Home Equity Loan Rates By Bank bring to light a vital financial option for homeowners looking to leverage their property’s value. These loans allow individuals to access funds by borrowing against the equity they have built up in their homes. Understanding the landscape of these loans, including their purposes and historical evolution, is essential for making informed financial decisions.

Home equity loans can serve various purposes, such as home improvements, debt consolidation, or major purchases. As the market for these loans has evolved, so too have the rates offered by different banks, influenced by numerous factors including credit scores, loan amounts, and prevailing economic conditions.

Overview of Home Equity Loans

Home equity loans are financial products that allow homeowners to borrow against the equity they have built in their property. Equity is the difference between the current market value of a home and the outstanding balance on the mortgage. These loans function similarly to traditional loans, where the borrower receives a lump sum of money that must be repaid over time, typically with a fixed interest rate.Homeowners utilize home equity loans for various purposes, making them a versatile financial tool.

Common uses include home renovations, debt consolidation, education expenses, and major purchases. By tapping into the equity of their home, borrowers can access funds at potentially lower interest rates than those associated with credit cards or personal loans.

History and Market Evolution of Home Equity Loans

The concept of home equity loans can be traced back to the mid-20th century when the U.S. housing market began to expand significantly. Initially, these products were not widely available; however, as homeownership rates increased, lenders recognized the potential for offering loans secured by home equity. Over the years, the market for home equity loans has evolved considerably. The introduction of adjustable-rate home equity lines of credit (HELOCs) provided homeowners with more flexible borrowing options.

As interest rates fluctuated, these products gained popularity due to their ability to offer lower initial rates compared to fixed-rate home equity loans. The growth of the housing market in the early 2000s saw a surge in home equity borrowing, driven by rising home values and aggressive lending practices. However, the financial crisis of 2008 led to a reevaluation of lending standards, resulting in stricter requirements for borrowers.

In recent years, as the economy has stabilized, home equity loans have regained traction, with many homeowners seeking to leverage their home equity for investment opportunities or financial relief.In summary, home equity loans provide a means for homeowners to access funds based on their property’s value, with a history that reflects the broader economic landscape and shifting lending practices.

Factors Influencing Home Equity Loan Rates

The rates associated with home equity loans are not fixed; they fluctuate based on various key factors. Understanding these elements is crucial for borrowers looking to secure favorable financing terms. These factors include the borrower’s creditworthiness, the amount of the loan relative to the home’s value, and prevailing economic conditions that shape market trends.

Role of Credit Score

A borrower’s credit score is one of the most significant determinants of the interest rate on a home equity loan. Lenders utilize credit scores to assess the likelihood of timely repayments. Higher credit scores generally lead to lower interest rates due to perceived lower risk by lenders.

A credit score of 740 and above typically qualifies borrowers for the best interest rates.

Loan Amount and Home Value

The total amount borrowed in relation to the appraised value of the home, known as the loan-to-value (LTV) ratio, also influences rates. A lower LTV indicates a higher equity stake in the property and typically results in more favorable interest rates for the borrower.

An LTV ratio below 80% is often seen as optimal for securing lower rates.

Market Trends and Economic Conditions

Economic factors such as inflation, interest rate trends, and housing market health can affect home equity loan rates. For example, in a rising interest rate environment, lenders may increase rates to maintain their profit margins.

When the Federal Reserve raises interest rates, lenders often follow suit, leading to higher borrowing costs for consumers.

The state of the housing market also plays a vital role. If home values are appreciating, borrowers may find it easier to obtain loans at lower rates, whereas declining home values can lead to stricter lending practices and higher rates.

Market demand for home equity loans fluctuates with broader economic trends, affecting the rates lenders are willing to offer.

Comparison of Home Equity Loan Rates by Bank

Source: credible.com

In the realm of home equity loans, interest rates and terms can vary significantly depending on the lender. Understanding these differences allows borrowers to make informed decisions that align with their financial goals. In this section, we will explore a comparative analysis of home equity loan rates from several major banks and highlight the distinctions between traditional banks and online lenders.

