Exploring Average Home Equity Loan Rates reveals a vital aspect of financial planning for homeowners. Home equity loans can serve as a powerful tool, enabling individuals to tap into their property’s value for various needs. By understanding how these loans work and the rates associated with them, borrowers can make informed decisions that significantly impact their financial future.

This overview will delve into the intricacies of home equity loans, highlighting key factors that influence interest rates, current trends in the market, and strategies to secure the best possible rates. Whether you are considering a home equity loan for home improvements, debt consolidation, or other financial goals, knowing the average rates can guide you toward the most beneficial choices.

Overview of Home Equity Loans

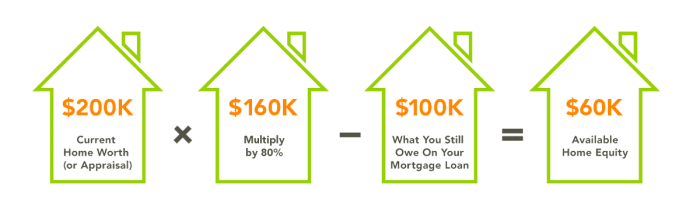

Home equity loans are financial products that allow homeowners to borrow against the equity they have built up in their property. This type of loan provides a lump sum payment that can be used for various purposes, such as home improvements, debt consolidation, or major expenses. The key advantage of a home equity loan is that it typically offers lower interest rates compared to unsecured loans, as the loan is secured by the homeowner’s property.Obtaining a home equity loan involves several steps.

First, homeowners need to assess their equity, which is the difference between the current market value of their home and the outstanding mortgage balance. After determining eligibility, borrowers will typically go through an application process that includes credit checks, income verification, and an appraisal of the property. Once approved, the funds are disbursed in a lump sum, and the borrower begins making monthly payments, which generally include both principal and interest.

Differences Between Home Equity Loans and Home Equity Lines of Credit (HELOCs)

Understanding the distinctions between home equity loans and HELOCs is crucial for homeowners considering leveraging their property for financial needs. Home equity loans provide a one-time lump sum, whereas HELOCs function more like credit cards, allowing borrowers to draw funds as needed up to a predetermined limit. Here are key differences between the two options:

- Disbursement: Home equity loans release a lump sum amount at once, while HELOCs allow for ongoing access to funds as required.

- Interest Rates: Home equity loans usually come with fixed interest rates, making monthly payments predictable; HELOCs typically have variable interest rates that can fluctuate over time.

- Repayment Structure: Home equity loans require fixed monthly payments over a set term, whereas HELOCs may have an interest-only payment period followed by a repayment period that includes both principal and interest.

- Uses of Funds: While both can be used for similar purposes, HELOCs offer flexibility for ongoing expenses, such as home renovations, while home equity loans might be preferred for a specific large expense.

In summary, while both home equity loans and HELOCs allow homeowners to access their home equity, the choice between them depends on individual financial needs, repayment preferences, and the intended use of the funds.

Importance of Home Equity Loan Rates

Source: cbsnewsstatic.com

Home equity loan rates hold significant importance in the financial landscape of homeowners. These rates directly influence the affordability and viability of borrowing against home equity. Understanding their implications can help homeowners make informed decisions about leveraging their property to access additional funds.The interest rates associated with home equity loans play a crucial role in determining the cost of borrowing.

A lower interest rate can mean substantial savings over the life of the loan, while a higher rate can lead to increased monthly payments and overall financial strain for the borrower. It is imperative to closely monitor these rates, as they can fluctuate based on market conditions, personal credit scores, and economic factors.

Impact on Monthly Payments

The effect of home equity loan rates on monthly payments is a critical consideration for borrowers. These rates dictate the amount of interest paid over the life of the loan. When interest rates rise, so do monthly payments, which can affect budget planning and financial stability. To illustrate this impact, consider the following example:

- A homeowner takes out a $50,000 home equity loan at a fixed interest rate of 4% for 15 years. The monthly payment will be approximately $370.

- Conversely, if the interest rate increases to 6%, the same loan would result in a monthly payment of about $422.

This example highlights how a mere 2% increase in interest can lead to a significant rise in monthly payments, emphasizing the importance of securing the best possible rate.

Relationship Between Home Equity Loan Rates and Overall Borrowing Costs

The relationship between home equity loan rates and overall borrowing costs is inherently linked. Home equity loans are often regarded as a cost-effective way to access funds; however, the interest rate applied can substantially impact the total repayment amount. The overall cost of borrowing is calculated by considering both the principal amount and the interest paid over the loan’s duration.Factors that influence the overall borrowing costs include:

Loan Amount

Higher amounts borrowed generally lead to increased total interest costs.

