As Current Home Equity Loan Rates take center stage, an exploration of the factors that shape these rates is essential for any homeowner considering leveraging their property. With recent statistics reflecting a dynamic market, understanding the intricacies of home equity loans can empower individuals to make informed financial decisions.

This discussion will delve into the various types of home equity loans available, the calculation of home equity, and the significant role credit scores play in determining loan rates. Additionally, it will offer insights into the application process, associated risks, and comparisons of rates from different lenders. As we navigate through this topic, we will also examine potential future trends that may impact home equity loan rates.

Current Overview of Home Equity Loan Rates

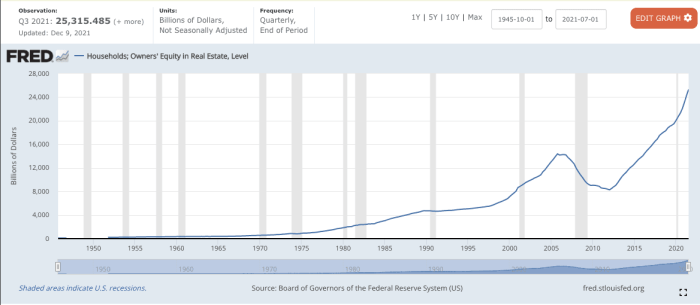

As of October 2023, home equity loan rates have exhibited notable trends that reflect the broader economic environment. Currently, the average rate for home equity loans sits around 7.5%, varying based on factors such as credit score, loan-to-value ratio, and lender-specific policies. These rates have seen fluctuations in response to shifting economic conditions, providing homeowners with both opportunities and challenges in leveraging their home equity.Home equity loan rates are influenced by several key factors, including the Federal Reserve’s monetary policy, inflation rates, and housing market dynamics.

The Federal Reserve’s decisions on interest rates directly impact the cost of borrowing, with higher rates often leading to increased home equity loan rates. Additionally, inflation continues to play a critical role; as the cost of living rises, lenders may adjust rates to compensate for the decreased purchasing power of the dollar. Furthermore, the overall health of the housing market, characterized by home price appreciation and demand-supply equilibrium, also significantly affects loan rates.

Factors Influencing Home Equity Loan Rates

Understanding the various elements that influence home equity loan rates is crucial for homeowners considering this financial option. Key factors include:

- Federal Reserve Interest Rates: The Federal Reserve sets benchmark interest rates, which serve as a guideline for lenders. When the Fed raises rates, home equity loan rates typically increase as well.

- Credit Score: A higher credit score generally allows borrowers to secure lower interest rates. Lenders view individuals with good credit as less risky, leading to more favorable loan terms.

- Loan-to-Value Ratio (LTV): This ratio compares the loan amount to the appraised value of the home. A lower LTV indicates less risk for lenders, often resulting in lower rates.

- Market Conditions: Economic factors such as inflation and employment rates affect consumer confidence and spending. In a robust economy, demand for loans may increase, potentially driving rates higher.

The interplay of these factors creates a dynamic environment for home equity loan rates. Borrowers should remain informed about market trends and be proactive in reviewing their financial profiles to maximize the benefits of home equity financing.

“A higher credit score generally allows borrowers to secure lower interest rates, as lenders view individuals with good credit as less risky.”

Economic conditions, including inflation, consumer spending, and employment rates, further influence home equity loan rates. As inflation rises, lenders may raise rates to maintain margins, impacting affordability for potential borrowers. Monitoring these economic indicators can provide valuable insights into future rate movements, helping homeowners make informed financial decisions.

Types of Home Equity Loans

Source: kpcu.com

Home equity loans provide homeowners with a means to borrow against the equity they have built in their properties. Understanding the different types available is crucial for making informed financial decisions. Home equity loans are typically categorized into two main types: fixed-rate and variable-rate loans. Each type offers distinct advantages and disadvantages that cater to different financial needs and situations.

