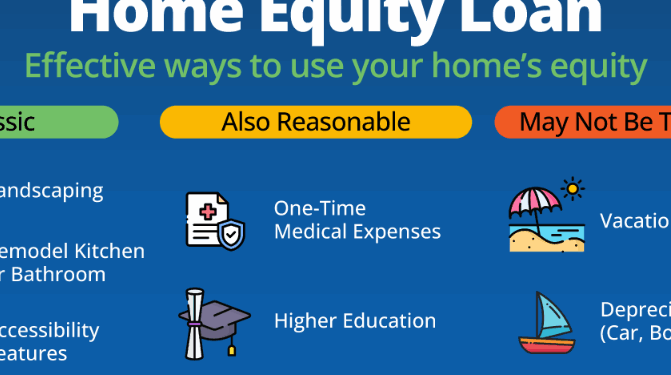

Home Equity Loan Rates Today provides an essential overview for homeowners considering leveraging their property’s equity. These loans offer a unique opportunity to access funds for various needs, from home improvements to debt consolidation, making them a valuable financial tool. Understanding the intricacies of home equity loans, including how rates are determined and the factors that influence them, empowers borrowers to make informed decisions.

In today’s economic climate, where interest rates fluctuate, staying updated on current home equity loan rates can lead to significant savings. This guide will delve into the essential elements influencing these rates, compare options from different lenders, and Artikel steps to secure the most favorable terms.

Understanding Home Equity Loans

Source: googleusercontent.com

Home equity loans are a form of borrowing where homeowners can leverage the equity they have built in their property. These loans allow individuals to access a lump sum of money, which can be utilized for various purposes, such as home renovations, debt consolidation, or other significant expenses. As homeowners pay down their mortgage and property values increase, the equity in their homes grows, thus creating an opportunity for borrowing.The distinction between home equity loans and home equity lines of credit (HELOCs) is significant.

Home equity loans provide a fixed amount of money at a fixed interest rate, typically repaid over a set term. In contrast, a HELOC operates more like a credit card, allowing borrowers to draw funds up to a predetermined limit during a certain period, with a variable interest rate that can fluctuate over time. This gives borrowers flexibility in managing their finances, but also involves a degree of uncertainty with repayment amounts.

Factors Affecting Home Equity Loan Eligibility

Several key factors influence a homeowner’s eligibility for a home equity loan. Understanding these factors is essential for anyone considering this type of financing.

- Credit Score: Lenders typically require a good credit score to qualify for a home equity loan. A higher credit score indicates a lower risk to lenders and may also result in more favorable interest rates.

- Debt-to-Income Ratio: This ratio measures an individual’s total monthly debts against their gross monthly income. Lenders prefer a lower ratio, as it indicates that the borrower is more likely to manage additional debt responsibly.

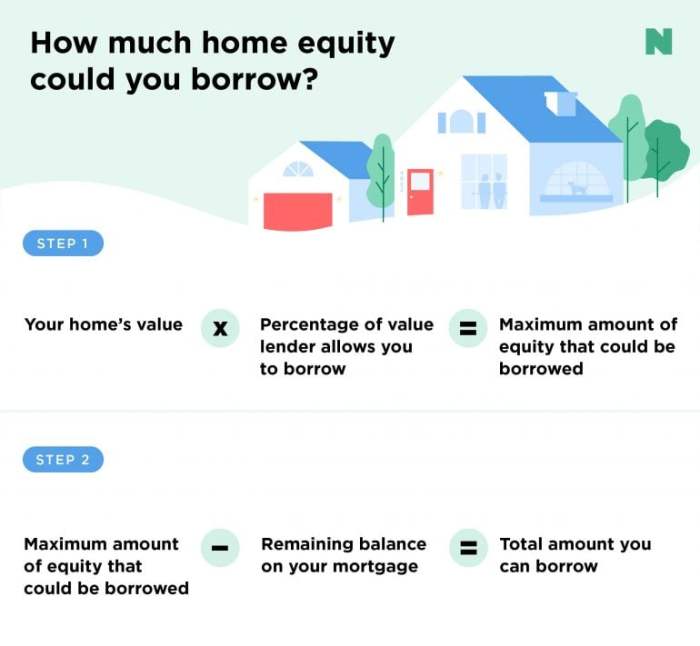

- Equity in Home: The amount of equity a homeowner has in their property is crucial. Most lenders require homeowners to have at least 15-20% equity to qualify for a loan. Equity is calculated by subtracting the outstanding mortgage balance from the home’s current market value.