Loan Term

Longer terms may offer lower monthly payments but result in higher total interest paid over time.

Market Conditions

Economic factors such as inflation and the Federal Reserve’s monetary policy can affect interest rates.

When comparing home equity loan rates, it’s essential to consider the annual percentage rate (APR), which reflects the total cost of borrowing, including interest and fees.

Understanding these dynamics allows borrowers to make strategic financial choices. For instance, refinancing a home equity loan during a period of declining interest rates can reduce overall costs, providing substantial financial relief over time. With the right information and timing, homeowners can effectively manage their home equity loans to align with their financial goals.

Factors Influencing Average Home Equity Loan Rates

The average home equity loan rates are influenced by a variety of factors that collectively determine the cost of borrowing against home equity. Understanding these factors can help homeowners make informed decisions when considering a home equity loan. The three primary elements impacting these rates include credit scores, loan-to-value ratios, and broader market conditions.

Impact of Credit Scores on Loan Rates

Credit scores play a pivotal role in determining the interest rates offered on home equity loans. Lenders assess an applicant’s creditworthiness through their credit score, which reflects their credit history, payment behavior, and outstanding debts. A higher credit score typically results in lower interest rates, as it indicates to lenders that the borrower poses less risk. For instance, a borrower with a credit score of 740 or above may qualify for significantly more favorable rates compared to someone with a score below 620.

A difference of just 100 points in a credit score can lead to a variation of about 1% in the interest rate offered on a home equity loan.

Loan-to-Value Ratio (LTV) and Interest Rates

The loan-to-value ratio (LTV) is another critical factor influencing home equity loan rates. LTV is calculated by dividing the total amount of the loan by the appraised value of the home. A lower LTV ratio indicates that the homeowner has substantial equity in their property, which can lead to more favorable loan terms and lower interest rates. Conversely, a higher LTV ratio suggests higher risk for the lender, often resulting in increased rates.For example, if a homeowner has a property valued at $300,000 and seeks a loan of $90,000, their LTV would be 30%.

This relatively low LTV could qualify them for better interest rates compared to a borrower looking for a $150,000 loan on the same property, resulting in an LTV of 50%.

Market Conditions and Economic Factors

Market conditions and broader economic factors also play a significant role in shaping home equity loan rates. Economic indicators such as inflation, employment rates, and the Federal Reserve’s monetary policy can influence interest rates across the board. When the economy is robust, interest rates may rise due to increased demand for loans and higher inflation expectations. Conversely, in a sluggish economy, rates may decrease to stimulate borrowing and investment.Additionally, market competition among lenders can affect rates.

When more lenders enter the market or offer attractive terms, borrowers might benefit from lower rates. Keeping an eye on economic trends and understanding their potential impact on borrowing costs can empower homeowners to secure the best possible rates for their home equity loans.

Current Trends in Home Equity Loan Rates

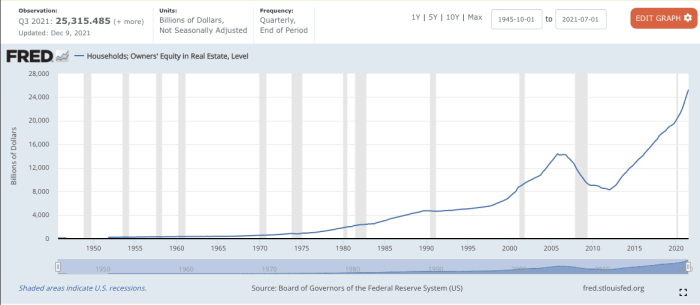

Recent trends in home equity loan rates indicate a dynamic shift in the borrowing landscape. As interest rates fluctuate due to various economic factors, homeowners are closely monitoring these changes to make informed lending decisions. The current environment reflects a blend of competitive offers from lenders and heightened consumer demand, influenced by national monetary policies and housing market conditions.The average home equity loan rates have seen variances compared to historical figures, providing insight into the evolving market landscape.

Historically, during periods of economic stability, rates tended to hover in the range of 4% to 6%. However, recent data suggests that current rates are slightly higher, often ranging between 6% and 8%, reflecting changes in the Federal Reserve’s interest rate adjustments and market sentiments. This upward trend emphasizes the importance of understanding the broader economic environment when considering a home equity loan.