Fixed-Rate Home Equity Loans

Fixed-rate home equity loans are structured to offer a consistent interest rate throughout the life of the loan. This predictability can be beneficial for budgeting and long-term financial planning. Borrowers receive a lump sum amount upfront and repay it over a specified term, usually ranging from 5 to 30 years.The key characteristics of fixed-rate home equity loans include:

- Stability: Monthly payments remain constant, making it easier to manage personal finances over time.

- Predictable Interest Costs: Borrowers can forecast the total interest paid over the loan’s duration, facilitating better financial planning.

- Long-Term Loan Terms: Fixed-rate loans often have longer repayment terms, which can make monthly payments more manageable.

However, there are also drawbacks to consider:

- Higher Initial Rates: Fixed-rate loans generally have higher initial interest rates compared to variable-rate options, which can increase overall borrowing costs.

- Less Flexibility: Once locked in, the rate cannot change, potentially leading to higher costs if market rates decline.

Variable-Rate Home Equity Loans

Variable-rate home equity loans, also known as adjustable-rate home equity loans, have interest rates that fluctuate based on market conditions. This type of loan can provide initial lower rates, making it an attractive option for borrowers seeking immediate cost savings.Key features of variable-rate home equity loans include:

- Potential for Lower Initial Rates: Borrowers often benefit from lower starting rates compared to fixed-rate loans, resulting in reduced initial monthly payments.

- Rate Adjustments: Interest rates can change periodically, typically after an initial fixed period, which may lead to lower payments if market rates decrease.

Nevertheless, these loans come with potential risks:

- Unpredictable Payments: Monthly payments can vary significantly based on interest rate changes, making budgeting more challenging.

- Potential for Higher Costs: If market rates rise, borrowers may face higher monthly payments, which could strain their finances.

In summary, both fixed-rate and variable-rate home equity loans present unique advantages and challenges. Choosing the right type ultimately depends on individual financial circumstances, risk tolerance, and long-term goals.

How to Determine Your Home Equity

Determining your home equity is a vital step in managing your finances, especially if you are considering a home equity loan. Home equity represents the portion of your home that you truly own, and it can be a valuable asset in your financial portfolio. Understanding how to calculate home equity accurately allows homeowners to make informed decisions regarding refinancing, selling, or securing loans against their property.The calculation of home equity involves understanding the current market value of your home and the remaining balance on your mortgage.

Home equity is defined as the difference between these two figures. The formula for calculating home equity is straightforward:

Home Equity = Current Market Value of Home – Outstanding Mortgage Balance

Example Calculation of Home Equity

To illustrate the calculation of home equity, consider the following example. Assume your home has a current market value of $300,000, and you still owe $200,000 on your mortgage. Using the aforementioned formula:

Home Equity = $300,000 (Market Value)

$200,000 (Mortgage Balance) = $100,000

In this scenario, your home equity would be $100,000. This amount represents the portion of your home that you own outright and can potentially use for various financial needs.

Factors Affecting Home Equity Levels

Several key factors can influence the level of home equity you possess. Understanding these factors is crucial for homeowners looking to maximize their equity. The following points highlight the most significant elements affecting home equity:

- Market Value Fluctuations: Changes in the real estate market can directly impact your home’s market value. An increase in property values generally boosts equity, while a decline can reduce it.

- Mortgage Payments: Regular payments towards your mortgage principal increase your ownership stake in the property, thereby increasing your home equity over time.

- Home Improvements: Renovations and upgrades can enhance the market value of your home, leading to a higher equity level.

- Loan Type and Terms: Different mortgage types and terms can affect how quickly equity accumulates. Loans with higher interest rates may take longer to build equity compared to those with lower rates.

- Local Economic Conditions: Economic factors such as job growth, interest rates, and local housing demand can affect home prices and, consequently, your home’s market value.

Each of these elements plays a significant role in determining how much equity you have in your home. By being aware of these factors, homeowners can take proactive steps to enhance their equity position.

Impacts of Credit Score on Home Equity Loan Rates

Source: amazonaws.com

The relationship between credit score and home equity loan rates is significant and can affect a borrower’s financial future. A higher credit score typically results in lower interest rates, while a lower score may lead to increased borrowing costs. Understanding this relationship can help homeowners make informed decisions when considering a home equity loan.