- Employment Stability: Consistent and stable employment can enhance a borrower’s profile, as it suggests reliable income. Lenders may review employment history and income documentation to assess the borrower’s ability to repay the loan.

“Home equity loans can provide substantial financial support, but it is crucial for borrowers to understand the qualifications involved.”

The aforementioned factors collectively contribute to a lender’s decision-making process when evaluating a borrower’s application for a home equity loan. It is advisable for potential borrowers to review their financial situation and credit history before applying to increase their chances of approval.

Current Home Equity Loan Rates

The landscape of home equity loan rates is continually evolving, influenced by various economic factors and lending practices. Understanding where to find these rates and what influences them can empower homeowners to make informed financial decisions. This section delves into the current home equity loan rates, identification of reliable sources for these rates, and a breakdown of typical rates by lender.

Sources for Current Home Equity Loan Rates

Home equity loan rates can be found through a variety of reputable sources. It is essential to consult multiple platforms to get a comprehensive view of the rates available. The following resources are highly recommended:

- Bank and Credit Union Websites: Most lenders display their current rates directly on their websites, which is frequently updated to reflect market changes.

- Financial News Websites: Websites like Bankrate, NerdWallet, and Investopedia provide comparative rate analysis and can help borrowers find competitive offers.

- Mortgage Brokers: Brokers work with various lenders and can provide tailored information based on an individual’s credit profile and needs.

- Government Resources: The Federal Reserve and other governmental financial regulatory bodies often publish reports that include average interest rates for home equity loans.

Determining Factors for Home Equity Loan Interest Rates

Home equity loan interest rates are influenced by several key factors, which lenders assess to determine the creditworthiness of an applicant. Understanding these factors can help potential borrowers prepare for negotiations:

- Credit Score: A higher credit score typically results in lower interest rates, as it indicates a lower risk of default.

- Loan-to-Value Ratio (LTV): This ratio compares the loan amount to the appraised value of the home. A lower LTV usually leads to better rates.

- Market Conditions: Economic indicators such as inflation, the Federal Reserve’s interest rate policies, and overall demand for loans impact rates.

- Loan Amount and Term: The amount borrowed and the length of the loan can also affect the rate, with larger loans generally having different rate structures compared to smaller loans.

Typical Home Equity Loan Rates by Lender

When considering home equity loans, it’s beneficial to compare rates among various lenders. Below is a summary of typical interest rates provided by different types of lenders in today’s market:

| Lender Type | Typical Rate Range (%) |

|---|---|

| Traditional Banks | 3.50% – 7.00% |

| Credit Unions | 3.25% – 6.75% |

| Online Lenders | 3.00% – 7.25% |

| Mortgage Brokers | 3.10% – 6.90% |

“Rates can vary significantly between lenders, so it’s prudent to shop around and consider various offers before making a decision.”

Understanding the variations in home equity loan rates across lenders can lead to substantial savings and better financial options for homeowners. By utilizing the aforementioned sources and comprehending how rates are determined, borrowers can navigate the home equity loan landscape more effectively.

Factors Influencing Home Equity Loan Rates Today

Source: cbsnewsstatic.com

The determination of home equity loan rates is influenced by several crucial factors that can significantly affect the borrowing costs for homeowners. Understanding these factors is essential for making informed decisions regarding home equity loans. Three primary influences include credit scores, the state of the economy, and the loan-to-value ratio (LTV).

Impact of Credit Scores on Loan Rates

Credit scores play a vital role in determining the interest rates homeowners will receive on their home equity loans. Generally, a higher credit score indicates a lower risk to lenders, which can lead to more favorable loan terms. Lenders typically categorize credit scores into ranges, with those in the higher range (typically above 740) being eligible for lower interest rates.

The difference in rates can be significant. For instance, a homeowner with a credit score of 800 may secure a rate that is 0.5% to 1% lower than someone with a score of 680. This variation not only affects overall borrowing costs but also impacts the total amount of interest paid over the life of the loan.

The formula for calculating effective loan costs is represented as: Total Interest = Loan Amount x Interest Rate x Loan Term.

