Understanding the intricacies of Best Home Equity Loan Rates is essential for homeowners looking to leverage their property’s value for financial gain. Home equity loans can serve as a favorable option for funding various needs, from home renovations to debt consolidation, offering potentially lower interest rates compared to other borrowing methods.

As we dive deeper into the factors influencing these rates, the current market trends, and strategies to secure the best deals, you will gain valuable insights that can empower your financial decisions.

Understanding Home Equity Loans

Home equity loans serve as financial tools that allow homeowners to leverage the value of their homes for various purposes, such as debt consolidation, home improvements, or major purchases. By tapping into the equity built up in their properties, borrowers can access funds with typically favorable interest rates compared to unsecured loans.Home equity loans are secured loans that use the borrower’s home as collateral.

This arrangement provides lenders with a level of security, which often results in lower interest rates. The primary distinction between home equity loans and home equity lines of credit (HELOCs) lies in their structure. A home equity loan provides a lump sum of money that is repaid in fixed monthly payments over a set term, usually ranging from five to fifteen years.

In contrast, a HELOC functions more like a credit card, allowing borrowers to withdraw funds as needed up to a predetermined limit, making it more flexible but potentially more complex in terms of repayment.

Qualification Criteria for Home Equity Loans

Understanding the qualification criteria for obtaining a home equity loan is essential for potential borrowers. Lenders typically assess several factors before approving an application, which may include the following:

- Credit Score: A good credit score is generally required, often above 620, to secure favorable loan terms. Higher scores can lead to lower interest rates.

- Loan-to-Value (LTV) Ratio: Lenders usually look for an LTV ratio of 80% or less, meaning the total amount of the loan should not exceed 80% of the home’s appraised value.

- Income and Employment Stability: Proof of stable income and a consistent employment history can enhance a borrower’s qualification prospects, demonstrating the ability to make regular payments.

- Debt-to-Income (DTI) Ratio: A lower DTI ratio, ideally below 43%, indicates that the borrower has a manageable level of debt in relation to their income, making them a more attractive candidate for a loan.

In addition to these factors, lenders may require a home appraisal to determine the current market value of the property, ensuring that the loan amount aligns with the risks involved. Borrowers should also be prepared to provide documentation such as tax returns, bank statements, and proof of assets to facilitate the application process.

“Home equity loans allow homeowners to access funds at lower interest rates by leveraging the value of their homes.”

Factors Influencing Home Equity Loan Rates

Source: money.com

The rates associated with home equity loans are determined by a combination of various factors that play a significant role in lending decisions. Understanding these factors is crucial for borrowers seeking to secure the best possible rates. By recognizing how each element contributes to the overall rate, homeowners can make informed decisions that align with their financial goals.The determination of home equity loan rates is influenced primarily by two key factors: credit scores and the loan-to-value (LTV) ratio.

Each of these components carries weight in the risk assessment conducted by lenders, thus impacting the final interest rate offered to borrowers.

Impact of Credit Scores on Loan Rates

Credit scores are a pivotal element in the evaluation process for home equity loans, as they serve as an indicator of creditworthiness. Typically, a higher credit score reflects lower risk for the lender, resulting in more favorable loan rates. Here are some important points regarding credit scores:

- A score of 700 or above often qualifies for the best rates, as it suggests a history of responsible credit use.

- Scores between 640 and 699 may still secure decent rates, although they will likely be higher than those offered to higher-scoring borrowers.

- Scores below 640 may lead to higher interest rates or even disqualification from certain loan options, as they indicate a higher risk of default.

Additionally, lenders typically consider the entirety of a borrower’s credit profile, including the length of credit history, types of credit accounts, and recent credit inquiries. Borrowers are encouraged to check their credit reports and rectify any inaccuracies before applying for a loan to improve their chances of receiving better rates.

Role of Loan-to-Value Ratio in Rate Calculations

The loan-to-value ratio (LTV) is another critical factor that influences home equity loan rates. This ratio is calculated by dividing the total amount of the loan by the appraised value of the property. A lower LTV indicates that the borrower has more equity in their home, which typically results in lower rates. The relationship between LTV and loan rates can be summarized as follows:

- An LTV of 80% or lower is generally viewed as favorable, often leading to competitive rates.

- As the LTV ratio increases above 80%, the perceived risk to lenders rises, which may result in higher interest rates.

- For LTV ratios exceeding 95%, borrowers may face significant rate increases or even limitations on loan options available to them.

In essence, maintaining a low LTV is advantageous for borrowers to secure attractive loan rates, as it demonstrates both a commitment to financial responsibility and a reduced risk for lenders. Additionally, understanding these factors can empower homeowners to strategically improve their financial standing before seeking a home equity loan.