Comparison Table of Home Equity Loan Rates

The following table presents a comparison of home equity loan rates, showcasing the interest rates, loan terms, and fees associated with various banks. This data is crucial for borrowers seeking the best available options for their financial needs.

| Bank Name | Interest Rate | Loan Terms | Fees |

|---|---|---|---|

| Bank of America | 6.25% | 5-30 years | Varies by state, avg. $200 |

| Wells Fargo | 6.50% | 5-30 years | Origination fee up to 1.5% |

| Chase | 6.75% | 5-20 years | $0-$500 depending on loan size |

| Citibank | 6.30% | 10-30 years | Processing fee of $75 |

| SoFi (Online Lender) | 5.99% | 5-20 years | No origination or prepayment fees |

| Rocket Mortgage (Online Lender) | 6.10% | 8-30 years | Varies; typically low fees |

The comparison illustrates a range of interest rates and fees. Traditional banks tend to have slightly higher rates and various fees, such as origination or processing charges. Conversely, online lenders like SoFi and Rocket Mortgage often present competitive rates with fewer fees, making them an appealing choice for many borrowers. This distinction can significantly impact the overall cost of borrowing, and potential borrowers should weigh these factors carefully when selecting a lender.

How to Choose the Right Bank for Home Equity Loans

Selecting the right bank for a home equity loan is a critical step for homeowners looking to leverage their property’s value. The decision requires careful consideration of various factors to ensure that the loan terms align with financial goals and circumstances. This guide provides homeowners with essential criteria and a checklist to help facilitate an informed choice.

Criteria for Selecting a Bank

When evaluating banks for home equity loans, homeowners should consider several key criteria that can significantly impact their borrowing experience. The following points highlight important aspects to assess:

- Interest Rates: Compare the offered interest rates across different banks, as even a slight difference can affect total repayment amounts.

- Fees and Closing Costs: Evaluate any associated fees, such as application fees, origination fees, and closing costs that could increase the overall cost of the loan.

- Loan Terms: Look for flexibility in loan terms, including the length of the repayment period and whether fixed or variable rates are available.

- Customer Service: Research the bank’s reputation for customer service through reviews and ratings, as a responsive support team can ease the borrowing process.

- Accessibility: Consider the convenience of the bank’s locations and online services, especially if regular visits or digital communication are needed.

- Promotions and Discounts: Some banks may offer special promotions or discounts for existing customers or specific demographics, which can provide additional savings.

Checklist for Evaluating Bank Offers and Terms

To systematically evaluate different bank offers, homeowners can utilize the following checklist. This tool assists in gathering and comparing crucial information before making a decision.

- Interest Rate: Record the interest rates presented by each bank.

- Annual Percentage Rate (APR): Include the APR to understand the true cost of the loan.

- Monthly Payment Estimates: Calculate the potential monthly payments based on loan amount and terms.

- Types of Rates: Identify if the rates are fixed or variable and the implications of each.

- Fees Breakdown: List all fees associated with the loan, including any hidden charges.

- Loan Amount Limits: Check the minimum and maximum amounts the bank is willing to lend.

- Prepayment Penalties: Verify if there are any penalties for early repayment.

- Approval Process Duration: Note how long the approval process typically takes.

- Bank Reputation: Look into customer experiences and reviews regarding the bank’s service and reliability.

Negotiating Rates and Fees with Banks

When exploring home equity loan options, homeowners should be prepared to negotiate rates and fees with banks. Engaging in this process can yield better terms and reduce overall loan costs.

Effective negotiation can lead to significant savings on interest rates and fees.

Homeowners can employ several strategies to enhance their negotiating position:

- Research Competitors: Gather information on competitors’ rates and offers to use as leverage during negotiations.

- Highlight Positive Financial History: Present a strong credit score and reliable payment history to strengthen your case for better rates.

- Discuss Existing Relationships: Mention any existing relationships with the bank, as they may offer loyalty discounts.

- Be Clear on Your Needs: Clearly communicate your loan needs and budget constraints to guide the bank in proposing suitable terms.