When lenders assess a borrower’s application for a home equity loan, the credit score plays a crucial role in determining the terms and conditions of the loan. Credit scores generally range from 300 to 850, with higher scores indicating better creditworthiness. Lenders utilize credit scores to gauge the risk associated with lending to an individual, impacting the rates offered for home equity loans.

As a result, homeowners with higher credit scores benefit from lower interest rates, while those with lower scores may face higher rates, resulting in increased overall loan costs.

Loan Rates by Credit Score Range

To illustrate the impact of different credit score ranges on home equity loan rates, the following table presents typical loan rates associated with each range. The data is based on industry averages and may vary by lender and market conditions.

| Credit Score Range | Average Loan Rate (%) |

|---|---|

| 300 – 579 | 8.0 – 10.0 |

| 580 – 669 | 6.5 – 8.0 |

| 670 – 739 | 5.0 – 6.5 |

| 740 – 799 | 3.5 – 5.0 |

| 800 – 850 | 3.0 – 3.5 |

It is essential to note that borrowers with lower credit scores may also encounter additional costs beyond higher interest rates. These costs can significantly affect the total cost of borrowing over the life of the loan. For instance, lenders might impose higher origination fees, increased closing costs, or require private mortgage insurance (PMI) for those with lower credit scores. Such additional expenses can add up, impacting the overall affordability of a home equity loan.

“Lower credit scores not only affect interest rates but can also lead to higher upfront costs and additional fees, making home equity loans more expensive.”

Steps to Apply for a Home Equity Loan

Source: co.uk

Applying for a home equity loan can provide homeowners with significant financial resources, leveraging the equity built in their property. Understanding the application process, necessary documentation, and strategies to increase the chances of approval is crucial for a smooth experience. The application process for obtaining a home equity loan involves several key steps, beginning with an assessment of your financial situation and concluding with the loan disbursement.

It is essential to prepare adequately to ensure that all necessary documentation is in order, which will facilitate a more efficient application process.

Application Process Overview

The application process for a home equity loan typically involves the following steps:

1. Assess Your Financial Situation

Review your income, debts, and credit score to determine your borrowing capacity.

2. Research Lenders

Compare rates and terms from various lenders to find the best option.

3. Gather Necessary Documentation

Collect the required paperwork to support your application.

4. Submit Your Application

Complete the loan application with your selected lender, providing all requested information.

5. Loan Underwriting

The lender will review your application, verify your information, and assess risk.

6. Closing

If approved, you will sign the loan documents and receive the funds.

Necessary Documentation for Application

When applying for a home equity loan, you will need to provide specific documentation to support your application. The following documents are typically required:

Identification

Government-issued photo ID, such as a driver’s license or passport.

Income Verification

Recent pay stubs, tax returns, or W-2 forms to verify your income.

Employment Verification

A letter from your employer confirming your position and salary may also be requested.

Property Information

Documents proving ownership, such as the title deed, and recent property tax statements.

Credit History

Lenders may conduct a credit check; however, you can also provide your recent credit report.

Debt Information

A list of current debts and monthly payments to assess your debt-to-income ratio.

Tips for Increasing Chances of Loan Approval

To enhance your chances of securing a home equity loan, consider the following strategies:

Improve Your Credit Score

Pay off outstanding debts, make payments on time, and avoid new credit inquiries before applying.

Increase Your Equity

Aim for a higher home equity ratio by paying down your mortgage or ensuring your property’s value has increased.

Reduce Debt-to-Income Ratio

Minimize existing debts to improve your financial profile.

Provide Comprehensive Documentation

Ensure all required documents are accurate, complete, and submitted on time.

Consult with a Mortgage Advisor

Seeking professional advice can help you understand lender requirements and prepare accordingly.By following these steps and preparing thoroughly, homeowners can navigate the application process for a home equity loan more effectively, increasing the likelihood of approval and securing the necessary funding for their financial needs.