Current Best Home Equity Loan Rates

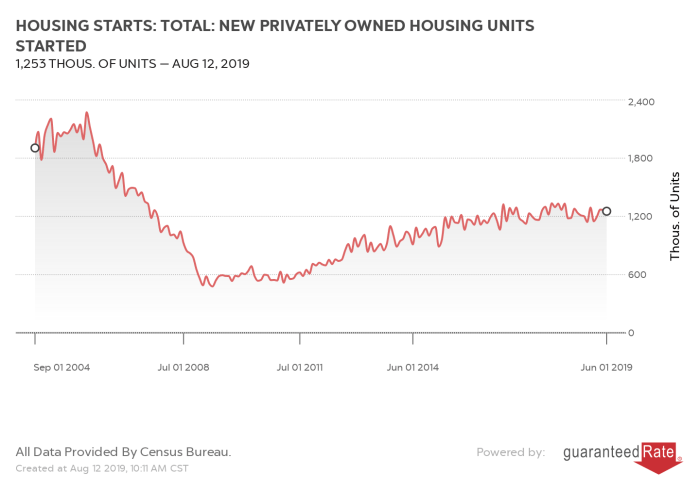

The landscape of home equity loan rates has been shaped significantly by current market trends, which reflect broader economic conditions, interest rate fluctuations, and lending practices. As of now, homeowners are witnessing a mixture of competitive offerings as lenders seek to attract borrowers in a dynamic housing market. Understanding these rates is crucial for anyone considering tapping into their home equity.Currently, home equity loan rates are influenced by several factors, including the Federal Reserve’s monetary policies, inflation rates, and overall demand for loans.

The average rates can fluctuate, but they provide a starting point for borrowers looking to finance home improvements, consolidate debt, or make significant purchases. According to recent data, home equity loan rates generally range from 4.5% to 8% depending on the lender, the borrower’s creditworthiness, and the loan-to-value ratio.

Comparison of Home Equity Loan Rates from Different Lenders

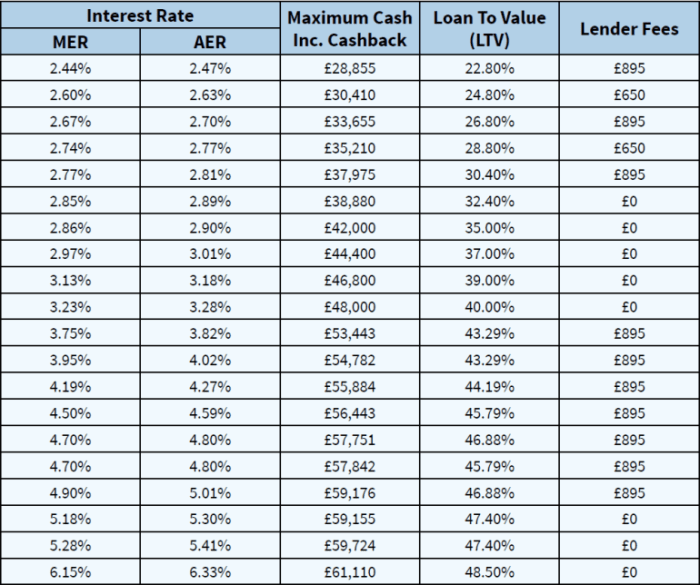

In order to make informed decisions, it is essential to compare the rates offered by various lending institutions. Below is a table that showcases some of the top lenders and their respective home equity loan rates as of the latest market analysis:

| Lender | Home Equity Loan Rate (%) | Loan Amount Range | Term Length |

|---|---|---|---|

| Bank of America | 4.75% | $25,000 – $1,000,000 | 5 to 30 years |

| Wells Fargo | 5.00% | $30,000 – $1,000,000 | 5 to 30 years |

| Chase | 4.85% | $20,000 – $500,000 | 5 to 30 years |

| PNC Bank | 5.25% | $15,000 – $500,000 | 5 to 30 years |

| Citibank | 4.90% | $10,000 – $1,000,000 | 5 to 30 years |

These rates are indicative and can vary based on the borrower’s credit score, property value, and other financial factors. It is advisable for borrowers to conduct thorough research and obtain personalized quotes from lenders to ensure they secure the best possible terms for their home equity loans. Additionally, some lenders may offer promotional rates that can further enhance the attractiveness of their products.

How to Secure the Best Home Equity Loan Rates

To secure the best home equity loan rates, it is essential to approach the lending process with a well-informed strategy. By understanding how to negotiate effectively, improve your credit score, and prepare the necessary documentation, you position yourself for favorable loan terms. This section discusses practical steps that can lead to better interest rates and an overall smoother application process.