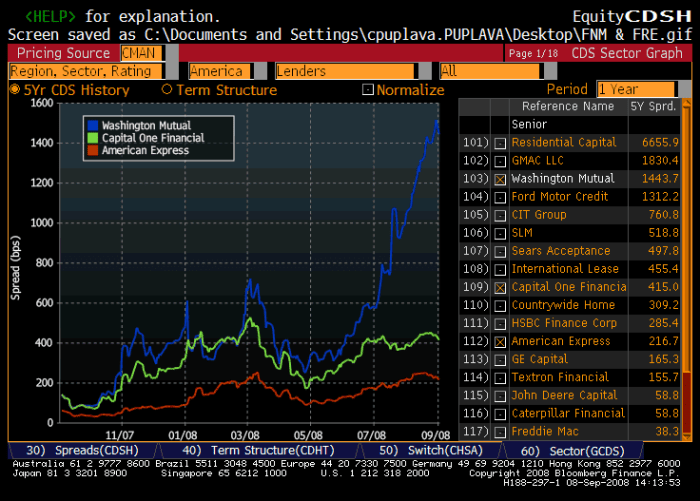

Current Economic Climate and Its Effects

The broader economic environment can greatly influence home equity loan rates. Factors such as inflation, employment rates, and the Federal Reserve’s monetary policy contribute to fluctuations in interest rates. When the economy is strong and inflation is rising, the Federal Reserve may increase interest rates to regulate spending and stabilize prices. Consequently, as benchmark rates rise, lenders typically adjust their home equity loan rates upward as well.

Conversely, during a recession, the Fed may lower rates to encourage borrowing and stimulate economic growth, resulting in lower home equity loan rates.For example, in times of economic downturn, rates might decrease to levels as low as 3% or 4%, making loans more accessible.

Role of Loan-to-Value Ratio (LTV)

The loan-to-value ratio (LTV) is another critical factor that lenders consider when determining home equity loan rates. The LTV ratio measures the amount of the loan relative to the appraised value of the property. A lower LTV indicates that the homeowner has more equity in the property, which reduces the risk for lenders.Typically, LTV ratios are categorized as follows:

- Low LTV (below 80%): Homeowners with an LTV below 80% are often rewarded with lower interest rates, as they are perceived as lower risk borrowers.

- Moderate LTV (80%

-90%): Rates may be higher for this range due to increased risk, but options may still be favorable. - High LTV (above 90%): Loans with LTV ratios above 90% are usually associated with higher rates and may require private mortgage insurance (PMI).

Understanding these LTV categories helps borrowers gauge their potential rates and assists in planning their borrowing strategy effectively. A homeowner looking to leverage their equity might aim to maintain an LTV below 80% to secure the most favorable terms.

Comparison of Home Equity Loan Rates

The comparison of home equity loan rates is essential for homeowners considering this financial option. By examining various lenders, individuals can identify the best rates that meet their financial needs, taking into account fixed versus variable interest rates and regional differences.

Comparison Table of Home Equity Loan Rates

The following table presents a comparison of home equity loan rates from several prominent lenders as of today’s market. Rates may vary based on individual credit scores, loan amounts, and terms.

| Lender | Fixed Rate (%) | Variable Rate (%) | Loan Term (Years) |

|---|---|---|---|

| XYZ Bank | 3.75 | 3.25 | 10 |

| ABC Credit Union | 4.00 | 3.50 | 15 |

| 123 Mortgage Co. | 3.50 | 3.00 | 20 |

| MNO Financial Services | 4.25 | 3.75 | 30 |

Advantages and Disadvantages of Fixed vs. Variable Interest Rates

Understanding the differences between fixed and variable interest rates is crucial for homeowners when selecting a home equity loan. Each type has its unique benefits and drawbacks.The advantages of fixed interest rates include:

- Stability: Payments remain consistent throughout the loan term, aiding in budgeting.

- Protection against rate increases: Borrowers are shielded from fluctuations in market interest rates.

The disadvantages include:

- Higher initial rates: Fixed rates can be higher than the starting rates of variable loans.

- Less flexibility: If market rates drop, borrowers may miss out on lower rates.

In contrast, variable interest rates present the following advantages:

- Lower initial rates: Often provide a lower starting interest rate compared to fixed loans.

- Potential for reduced payments: If market rates decline, borrowers may benefit from lower payments.

However, the disadvantages include:

- Uncertainty: Monthly payments can fluctuate, making it harder to plan finances.

- Possibility of increased payments: Borrowers risk facing rising interest rates over time.