- Consider Alternatives: Be prepared to walk away if the offer does not meet expectations, showing that you have other options can motivate banks to improve their offers.

Pros and Cons of Home Equity Loans

Home equity loans can be a viable financial tool for homeowners looking to leverage the equity in their homes for various purposes. Understanding the advantages and disadvantages associated with these loans is essential for making informed decisions. Home equity loans allow homeowners to borrow against the equity built up in their properties, typically offering lower interest rates than unsecured loans, but they also come with risks and responsibilities.

Below is a comprehensive overview of the benefits and drawbacks of home equity loans.

Advantages of Home Equity Loans

Home equity loans come with several advantages that make them appealing to many borrowers. Understanding these benefits can help homeowners assess whether this financial option is suitable for their needs.

- Lower Interest Rates: Home equity loans generally have lower interest rates compared to unsecured loans, as they are secured by the property.

- Fixed Interest Rates: Many home equity loans offer fixed interest rates, providing predictable monthly payments over the loan term.

- Tax-Deductible Interest: In some cases, the interest paid on home equity loans may be tax-deductible, subject to IRS regulations.

- Lump-Sum Disbursement: Borrowers receive the full loan amount upfront, which can be beneficial for large expenses, such as home renovations or debt consolidation.

- Access to Large Amounts: Home equity loans typically allow borrowers to access significant amounts of money based on their home equity, often in the tens of thousands of dollars.

Disadvantages and Risks of Home Equity Loans

While home equity loans offer various benefits, it is crucial to be aware of the potential risks and drawbacks. Understanding these factors can help borrowers make informed financial decisions.

- Risk of Foreclosure: Since the loan is secured by the home, failure to repay could lead to foreclosure, putting the borrower’s property at risk.

- Closing Costs and Fees: Home equity loans may come with significant closing costs and fees that can add to the overall expense of borrowing.

- Debt Accumulation: Borrowers may incur additional debt if they take out a home equity loan without a clear repayment plan, leading to financial strain.

- Market Fluctuations: A decline in the housing market can reduce home equity, affecting the borrower’s ability to refinance or sell the property.

- Limited Use of Funds: Some lenders may impose restrictions on how borrowed funds can be used, limiting the borrower’s flexibility.

Scenarios Favoring Home Equity Loans

Home equity loans can be particularly advantageous in specific financial situations. Identifying these scenarios is essential for determining when this loan type may be preferable to others.Home equity loans are often more favorable for large, one-time expenses such as home improvements, education costs, or significant debt consolidation efforts. For instance, a homeowner planning a major kitchen renovation can benefit from tapping into their home equity, as the fixed interest rates and lower costs compared to personal loans may offer substantial savings.

Additionally, homeowners with substantial equity and a solid repayment strategy may find these loans more beneficial than personal loans or credit cards, which typically have higher interest rates and shorter terms. In summary, while home equity loans provide opportunities for leveraging property value, they also come with inherent risks that need careful consideration.

Application Process for Home Equity Loans

Applying for a home equity loan involves several key steps that ensure the process is efficient and straightforward. Understanding these steps can help homeowners navigate the application smoothly and enhance their chances of approval. In this section, we will Artikel the necessary steps in the application process, the required documents, and how to prepare effectively.

Step-by-Step Application Process

The application process for a home equity loan can be broken down into several essential steps. Each step requires specific actions and documentation, which are critical for achieving a successful application outcome.

- Pre-Application Preparation: Begin by assessing your financial situation and determining how much equity you have in your home. This will help you decide how much you want to borrow. It is advisable to check your credit report for any inaccuracies and improve your credit score if necessary.

- Gather Required Documents: Most lenders require a standard set of documents to evaluate your application. These typically include:

- Proof of income (recent pay stubs, W-2 forms, or tax returns)

- Proof of home ownership (property deed or title)

- Current mortgage statement

- Homeowners insurance details

- Personal identification (driver’s license or passport)

- Credit history information

- Submit Application: After gathering the necessary documents, you can submit your application to the lender of your choice. Most lenders offer online applications, making this step convenient. Ensure that all information provided is accurate and complete to avoid delays.