Variability in Lender Rates

Different lenders exhibit significant variability in their home equity loan rates, influenced by their individual underwriting criteria, risk assessment strategies, and market positioning. This variance necessitates careful comparison by potential borrowers. To illustrate the current lending landscape, here are some examples of average home equity loan rates from notable lenders:

| Lender | Average Rate (%) | Notes |

|---|---|---|

| Lender A | 6.25 | Offers competitive rates for borrowers with excellent credit. |

| Lender B | 7.00 | Rates vary based on loan amount and borrower’s credit profile. |

| Lender C | 6.75 | Promotional offers available for existing customers. |

This table demonstrates how borrower profiles can influence rates across different lending institutions. Additionally, lenders may offer varied terms and conditions, which can impact the total cost of borrowing. Homeowners seeking a home equity loan should consider these variables before making a decision.

Understanding that rates can differ significantly among lenders underscores the necessity of thorough research and comparison.

Strategies for Securing the Best Home Equity Loan Rates

Securing the best home equity loan rates is crucial for homeowners seeking to leverage their property’s value for financial gain. Implementing effective strategies can significantly impact the rates offered by lenders. It is essential to understand the processes involved and the factors that can enhance your eligibility for favorable loan terms.

Improving Credit Scores

One of the most critical steps in obtaining favorable loan rates is ensuring your credit score is in good shape. A higher credit score not only enhances your chances of approval but also positions you for lower interest rates. Consider the following methods to enhance your credit score before applying for a home equity loan:

- Review Credit Reports: Obtain copies of your credit reports from major credit bureaus and scrutinize them for inaccuracies. Disputing any errors can significantly improve your score.

- Pay Down Existing Debt: Reducing outstanding debts, particularly revolving credit accounts, can lower your credit utilization ratio, positively affecting your score.

- Make Timely Payments: A history of on-time payments demonstrates reliability to lenders. Prioritize paying bills on time to maintain or boost your credit score.

- Avoid New Credit Applications: Refrain from applying for new credit accounts in the months leading up to your loan application, as this can temporarily lower your credit score.

Comparing Rates from Multiple Lenders

Shopping around for the best home equity loan rates is essential. By comparing offers from various lenders, you can identify the most competitive rates. The following strategies can aid in this process:

- Gather Loan Estimates: Request personalized loan estimates from multiple lenders to compare interest rates, fees, and terms side-by-side.

- Evaluate the Annual Percentage Rate (APR): The APR reflects the total cost of borrowing, including interest and fees, providing a clearer picture of the loan’s expense.

- Use Online Tools: Take advantage of online comparison tools that aggregate loan offers, making it easier to see differences and select the best option.

- Consider Local Credit Unions: Local credit unions often offer competitive rates and personalized service, which may be more favorable than larger financial institutions.

Negotiating Loan Terms and Rates

Negotiating your loan terms and rates can lead to better financial outcomes. Many borrowers may not realize that lenders are often open to discussions regarding rates and terms. Here are some considerations for effectively negotiating:

- Leverage Competing Offers: Presenting a competitive offer from another lender can encourage your preferred lender to match or beat that offer.

- Demonstrate Financial Stability: Show lenders your financial strength through documentation of income, assets, and a strong credit history, which can bolster your bargaining position.

- Request Specific Terms: Be clear about your desired loan terms and ask if the lender can accommodate your requests, such as a lower interest rate or reduced fees.

- Be Prepared to Walk Away: If the offered terms do not meet your expectations, be willing to seek alternatives. This mindset can enhance your negotiating power.

Impact of Average Home Equity Loan Rates on Borrowers

The average home equity loan rates have a significant influence on borrowers’ decisions and their long-term financial health. As these rates fluctuate, they can directly impact the affordability of loans, borrowing power, and the overall financial landscape for homeowners. Understanding these implications is crucial for anyone considering tapping into their home equity.High-interest rates can lead borrowers to reconsider their options when it comes to home equity loans.

As rates rise, the cost of borrowing increases, which may deter potential borrowers from taking out a loan. The decision to borrow is often influenced by the monthly payments that higher rates necessitate. For instance, a borrower may initially plan to take out a $50,000 home equity loan but may find that the monthly payments for such a loan at a 7% interest rate are significantly higher compared to a 4% rate.

This can result in borrowers opting for smaller loan amounts or delaying their borrowing plans altogether.

Long-term Financial Implications of Varying Rates

The selection of a home equity loan with varying interest rates can have long-lasting financial implications. Borrowers must consider both current and future financial scenarios. The following points detail critical aspects of choosing loans with varying rates:

- The potential for payment increases: With variable-rate loans, payments can rise significantly if interest rates increase, which could strain borrowers’ budgets.

- Impact on overall loan cost: Higher rates mean that the total interest paid over the life of the loan can skyrocket, leading to a more expensive borrowing experience.

- Effect on credit scores: If rising rates lead to missed payments, borrowers’ credit scores may suffer, affecting their ability to secure future financing.