Regional Differences in Home Equity Loan Rates

Home equity loan rates can vary significantly based on geographic location. Different regions may experience distinct economic conditions and demand for home equity loans, impacting the rates offered by lenders.For example, urban areas typically have higher property values, which can result in better loan terms for homeowners with equity. Conversely, rural areas may see slightly higher rates due to the perceived risk and lower demand for loans.

Additionally, regional economic conditions such as unemployment rates, housing market trends, and local competition among lenders can also play a role in determining loan rates.In summary, homeowners should not only consider the specific rates when comparing lenders but also evaluate how regional differences might affect their borrowing options. Understanding these factors can aid in making informed financial decisions regarding home equity loans.

Steps to Secure the Best Home Equity Loan Rate

Securing the best home equity loan rate requires careful planning and informed decision-making. By following a systematic approach, borrowers can enhance their chances of obtaining favorable terms from lenders. The process involves gathering necessary documentation, evaluating different lenders, and skillfully negotiating rates.

Necessary Documentation for Applying for a Home Equity Loan

A variety of documents is required when applying for a home equity loan to verify the borrower’s financial situation and the value of the property. Having these documents organized can expedite the application process and improve credibility with lenders. The essential documentation includes:

- Proof of Income: Recent pay stubs, W-2 forms, or tax returns for self-employed individuals.

- Credit Report: A recent credit report allowing lenders to assess your creditworthiness.

- Property Information: Documentation of the property’s current market value, such as a recent appraisal or a comparative market analysis.

- Debt Information: Statements for existing mortgages and other debts to determine the debt-to-income ratio.

- Identification: Government-issued identification, such as a driver’s license or passport.

Checklist for Comparing Lenders and Their Rates

When comparing lenders, borrowers should consider specific criteria that can affect the overall cost of the loan. A thorough checklist can help simplify the comparison process and ensure that the most suitable lender is chosen. Important factors to include in the checklist are:

- Interest Rates: Compare the annual percentage rates (APRs) offered by different lenders.

- Fees: Identify any application fees, appraisal fees, and closing costs associated with the loan.

- Loan Terms: Review the duration of the loan and the repayment options available.

- Credit Score Requirements: Confirm the minimum credit score needed by each lender to qualify for their best rates.

- Customer Service: Assess lender reviews and ratings regarding customer satisfaction and support.

Negotiation Process for Securing Better Rates with Lenders

Negotiating with lenders can lead to better terms and lower interest rates. Understanding the negotiation process is essential for borrowers to advocate effectively for themselves. Key strategies for negotiation include:

- Research Competitor Offers: Gather information on rates and terms from multiple lenders to leverage in negotiations.

- Highlight Strong Financials: Present a strong financial profile by showcasing good credit scores and low debt-to-income ratios.

- Be Prepared to Walk Away: Indicate readiness to explore other options if the terms do not meet expectations, which can motivate lenders to reconsider their offers.

- Ask About Discounts: Inquire about any potential discounts or fee waivers for loyalty, bundling services, or participating in certain programs.

- Stay Informed: Keep abreast of current market trends and rates to facilitate an informed negotiation.

Risks Associated with Home Equity Loans

Home equity loans can be a valuable financial tool, but they also come with inherent risks that borrowers must carefully consider. Understanding these risks is crucial for making informed decisions about leveraging home equity to secure funds. This section elucidates the potential dangers associated with home equity loans, including fluctuating interest rates and the consequences of defaulting on repayment.

Potential Risks When Taking Out a Home Equity Loan

Home equity loans represent a significant financial commitment, and as such, they carry specific risks that borrowers should be aware of. The primary risks include:

- Loss of Home: Since a home equity loan is secured by the borrower’s property, failure to repay the loan can result in foreclosure, meaning the lender can seize the home to recover the owed amount.

- Debt Accumulation: Borrowing against home equity can lead to increased overall debt. If not managed properly, borrowers may find themselves over-leveraged, making it difficult to meet other financial obligations.

- Market Value Fluctuations: The value of a home can decrease due to market conditions, which reduces the equity available to the borrower. This can complicate refinancing or selling the home in the future.

Impact of Fluctuating Interest Rates

Interest rates can significantly affect borrowers with home equity loans, particularly if they are variable rate loans. When interest rates rise, borrowers may experience increased monthly payments, which can strain their finances. For example, if a borrower takes out a home equity loan with an initial rate of 4% and the market rate rises to 6%, their monthly payment will increase, potentially leading to financial distress.

