5 Year Home Equity Loan Rates sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail. This short-term borrowing option allows homeowners to leverage their property equity for various financial needs while enjoying the benefits of manageable repayments. Understanding the dynamics of these rates can empower homeowners to make informed decisions that align with their financial goals.

As the economy evolves, understanding the structure and benefits of 5 year home equity loans becomes increasingly important. These loans not only provide quick access to funds but also come with a unique set of advantages compared to longer-term loans. Exploring the implications of current market trends, borrower preferences, and the application process can enhance one’s knowledge and improve the overall borrowing experience.

Overview of 5 Year Home Equity Loan Rates

Source: norton.com

A 5 year home equity loan is a type of borrowing that allows homeowners to leverage the equity built up in their property. This loan is generally offered as a fixed-rate option, meaning that the interest rate remains consistent throughout the loan term, making it easier for borrowers to plan their finances. Over five years, homeowners can access substantial funds for various purposes, such as home renovations, debt consolidation, or major purchases, while repaying the loan in equal monthly installments.The rates for 5 year home equity loans are influenced by several key factors.

These include the applicant’s credit score, the loan-to-value (LTV) ratio, market conditions, and prevailing interest rates. A higher credit score typically qualifies borrowers for lower rates, while a higher LTV ratio may lead to higher rates due to perceived risk from lenders. Additionally, changes in the economic environment, such as inflation and Federal Reserve interest rate adjustments, directly impact these loan rates.

Current Average Rates and Historical Trends

Understanding the current trends in 5 year home equity loan rates is essential for potential borrowers. As of recent data, the average rate for a 5 year home equity loan hovers around 6.5%. This figure reflects a slight increase from the previous year’s average of 5.8%, indicating an upward trend that aligns with broader economic developments.Historical data shows fluctuations in these rates, which are often influenced by macroeconomic conditions.

For instance, in the aftermath of the 2008 financial crisis, rates plummeted to record lows, with averages falling below 4%. However, as the economy recovered over the subsequent years, rates gradually increased. The chart below illustrates the average rates over the last decade:

| Year | Average Rate (%) |

|---|---|

| 2013 | 4.5 |

| 2015 | 4.0 |

| 2018 | 5.0 |

| 2020 | 3.5 |

| 2022 | 5.8 |

| 2023 | 6.5 |

Overall, the historical trends reveal that while rates can vary significantly over time, they tend to reflect broader economic conditions and changes in the housing market. Borrowers considering a 5 year home equity loan should stay informed about these trends to make knowledgeable financial decisions.

Benefits of 5 Year Home Equity Loans

Source: refiguide.org

year home equity loans present a unique opportunity for homeowners looking to leverage the equity in their homes while enjoying favorable loan terms. These loans typically offer lower interest rates compared to longer-term loans, allowing borrowers to take advantage of short-term borrowing benefits while maintaining financial flexibility. Choosing a 5 year term over longer terms has several advantages that can significantly enhance a borrower’s financial strategy.

The primary benefit revolves around the interest savings associated with shorter repayment periods. With fewer years to pay off the loan, interest is calculated on a smaller principal balance for a shorter duration, which can lead to substantial savings over the life of the loan.

Advantages of Shorter Loan Terms

The appeal of a 5 year home equity loan lies in its structured repayment plan, which allows borrowers to pay off their debt more quickly. The following points Artikel the key benefits of opting for a shorter loan term:

- Lower Interest Rates: Generally, shorter loan terms come with lower interest rates, which can lead to reduced overall costs. For instance, a borrower might secure a rate of 4% on a 5 year loan, compared to a rate of 5% on a 15 year loan.

- Rapid Equity Building: Homeowners can build their equity faster, as a larger portion of their monthly payment goes toward the principal rather than interest.

- Less Overall Interest Paid: Borrowers save on interest payments because the total interest paid over the life of the loan is significantly less for shorter terms.

- Faster Financial Freedom: Completing payments sooner allows borrowers to regain full control of their financial resources and invest in other opportunities.

The scenarios where a 5 year home equity loan is particularly beneficial often involve homeowners with a specific financial goal in mind. Situations include debt consolidation, home renovations, and financing education expenses. In these cases, the borrower can quickly access funds while minimizing interest costs.For instance, a homeowner looking to renovate their kitchen may take out a 5 year home equity loan to finance the project.

