorter repayment terms, often ranging from 3 to 7 years, compared to the 5 to 30 years often associated with fixed home equity loans.

Detailed Breakdown of Fixed Rates Against Home Equity Lines of Credit (HELOC)

Home equity lines of credit (HELOCs) offer a flexible borrowing option that allows homeowners to draw against their equity as needed. Unlike fixed home equity loans, which have a consistent interest rate throughout the life of the loan, HELOCs often have variable interest rates that can fluctuate based on market conditions. This variability can pose risks to borrowers if rates increase significantly over time.When comparing these two options, homeowners should consider the following differences:

Interest Rate Structure

Fixed home equity loans have a stable interest rate, providing predictable monthly payments, while HELOCs have variable rates that can change, complicating repayment planning.

Flexible Borrowing

HELOCs allow for borrowing as needed up to a certain limit, making them suitable for ongoing expenses. Conversely, fixed home equity loans provide a lump sum upfront.

Repayment Terms

Fixed home equity loans generally offer longer repayment terms, which can ease monthly payments. HELOCs may require interest-only payments during the draw period, which can lead to larger payments later on.

Pros and Cons of Fixed Home Equity Loans vs. Other Financing Options

Understanding the advantages and disadvantages of fixed home equity loans compared to personal loans and HELOCs is crucial for making a suitable financial choice. Below is a table highlighting these factors:

| Financing Option | Pros | Cons |

|---|---|---|

| Fixed Home Equity Loans |

|

|

| Personal Loans |

|

|

| HELOC |

|

|

Current Trends in Fixed Home Equity Loan Rates

The landscape of fixed home equity loan rates is influenced by a multitude of factors, including economic conditions, interest rate fluctuations, and changes in housing market dynamics. In recent months, these elements have engendered notable trends that potential borrowers should be aware of when considering fixed home equity loans. This analysis delves into current market trends, recent statistical changes, and regional variations in fixed home equity loan rates.

Market Trends Influencing Fixed Home Equity Loan Rates

The current market environment has seen a modest increase in fixed home equity loan rates, largely due to the Federal Reserve’s ongoing adjustments to interest rates aimed at combating inflation. Over the past year, average fixed home equity loan rates have experienced fluctuations, generally ranging from 5% to 7%, with a notable spike in mid-2023. According to data from the Mortgage Bankers Association, the average rate for fixed home equity loans rose from approximately 5.5% in January to around 6.8% by September, reflecting the broader trends in the lending market.

Regional Differences in Fixed Home Equity Loan Rates

Regional variations play a significant role in the determination of fixed home equity loan rates across the United States. Factors influencing these differences include local economic conditions, property values, and demand for home equity financing. For instance, states with higher home values such as California and New York typically exhibit slightly higher fixed home equity loan rates compared to states with more affordable housing markets like Ohio or Texas.To illustrate this, a comparison of average fixed home equity loan rates across several states reveals the following:

| State | Average Fixed Home Equity Loan Rate (%) |

|---|---|

| California | 6.9 |

| New York | 6.7 |

| Texas | 6.3 |

| Ohio | 6.1 |

These rates indicate that borrowers in states with higher property values may pay more for home equity loans, while those in regions with lower home values can benefit from comparatively lower rates. Understanding these trends and regional disparities is crucial for potential borrowers, as they navigate the fixed home equity loan landscape in pursuit of favorable financing options.

How to Secure the Best Fixed Home Equity Loan Rates

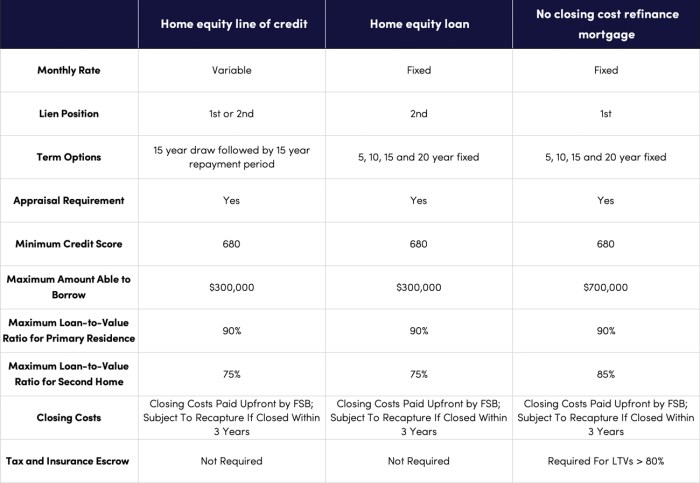

Source: 802cu.com

Homeowners seeking fixed home equity loan rates can take several proactive steps to improve their chances of obtaining more favorable terms. Understanding the nuances of loan offers, as well as the marketplace dynamics, can empower borrowers to negotiate effectively and select the best options available.

A critical strategy involves enhancing one’s financial profile, which lenders assess to determine risk. Factors such as credit score, debt-to-income ratio, and overall financial health significantly influence loan terms. Homeowners should also consider the competitive landscape among lenders to ensure they are making well-informed decisions. Comparing multiple lenders will often yield better rates and terms.