Risks Associated with Home Equity Loans

Home equity loans can provide valuable financial resources for homeowners, but they are not without risks. Understanding these risks is crucial for any homeowner considering leveraging their equity. This segment discusses the potential consequences of defaulting on a home equity loan and Artikels strategies for mitigating these risks.

Potential Consequences of Defaulting on a Home Equity Loan

Defaulting on a home equity loan can lead to severe repercussions. Since these loans are secured by the borrower’s home, failure to make payments may result in foreclosure. This process allows lenders to reclaim the property, and homeowners can lose their residence. Additionally, defaulting can significantly damage a borrower’s credit score, which complicates future borrowing and may lead to higher interest rates on other loans.Understanding the potential consequences of defaulting is essential for homeowners weighing the risks versus benefits of a home equity loan.

Strategies for Mitigating Risks Involved with Home Equity Loans

There are several strategies that homeowners can employ to reduce the risks associated with home equity loans. Implementing these strategies can enhance financial stability and provide peace of mind.Firstly, assessing personal financial status before applying for a loan is crucial. Homeowners should evaluate their income, expenses, and existing debts to ensure they can manage additional payments without financial strain. Secondly, it is advisable to borrow only what is necessary.

Taking out a loan amount that aligns with specific projects or needs can help prevent overextension. Thirdly, maintaining an emergency fund is vital. Having a financial buffer can assist homeowners in managing unexpected expenses or changes in income, thus safeguarding against default.Additionally, homeowners should consider fixed-rate loans over variable-rate loans. Fixed-rate loans provide predictable monthly payments, which can be easier to budget for over time.Lastly, seeking advice from financial advisors can offer valuable insights tailored to individual situations.

Professional guidance can assist in navigating loan terms and risks effectively.In summary, while home equity loans offer opportunities for leveraging property value, understanding and managing associated risks is essential for ensuring long-term financial health.

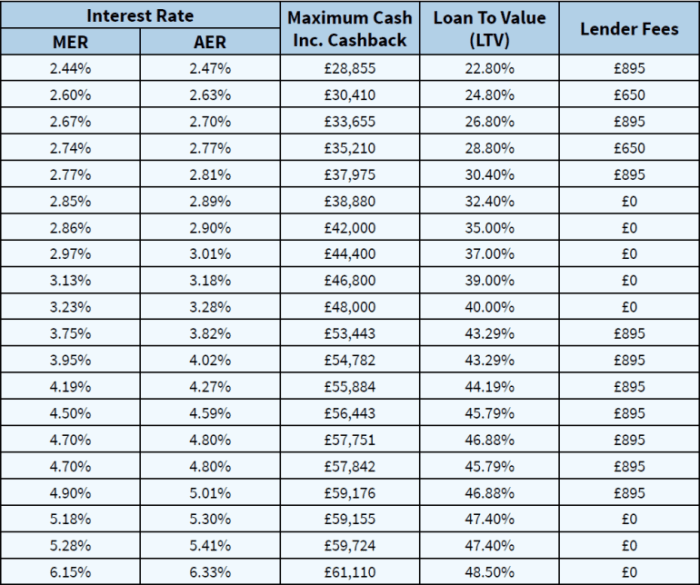

Comparison of Current Home Equity Loan Rates by Lenders

When considering a home equity loan, evaluating the rates offered by different lenders is crucial. The current market presents a variety of options, and understanding these choices can lead to significant savings. This section provides a comparative analysis of home equity loan rates among various lenders, highlighting the importance of diligent research in securing the best possible deal.

Overview of Lender Rates and Fees

It is essential to compare not only the interest rates but also the associated fees that lenders may charge. These can vary widely and significantly impact the overall cost of borrowing. Below is a table illustrating the current home equity loan rates from several prominent lenders, along with their respective fees.

| Lender Name | Interest Rate (%) | Origination Fee (%) | Other Fees ($) |

|---|---|---|---|

| Lender A | 5.00 | 1.00 | 500 |

| Lender B | 4.75 | 1.50 | 300 |

| Lender C | 5.25 | 0.75 | 400 |

| Lender D | 4.99 | 1.25 | 250 |

Shopping around for the best rates is essential, as even a small difference in interest rates can lead to substantial savings over the life of the loan. Additionally, understanding lender fees can help borrowers make a more informed decision.