By opting for a shorter loan term, they can leverage their increased home value post-renovation, potentially leading to a quicker sale or better refinancing options in the future. In summary, the potential savings associated with shorter repayment periods can be significant. With lower interest rates, faster equity building, and less overall interest paid, a 5 year home equity loan is an attractive option for many homeowners looking to maximize their financial well-being and achieve their goals within a concentrated timeframe.

Comparison with Other Loan Types

When considering financing options for home improvements, debt consolidation, or other significant expenses, it is crucial to understand the characteristics and differences between various loan types. Among these options, 5 year home equity loans, traditional mortgage loans, and home equity lines of credit (HELOC) each offer distinct features that cater to diverse financial needs.

Comparison of 5 Year Home Equity Loans and Traditional Mortgage Loans

year home equity loans and traditional mortgage loans serve different purposes in the borrowing landscape. Traditional mortgages primarily provide funds for purchasing homes, while home equity loans allow homeowners to borrow against the equity accrued in their property. One of the core differences lies in the interest rates. Traditional mortgage loans often have lower interest rates due to their long-term repayment structure, which can extend to 30 years.

In contrast, 5 year home equity loans typically feature higher interest rates that correlate with their shorter repayment term. Moreover, the establishment of home equity loans is simpler as they often require less paperwork compared to traditional mortgages.The repayment structure also presents notable distinctions. Traditional mortgages typically follow an amortization schedule that stretches across many years, resulting in smaller monthly payments.

Conversely, 5 year home equity loans have fixed monthly payments over a shorter timeframe, which can lead to higher monthly costs but rapid equity accumulation in a shorter period.

Differences Between 5 Year Home Equity Loans and HELOC

A home equity line of credit (HELOC) and a 5 year home equity loan differ fundamentally in terms of structure and payment flexibility. While a 5 year home equity loan provides a lump-sum amount that is repayable in fixed installments over five years, a HELOC operates more like a credit card. Borrowers can draw from a specified line of credit as needed and only pay interest on the amounts borrowed.The interest rates between these two options also vary significantly.

HELOCs typically have variable interest rates that can fluctuate based on market conditions, potentially resulting in lower initial payments but more uncertainty in total repayment costs. In contrast, 5 year home equity loans come with fixed interest rates, ensuring predictable monthly payments throughout the loan term.To further clarify the advantages and disadvantages of each loan type, the following table summarizes key points:

| Loan Type | Pros | Cons |

|---|---|---|

| 5 Year Home Equity Loan |

|

|

| Traditional Mortgage Loan |

|

|

| HELOC |

|

|

Eligibility Requirements

Applying for a 5 year home equity loan requires meeting specific eligibility criteria designed to ensure responsible lending and borrowing practices. By understanding these requirements, potential borrowers can better prepare for their application and improve their chances of approval.One of the primary qualifications needed to apply for a 5 year home equity loan is home equity. Borrowers typically must have a certain percentage of equity in their home, usually around 15% to 20%, which is the difference between the home’s current market value and the outstanding mortgage balance.

Additionally, lenders assess the borrower’s creditworthiness, income stability, and debt-to-income ratio.

Typical Qualifications

The qualifications for a 5 year home equity loan encompass several critical factors:

- Home Equity: As mentioned, having sufficient equity in your home is mandatory. A common threshold is around 15%-20% of the home’s value.

- Credit Score: Most lenders require a minimum credit score, often ranging from 620 to 700, with better scores yielding more favorable rates.

- Income Verification: Proof of stable income is necessary to demonstrate the ability to repay the loan comfortably.

- Debt-to-Income Ratio: This ratio should generally not exceed 43%, indicating that the borrower is not over-leveraged.

Documentation Required

The application process for a home equity loan necessitates specific documentation to validate the borrower’s financial status and home ownership. This documentation typically includes:

- Proof of Identity: A government-issued ID or driver’s license is required for verification.

- Income Documentation: Recent pay stubs, W-2 forms, or tax returns are essential to verify income.

- Property Documentation: This includes the deed to the home and recent mortgage statements to confirm ownership and existing debt.

- Credit Report: Lenders will pull the applicant’s credit report during the underwriting process, but it may be beneficial for borrowers to review it beforehand.