This scenario emphasizes the need for borrowers to consider the long-term trajectory of interest rates when taking out these loans.

Borrowers should always evaluate their capacity to manage higher payments should interest rates rise unexpectedly.

Consequences of Failing to Repay a Home Equity Loan

Defaulting on a home equity loan can have severe repercussions. The consequences include:

- Foreclosure: As mentioned, failure to repay the loan can lead to foreclosure, resulting in the loss of one’s home.

- Credit Score Impact: Missing payments or defaulting can dramatically lower a borrower’s credit score, making it harder to secure future loans and increasing borrowing costs.

- Legal Actions: Lenders may pursue legal action to recover the owed amount, resulting in additional financial strain and legal fees for the borrower.

Frequently Asked Questions about Home Equity Loan Rates

The topic of home equity loans often raises numerous queries among potential borrowers, particularly concerning rates and the process involved. Understanding these aspects can significantly enhance one’s financial decision-making. This section addresses common misconceptions, Artikels the timeline for obtaining a home equity loan, and provides guidance for evaluating the suitability of such loans based on current rates.

Common Misconceptions about Home Equity Loans

There are several misunderstandings surrounding home equity loans and their associated rates that can lead to poor financial decisions. Some of the prevalent misconceptions include:

- Home equity loans are always the best financing option: While they can be advantageous, they may not be suitable for everyone or every situation. Alternatives, such as personal loans or lines of credit, may serve better based on individual circumstances.

- Borrowing against home equity is risk-free: Utilizing home equity can result in the loss of your home if you fail to repay the loan, underscoring the importance of careful financial planning.

- Home equity loan rates are fixed and always low: Rates can vary widely based on market conditions, credit scores, and lender policies, meaning they are not universally fixed or low.

- Closing costs are minimal or nonexistent: Although some lenders may offer low or no closing cost options, borrowers should carefully assess potential fees associated with home equity loans.

Timeline for Obtaining a Home Equity Loan

The process of obtaining a home equity loan typically involves several key steps and can take a varying amount of time depending on multiple factors. The general timeline includes:

- Application Submission: After selecting a lender, you will need to submit an application along with required documentation, such as income verification and property information. This phase can take a few hours to a few days.

- Processing and Underwriting: The lender will evaluate your application, assess your creditworthiness, and order an appraisal of your home. This stage generally takes one to two weeks.

- Closing: Once approved, a closing date will be set where you will sign the loan documents and receive your funds. This finalizes the loan process, typically within a week after approval.

Assessing Suitability of Home Equity Loans Based on Current Rates

When considering a home equity loan, it is crucial to evaluate whether it is the right choice based on the prevailing rates. Factors influencing this assessment include:

- Current Interest Rates: Compare the current home equity loan rates with your financial goals. If rates are low, it may be an opportune moment to borrow.

- Personal Financial Situation: Evaluate your credit score, income stability, and existing debt levels. A higher credit score generally secures better rates.

- Loan Purpose: Determine if borrowing against home equity aligns with your financial objectives, such as home renovations or debt consolidation, making sure the potential benefits outweigh the risks.

Assessing your financial well-being in conjunction with current interest rates is essential for making informed decisions regarding home equity loans.

Ending Remarks

Source: nerdwallet.com

In conclusion, navigating the landscape of home equity loan rates requires careful consideration and understanding of various factors. By familiarizing yourself with the current rates, eligibility criteria, and potential risks, you can make a well-informed choice that aligns with your financial goals. Whether you seek to renovate your home or consolidate debt, a thorough examination of your options today will pave the way for a secure financial future.

Top FAQs

What is the typical timeline for securing a home equity loan?

The timeline can vary, but most borrowers can expect to complete the process in 30 to 45 days from application to funding.

Are closing costs associated with home equity loans?

Yes, home equity loans may incur closing costs, which can range from 2% to 5% of the loan amount.

Can I deduct interest on my home equity loan for tax purposes?

Interest on home equity loans may be tax-deductible if the funds are used for home improvements, but it’s recommended to consult a tax advisor for specifics.

How often should I shop around for better rates?

It’s advisable to compare rates annually or when considering a significant financial decision related to your home equity.

Will my credit score affect my home equity loan rate?

Yes, a higher credit score typically qualifies you for lower interest rates on home equity loans.