“Even a 0.25% difference in interest rates can lead to thousands of dollars in savings over the term of a home equity loan.”

By comparing these rates and understanding the fee structures, borrowers can effectively assess the total cost of each loan option. It is advisable to factor in not only the interest rates but also the total closing costs and any additional fees when making a comparison. This comprehensive approach ensures that borrowers select a lender that offers the best overall value for their home equity loan.

Future Trends in Home Equity Loan Rates

The landscape of home equity loan rates is continually evolving, influenced by a myriad of factors ranging from economic conditions to consumer behavior. As we analyze potential future trends, it becomes essential to consider the current data and expert predictions, which can provide valuable insights into the direction of home equity loan rates.Experts in the finance and real estate sectors predict a variety of scenarios for the future of home equity loan rates.

As the economy recovers from recent disruptions, there are several key factors that could significantly impact these rates. Understanding these elements is crucial for borrowers looking to navigate the home equity loan market effectively.

Potential Influencing Factors

Several critical factors could lead to fluctuations in home equity loan rates. These include economic growth, inflation rates, and changes in federal monetary policy. Each of these factors plays a significant role in determining the direction of interest rates in the home equity loan market:

- Economic Growth: Continued growth in the economy often leads to increased borrowing and spending, which can put upward pressure on interest rates. Strong job reports and GDP growth can indicate a robust economy, prompting lenders to raise rates.

- Inflation Rates: High inflation typically results in increased interest rates. If inflation remains above target levels, the Federal Reserve may choose to increase rates to stabilize prices, affecting home equity loan rates.

- Federal Monetary Policy: Decisions made by the Federal Reserve regarding the federal funds rate can directly influence home equity loan rates. A tightening of monetary policy usually leads to higher borrowing costs.

- Housing Market Dynamics: The health of the housing market can also influence home equity loan rates. If home prices continue to rise, borrowers may find increased equity, which could lead to more demand for home equity loans, potentially driving rates up.

- Consumer Demand: An increase in consumer confidence can lead to a surge in demand for home equity loans, affecting rates. If lenders perceive higher demand, they may adjust rates accordingly.

The interplay of these factors means that borrowers must remain vigilant about market conditions. For instance, if inflation trends upwards alongside a strong labor market, we may see home equity loan rates increase as lenders adjust to the changing economic landscape. On the other hand, if economic indicators suggest a slowdown, rates may stabilize or even decline as lenders become more competitive to attract borrowers.

“Understanding the influences on home equity loan rates is essential for making informed borrowing decisions.”

As stakeholders in the housing and finance markets continue to analyze these dynamics, their insights will be invaluable in forecasting the future of home equity loan rates. Thus, staying informed about both macroeconomic trends and market-specific developments is crucial for anyone considering a home equity loan in the coming years.

Final Wrap-Up

In conclusion, comprehending Current Home Equity Loan Rates is vital for maximizing financial opportunities while minimizing risks. By staying informed about the factors influencing these rates and understanding the various types of loans available, borrowers can better position themselves in the market. As we look ahead, awareness of market trends will further enhance one’s ability to make sound decisions regarding home equity loans.

Questions and Answers

What is a home equity loan?

A home equity loan allows homeowners to borrow against the equity of their home, providing a lump sum that can be used for various purposes.

How do I calculate my home equity?

Home equity is calculated by subtracting your mortgage balance from your home’s current market value.

Can I get a home equity loan with a low credit score?

While it is possible to obtain a home equity loan with a low credit score, it may result in higher interest rates and less favorable terms.

What are the typical terms for home equity loans?

Home equity loans typically have terms ranging from 5 to 30 years, with fixed or variable interest rates.

Is there a limit on how much I can borrow with a home equity loan?

Yes, lenders usually allow you to borrow up to 80-85% of your home’s equity, depending on the lender’s policies and your creditworthiness.