Negotiating Better Rates with Lenders

Negotiating with lenders can significantly impact the interest rates you may receive. It is important to approach this process confidently and well-prepared. Consider the following strategies to help you secure a better rate:

- Research multiple lenders: Compare rates from different financial institutions to understand the market and leverage competitive offers.

- Highlight your creditworthiness: Present your credit score, income stability, and any other financial strengths to demonstrate your reliability as a borrower.

- Ask about discounts: Inquire whether the lender offers discounts for autopay setups, existing customer loyalty, or other programs that could lower your rate.

- Be willing to negotiate: Don’t hesitate to ask for a lower rate based on your research and comparisons with other lenders.

Improving Credit Scores Before Applying

A strong credit score plays a crucial role in determining the interest rate of your home equity loan. Prior to applying, take the following steps to enhance your credit score:

- Pay off outstanding debts: Reducing your credit card balances and settling any loans can improve your credit utilization ratio.

- Make timely payments: Ensure all bills are paid on time, as late payments can negatively affect your credit score.

- Limit new credit inquiries: Refrain from opening new credit accounts shortly before applying for a loan to avoid potential dips in your score.

- Review your credit report: Check for inaccuracies or errors and dispute any discrepancies that may be lowering your score.

Required Documents for Loan Applications

Having the right documentation ready can streamline the application process and expedite your loan approval. The following is a list of commonly required documents when applying for a home equity loan:

- Proof of identity: A government-issued ID such as a driver’s license or passport.

- Income verification: Recent pay stubs, W-2 forms, or tax returns to demonstrate your income stability.

- Homeownership documentation: Title deeds or mortgage statements to confirm property ownership.

- Credit history: A recent credit report to present your creditworthiness to the lender.

- Asset documentation: Bank statements or investment account statements to showcase your financial health.

Risks and Considerations of Home Equity Loans

Home equity loans offer the advantage of leveraging the equity built in your home to secure funds for various needs. However, it is essential to recognize the inherent risks and considerations that accompany this financial decision. Understanding these risks is crucial to making an informed choice about whether a home equity loan aligns with your financial goals.Rising interest rates are a significant factor that can influence the affordability and risk associated with home equity loans.

A common risk is the potential for a decrease in property value, which can lead to owing more than the home is worth. This situation, known as being “underwater,” complicates selling the home or refinancing the loan. Additionally, if interest rates rise, borrowers with variable-rate loans may see their monthly payments increase significantly, impacting their budget and financial stability.

Impact of Rising Interest Rates

The landscape of interest rates can have profound implications for homeowners considering a home equity loan. A rise in interest rates can lead to higher borrowing costs, which may deter potential borrowers. The following points illustrate how rising rates can specifically affect home equity loans:

- Increased Monthly Payments: Higher interest rates result in increased monthly payments, which can strain a borrower’s finances and reduce discretionary spending.

- Reduced Loan Eligibility: Lenders may tighten their criteria for loan approval, making it harder for borrowers to qualify for a home equity loan as rates rise.

- Potential for Financial Strain: As payments become more burdensome, borrowers might find themselves in a precarious financial situation, potentially leading to late payments or default.

Fixed-Rate Loans Versus Variable-Rate Loans

When considering home equity loans, borrowers typically have the option between fixed-rate loans and variable-rate loans. Each type presents its own set of risks that should be carefully evaluated prior to committing. Fixed-rate loans offer the stability of consistent interest rates over the life of the loan. This predictability can be advantageous, particularly in a rising interest rate environment. Conversely, variable-rate loans often start with lower initial rates, which can be appealing; however, they come with the risk of fluctuating payments.

The following factors highlight the differences:

- Payment Consistency: Fixed-rate loans provide consistent monthly payments, making budgeting easier, while variable-rate loans can lead to unpredictable payment amounts as rates change.

- Long-term Cost: Although variable rates may start lower, they can eventually surpass the total cost of a fixed-rate loan if interest rates rise significantly.

- Risk of Payment Shock: Borrowers with variable-rate loans may experience payment shock when their interest rates adjust upwards, leading to sudden and substantial increases in monthly payments.

Alternatives to Home Equity Loans

Home equity loans have long been a popular choice for homeowners seeking funds for major expenses. However, there are several alternatives that may be better suited to certain financial situations. Understanding these options can help homeowners make informed decisions regarding their financing needs.When considering alternatives to home equity loans, various financing options are available to homeowners, each having unique benefits and drawbacks.

Among these alternatives, personal loans and credit lines stand out as viable options. Personal loans provide a lump sum that can be used for a variety of purposes, while credit lines offer more flexibility for ongoing expenses.

Comparison of Personal Loans Versus Home Equity Loans

The choice between personal loans and home equity loans depends on individual circumstances. Below is a comparison of the two options, highlighting their advantages and disadvantages.