- Loan Underwriting: Once submitted, the lender will begin the underwriting process, where they will analyze your financial information, creditworthiness, and the value of your home. This is a critical phase where your application will be thoroughly reviewed.

- Loan Approval and Closing: If approved, you will receive a loan offer that Artikels the terms and conditions. Review this carefully. If you agree, you will move to the closing stage, where you will sign the necessary paperwork and receive the funds.

Timeline for Application Process

Understanding the timeline for each step can help manage expectations. The entire process generally takes several weeks, with variations based on lender efficiency and applicant preparedness. Here is a typical timeline:

| Step | Timeframe |

|---|---|

| Pre-Application Preparation | 1-2 weeks |

| Document Gathering | 1 week |

| Application Submission | 1 day |

| Loan Underwriting | 1-3 weeks |

| Loan Approval and Closing | 1-2 weeks |

Tips for a Successful Application

To maximize approval chances, consider the following tips:

- Maintain a good credit score; aim for a score above 700 for better rates.

- Provide accurate and thorough documentation to avoid delays.

- Consider getting pre-approved to understand how much you can borrow.

- Work with a lender who specializes in home equity loans and has a good reputation.

- Be prepared to explain any discrepancies in your financial history that may arise during underwriting.

“Preparing thoroughly and staying organized can significantly improve your chances of securing a favorable home equity loan.”

Alternatives to Home Equity Loans

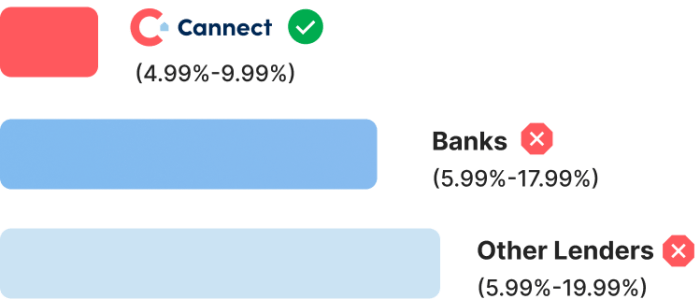

Source: cannect.ca

Home equity loans are not the only financing options available to homeowners looking to access their property’s equity. There are several alternatives that may better suit individual financial situations or preferences. Understanding these alternatives can help homeowners make informed decisions regarding their financing needs.There are various alternatives to home equity loans, each with unique advantages and drawbacks. These include personal loans, cash-out refinancing, and lines of credit, among others.

Below is a comparison of these options, highlighting their pros, cons, and eligibility requirements to assist homeowners in choosing the best financial route.

Comparison of Alternatives

The following table provides a comparative analysis of common alternatives to home equity loans, outlining their respective pros, cons, and eligibility criteria.

| Alternative | Pros | Cons | Eligibility Requirements |

|---|---|---|---|

| Personal Loans |

|

|

|

| Cash-Out Refinancing |

|

|

|

| Home Equity Line of Credit (HELOC) |

|

|

|

In certain scenarios, these alternatives may present more favorable options than home equity loans. For instance, personal loans may be suitable for individuals requiring quick access to funds without the need for collateral. Cash-out refinancing can be advantageous for those with substantial equity in their homes and who are looking to secure lower interest rates, while also accessing larger amounts of cash.

Similarly, a HELOC might be ideal for homeowners who need flexibility in borrowing and wish to draw funds as necessary.Overall, evaluating these alternatives in relation to individual financial circumstances, needs, and goals is crucial for making an informed decision regarding home financing.