“Selecting a home equity loan with a variable rate can create uncertainty in monthly financial obligations, potentially leading to financial strain.”

Examples of Rate Influence on Borrowing Power and Loan Amounts

Average home equity loan rates can markedly alter the borrowing power and maximum loan amounts for homeowners. Consider the following scenarios to illustrate this effect:

Scenario 1

A homeowner with a credit score of 750 and a home valued at $300,000 may qualify for a home equity loan of up to 80% of their home’s value, translating to a potential borrowing limit of $240,000. If the average rate is 3%, the monthly payment on a $240,000 loan could be approximately $1,011. However, if the rate rises to 6%, the same loan could increase the monthly payment to about $1,439, potentially dissuading the borrower from applying for the full amount.

Scenario 2

A couple planning to consolidate debt may initially consider a $100,000 home equity loan at an average rate of 4%. As rates climb to 8%, the couple might only feel comfortable borrowing $75,000 due to the increased payment burden, thus reducing their capacity to effectively manage existing debts.Overall, the implications of average home equity loan rates are profound, influencing not only immediate borrowing choices but also long-term financial stability for borrowers.

Resources for Home Equity Loan Rate Information

In today’s dynamic financial landscape, staying informed about home equity loan rates is crucial for homeowners considering borrowing against their property. Access to reliable resources can make a significant difference in understanding current market trends and making informed decisions. The following sections Artikel various resources available for tracking average home equity loan rates, the role of financial advisors, and the advantages of employing online calculators.

Websites and Tools for Tracking Average Home Equity Loan Rates

Numerous online resources provide valuable insights into home equity loan rates. Homeowners can equip themselves with accurate data by consulting these reputable sources:

- Bankrate.com: Offers an extensive database of current home equity loan rates and expert articles on the topic.

- LendingTree.com: Provides a comparison tool for loan rates from multiple lenders, allowing users to find competitive offers easily.

- MortgageNewsDaily.com: Features daily updates on mortgage rates, including home equity loans, along with market analysis.

- NerdWallet.com: Delivers comparative insights on various loan products and their associated average rates.

- Consumer Financial Protection Bureau (CFPB): Offers guidelines and educational resources regarding home equity loans and their implications.

Utilizing these websites will help borrowers gain a comprehensive understanding of the current market, enabling them to make informed lending decisions.

Consulting Financial Advisors for Rate Comparisons

Engaging with financial advisors can significantly enhance the decision-making process regarding home equity loans. Advisors possess the expertise to conduct detailed comparisons between different loan options and lenders. They can provide personalized recommendations based on individual financial situations, helping borrowers navigate complex lending terms and conditions.

“Financial advisors help borrowers identify the best loan products tailored to their unique financial needs.”

Working with a professional can lead to better rates and terms, ensuring homeowners maximize their borrowing potential while minimizing costs.

Utilizing Online Calculators for Estimating Loan Costs

Online calculators are invaluable tools for prospective borrowers, allowing them to estimate potential loan costs based on varying interest rates. These calculators can provide insights into monthly payments, total interest paid over the life of the loan, and the overall cost of borrowing.When using online calculators, homeowners should consider the following strategies:

- Input precise loan amounts and interest rates to obtain accurate estimates.

- Adjust different variables, such as loan term and payment frequency, to see their impact on monthly payments.

- Utilize calculators that factor in property taxes and insurance to get a well-rounded view of total monthly costs.

- Review multiple calculators from different financial websites to compare results and ensure accuracy.

By leveraging these online resources, homeowners can make informed decisions regarding their home equity loans with a clear understanding of associated costs and implications.

Closure

Source: firstmarkcu.org

In conclusion, understanding Average Home Equity Loan Rates is crucial for homeowners looking to leverage their equity wisely. By recognizing the factors that influence these rates and the current trends in the market, borrowers can navigate their options more effectively. With the right strategies in place, securing favorable rates can lead to enhanced financial stability and growth, ensuring that homeowners make the most of their investments.

Key Questions Answered

What is the typical duration for a home equity loan?

Home equity loans usually have a duration ranging from 5 to 30 years, depending on the lender and the specific loan agreement.

Can I deduct interest on my home equity loan?

Yes, interest on home equity loans may be tax-deductible if the funds are used for qualifying home improvements, subject to IRS regulations.

How can I improve my home equity loan rates?

Improving your credit score, lowering your debt-to-income ratio, and increasing your home’s value can help secure better rates.

Are there fees associated with home equity loans?

Yes, home equity loans may involve various fees such as appraisal, origination, and closing costs, which should be considered when evaluating loan options.

What happens if I default on my home equity loan?

Defaulting on a home equity loan can lead to foreclosure, where the lender may take possession of the property used as collateral.