- Personal Loans

- Typically unsecured, meaning no collateral is required.

- Faster approval and funding process, often within a few days.

- Fixed interest rates and monthly payments provide predictable budgeting.

- Home Equity Loans

- Lower interest rates compared to unsecured personal loans, due to the risk being lower for lenders.

- Allows borrowing against the equity built in the home, which can be substantial.

- Potential tax benefits on the interest paid, subject to current tax laws.

In light of the characteristics of these financing options, certain scenarios may make alternatives more beneficial. The following points illustrate circumstances in which considering alternatives to home equity loans might be advantageous:

- Homeowners with limited equity in their property may find personal loans a more accessible option.

- Individuals who require quick access to funds for emergencies or unexpected expenses can benefit from the faster processing of personal loans.

- Those who prefer not to put their property at risk by using it as collateral might favor personal loans.

- Borrowers who wish to avoid the lengthy approval process associated with home equity loans may opt for personal loans instead.

- Homeowners who want flexibility in borrowing smaller amounts for various needs can utilize a credit line more effectively than a home equity loan.

“Choosing the right financing option is crucial for effective financial management and should be aligned with personal financial goals.”

Understanding these alternatives equips homeowners with the knowledge to select the most appropriate financing option that aligns with their financial circumstances.

Frequently Asked Questions About Home Equity Loans

Source: co.uk

Home equity loans are a vital financial tool for homeowners, enabling them to leverage their property value to secure funds. However, misconceptions can cloud understanding, leading to confusion or hesitation in the decision-making process. This section addresses common misunderstandings and provides clarity on frequently asked questions about home equity loans.

Common Misconceptions About Home Equity Loans

Many homeowners harbor misconceptions about home equity loans that can lead to poor financial decisions. Understanding the truth behind these myths is crucial for making informed choices.

Home equity loans are only for people in financial trouble.

This statement is misleading; home equity loans can be used for various purposes, including home improvements, education expenses, or debt consolidation, and are not solely for individuals facing financial challenges.

Home equity loans have high interest rates compared to other loans.

While it is true that home equity loans involve interest, the rates are often lower than unsecured loans due to the collateral of the home, making them a more affordable option for many borrowers.

Detailed Answers to Frequently Asked Questions

Homeowners often have specific questions about the nature, process, and implications of home equity loans. Below are detailed responses to some of the most common inquiries:

What is a home equity loan?

A home equity loan allows homeowners to borrow against the equity they have built up in their property, providing a lump sum of money that is repaid over time, typically with a fixed interest rate.

How is home equity calculated?

Home equity is determined by subtracting the remaining mortgage balance from the current market value of the home. For example, if a home is valued at $300,000 and the outstanding mortgage balance is $200,000, the homeowner has $100,000 in equity.

Can I borrow 100% of my home equity?

Generally, lenders do not allow borrowers to access 100% of their home equity due to risk factors. Most lenders offer up to 80-90% of the home’s appraised value minus the existing mortgage balance.

What are the typical fees associated with home equity loans?

Home equity loans may incur various fees, including application fees, appraisal fees, and closing costs. It is essential to review the specific terms with each lender to understand the total cost involved.

Is there a difference between a home equity loan and a home equity line of credit (HELOC)?

Yes, a home equity loan provides a single lump sum with a fixed interest rate, while a HELOC functions like a credit line that borrowers can draw from as needed, often with variable rates.

How long does it take to get a home equity loan?

The process can take anywhere from a few weeks to a couple of months, depending on the lender, the complexity of the financial situation, and the required documentation.By understanding these common misconceptions and questions, homeowners can make educated decisions about whether a home equity loan suits their financial needs.

Final Summary

Source: rate.com

In conclusion, navigating the landscape of home equity loans requires careful consideration of various factors, including current rates and personal financial health. By understanding the risks, exploring alternatives, and employing effective strategies, you can position yourself to secure the most advantageous home equity loan rates available in the market today.

FAQ Section

What is a home equity loan?

A home equity loan is a type of loan that allows homeowners to borrow against the equity in their home, using the property as collateral.

How does my credit score impact my home equity loan rate?

Your credit score significantly influences the interest rate offered on a home equity loan; higher scores typically result in lower rates.

What is the difference between a home equity loan and a line of credit?

A home equity loan provides a lump sum payment with fixed repayment terms, while a home equity line of credit allows for borrowing up to a limit as needed, similar to a credit card.

Can I use a home equity loan for any purpose?

Yes, a home equity loan can be used for various purposes, including home improvements, paying off debt, or funding educational expenses.

Are there any fees associated with home equity loans?

Yes, common fees may include appraisal fees, origination fees, and closing costs, which can vary by lender.