Strategies to Improve Loan Offers

To enhance the likelihood of securing lower fixed home equity loan rates, homeowners can implement the following strategies, focusing on key financial aspects:

- Improve Credit Score: A higher credit score can lead to better interest rates. Homeowners should check their credit report for errors and work to pay down existing debts to boost their scores.

- Reduce Debt-to-Income Ratio: Lenders prefer borrowers with a lower debt-to-income ratio. Homeowners can achieve this by paying off loans or increasing their income, thereby showcasing stronger cash flow.

- Increase Home Equity: A higher equity percentage in the home may result in better loan terms. Homeowners might consider making extra mortgage payments or waiting until property values rise before applying.

- Choose the Right Loan Amount: Borrowing only what is necessary can keep the loan-to-value ratio favorable, potentially securing lower rates.

Shopping around for different loan offers is equally vital. Homeowners should seek multiple lenders, including traditional banks, credit unions, and online lenders, to compare rates and terms.

Evaluation Checklist for Loan Offers

To streamline the assessment of various loan offers, homeowners can utilize the following checklist, enabling them to make well-rounded comparisons:

- Interest Rate: What is the offered interest rate, and is it fixed for the entire loan term?

- APR: What is the annual percentage rate that reflects the true cost of the loan, including fees?

- Fees and Closing Costs: Are there any origination fees or closing costs? Understanding these can affect the overall loan cost.

- Loan Terms: What is the duration of the loan? Evaluate how the term length affects monthly payments and total interest paid.

- Repayment Flexibility: What options are available for repaying the loan? Consider whether there are penalties for early repayment.

- Customer Service: What is the lender’s reputation for customer service? Research reviews and seek recommendations.

By following these strategies and utilizing the checklist, homeowners can confidently navigate the market for fixed home equity loans, ultimately securing better rates and terms that align with their financial objectives.

Impact of Fixed Home Equity Loan Rates on Financial Planning

Source: five-starbank.com

Fixed home equity loan rates can have a significant influence on an individual’s long-term financial strategies. By providing predictable monthly payments, these rates allow homeowners to plan their finances with greater clarity and confidence. Understanding the implications of these fixed rates is essential, especially when it comes to achieving financial goals and managing retirement plans.The stability offered by fixed home equity loan rates can play a crucial role in long-term financial planning.

With fixed rates, homeowners can take advantage of consistent monthly payments, which aids in budgeting and cash flow management. This predictability can align with various financial goals, such as saving for a child’s education, investing in a business, or enhancing retirement savings.

Implications for Retirement Planning

Incorporating fixed home equity loans into retirement planning can yield several advantages and considerations. Given their structured payment plans, these loans can help retirees manage their cash flow effectively while leveraging their home equity.One key aspect is that homeowners nearing retirement can use fixed home equity loans to consolidate debt or fund necessary home improvements. This can increase the value of their property, making it easier to sell or leverage further down the line.

Here are some important factors to consider:

- Debt Consolidation: Retirees can use fixed home equity loans to pay off higher-interest debt, freeing up more of their retirement income for other expenses.

- Home Improvements: Investing in home renovations can significantly increase property value, providing better financial returns if the home is sold.

- Cash Flow Management: Fixed payments provide predictability, allowing retirees to manage their monthly budgets more effectively and avoid unexpected financial stress.

- Access to Liquidity: Home equity loans can offer liquidity in times of need, providing funds for emergencies or unexpected expenses without liquidating retirement savings.

Considering these aspects, homeowners should also evaluate how the fixed home equity rates align with their overall financial strategy. For instance, securing a fixed-rate loan at a lower interest rate can be a strategic move for homeowners planning for retirement.

“Consistent monthly payments from fixed home equity loans can simplify financial planning, ensuring homeowners can allocate resources efficiently towards their retirement goals.”

Homeowners should carefully weigh these factors, incorporating fixed home equity loans into their broader financial strategy. Assessing current financial standing, future goals, and the overall market conditions will ensure optimal decision-making in securing fixed home equity loan rates that will benefit their long-term financial health.

Summary

In summary, Fixed Home Equity Loan Rates present a dependable financing solution for homeowners seeking to tap into their home’s equity. By understanding the intricacies of these rates and their implications on financial planning, individuals can harness this knowledge to make strategic decisions that benefit their financial future. As the market continues to evolve, staying informed will empower homeowners to navigate their financing options successfully.

Question Bank

What is the typical duration for a fixed home equity loan?

The typical duration for a fixed home equity loan ranges from 5 to 30 years, depending on the lender and borrower preferences.

Can I refinance a fixed home equity loan?

Yes, refinancing a fixed home equity loan is possible, often to secure a lower interest rate or to adjust the loan term.

Are there any fees associated with fixed home equity loans?

Yes, there can be fees such as closing costs, appraisal fees, and origination fees, which vary by lender.

How does my credit score affect my fixed home equity loan rate?

A higher credit score typically results in more favorable fixed home equity loan rates, as it indicates lower risk to lenders.

What is the minimum equity required to qualify for a fixed home equity loan?

Most lenders require at least 15-20% equity in your home to qualify for a fixed home equity loan.