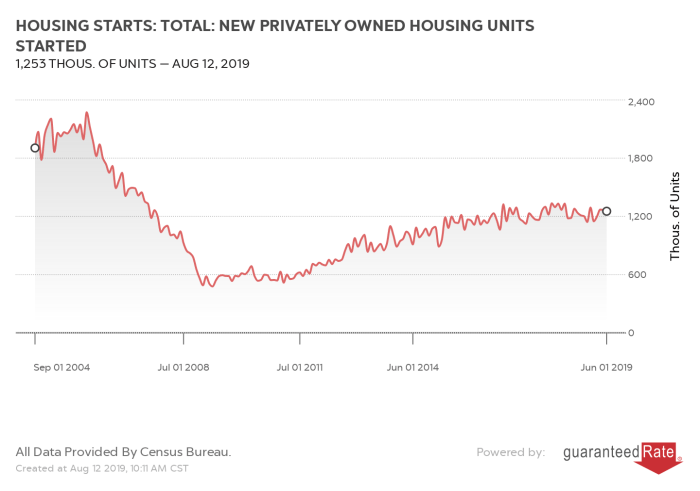

Current Trends in Home Equity Loan Rates

Source: rate.com

Recent developments in the economic landscape have significantly influenced home equity loan rates. Home equity loans, which allow homeowners to borrow against the value of their home, have seen fluctuations in rates due to various factors, including interest rate changes, inflation rates, and housing market dynamics. Understanding these trends is essential for homeowners considering borrowing options.The current trend points to a gradual increase in home equity loan rates, driven primarily by the Federal Reserve’s adjustments to the benchmark interest rates in response to inflationary pressures.

As the economy continues to recover, the cost of borrowing may rise, impacting the affordability of home equity loans for many homeowners. Furthermore, competition among lenders remains intense, which can lead to varying rates and terms being offered in the market.

Impact of Economic Indicators on Home Equity Loan Rates

Several economic indicators play a crucial role in determining the trend of home equity loan rates. These include:

- Federal Reserve Interest Rate Decisions: The Federal Reserve’s monetary policy directly influences borrowing costs. As rates are adjusted to combat inflation, home equity loan rates tend to follow suit.

- Inflation Rates: Rising inflation can lead to higher interest rates, affecting the overall cost of loans. Homeowners should monitor inflation trends as they can impact purchasing power and borrowing costs.

- Housing Market Trends: A robust housing market often leads to higher home values, which can create more equity for homeowners. However, if the market shows signs of slowing, lenders may adjust their rates accordingly to mitigate risk.

- Employment Rates: Higher employment rates can lead to increased consumer confidence, prompting more homeowners to consider borrowing against their home equity.

As these indicators fluctuate, they will shape the landscape for home equity loans. Homeowners should remain informed about these trends to make educated decisions regarding their financial strategies.

“Monitoring economic indicators is essential for homeowners to navigate the changing landscape of home equity loan rates effectively.”

Predictions for the future indicate a potential continuation of rising loan rates, especially if inflation remains a persistent issue. Homeowners looking to secure a home equity loan in the near future may need to act swiftly to lock in lower rates before any substantial increases occur. In summary, staying attuned to these economic factors is paramount for homeowners aiming to leverage their home equity effectively.

Final Thoughts

In conclusion, navigating the world of home equity loans and their rates requires careful consideration of various factors and an understanding of current market trends. By comparing rates from different banks and evaluating their terms, homeowners can make strategic choices that best suit their financial needs. Ultimately, being well-informed is the key to securing favorable loan conditions and maximizing the benefits of home equity.

User Queries

What is the difference between a home equity loan and a home equity line of credit?

A home equity loan provides a lump sum upfront, while a home equity line of credit (HELOC) offers a flexible borrowing limit that can be drawn upon as needed.

How does my credit score affect my home equity loan rate?

A higher credit score typically results in lower interest rates, as it indicates to lenders that you are a less risky borrower.

Are there fees associated with home equity loans?

Yes, there may be closing costs, appraisal fees, and origination fees associated with obtaining a home equity loan.

Can I use a home equity loan for anything other than home repairs?

Yes, funds from a home equity loan can be used for various purposes, including debt consolidation, education expenses, and major purchases.

What is the typical repayment term for a home equity loan?

Home equity loans generally have repayment terms ranging from 5 to 30 years, depending on the lender and loan amount.