Importance of Credit Scores

Credit scores play an instrumental role in determining both eligibility for a 5 year home equity loan and the rates offered. A higher credit score not only increases the likelihood of loan approval but also results in more favorable interest rates.

“Borrowers with credit scores above 740 will often qualify for the best rates, while those with scores below 620 may face higher interest rates or be denied altogether.”

Understanding this can guide potential borrowers in taking proactive steps to improve their credit scores before applying for a loan, such as paying down existing debts or correcting any inaccuracies on their credit reports. Ultimately, a strong credit profile reflects responsible financial management and enhances the chances of securing a loan with optimal terms.

Application Process

The application process for a 5 Year Home Equity Loan involves several important steps that ensure both the lender and borrower are adequately prepared. Understanding this process can facilitate a smoother experience and increase the chances of approval.The first step in applying for a 5 year home equity loan is to assess your financial situation, which includes understanding how much equity you have in your home and how much you need to borrow.

This will help in determining the amount of loan you can apply for. Once you have this information, you can proceed with gathering necessary documentation, completing application forms, and submitting your application to lenders for review.

Steps Involved in the Application Process

Preparation is key to a successful loan application. Below is a detailed checklist of common steps involved in the application process for a 5 year home equity loan:

Assess Your Home Equity

Before applying, calculate the equity in your home by subtracting your outstanding mortgage balance from your home’s current market value. This will help you determine how much you can potentially borrow.

Research Lenders

It is advisable to compare various lenders to find the best rates and terms for your home equity loan. Look for lenders that offer favorable interest rates, low fees, and good customer reviews.

Gather Financial Documents

Prepare the necessary financial documents, which typically include:

Recent pay stubs

Tax returns from the past two years

Bank statements

Current mortgage statement

- Proof of homeowners insurance

- Complete the Loan Application

Fill out the loan application form accurately. Ensure all information is complete, as inaccuracies can lead to delays or rejection.

Submit the Application

Once the application is completed, submit it to your chosen lender along with the collected financial documents.

Loan Processing and Underwriting

After submission, the lender will process your application. This includes verifying your information and assessing your creditworthiness. Be prepared for possible follow-up questions or requests for additional documentation.

Loan Approval and Closing

If approved, you will receive a closing disclosure detailing the loan terms, including interest rates, fees, and repayment schedule. Review this carefully before signing the closing documents.Preparing your financial documents before applying is essential for streamlining the application process. Here are some tips to aid in this preparation:

Organize Your Documents

Keep all essential documents in one accessible location to avoid last-minute searches.

Check for Accuracy

Ensure all information on your financial documents is accurate and up-to-date to prevent complications during processing.

Consult a Financial Advisor

Consider seeking advice from a financial expert if you have questions about your eligibility or the best loan options for your situation.This organized approach to the application process can greatly enhance your chances of securing a favorable 5 year home equity loan.

Rate Lock and Changes

A rate lock is a crucial feature that lenders provide to borrowers seeking home equity loans. It secures a specific interest rate for a designated period, protecting the borrower from any potential increases in rates before the loan closes. Understanding how rate locks function and the implications of interest rate fluctuations during the loan term is essential for making informed financial decisions.A rate lock typically lasts for a timeframe ranging from 30 to 90 days, depending on the lender’s policy.

During this period, the borrower can finalize their loan without worrying about rising interest rates. If rates increase during the lock period, borrowers benefit by maintaining the lower locked rate. Conversely, if rates decrease, the borrower might feel they are at a disadvantage, but many lenders allow for a one-time “float down,” which permits the borrower to take advantage of lower rates even after locking in.

Implications of Interest Rate Changes

Understanding the impact of interest rate changes is vital for home equity loan borrowers. The following details illustrate these implications:

Increased Borrowing Costs

If market interest rates rise after a borrower locks in a lower rate, the savings can be significant. For instance, a borrower locking in a rate of 3.5% on a $100,000 loan will save substantially compared to the new market rate of 4.5% if it rises during the lock period.

Potential Savings from Lower Rates

Conversely, if market rates decrease, a locked rate may result in higher overall loan costs. For example, if a borrower locks in a rate of 4% but rates fall to 3.5%, they may miss out on potential savings unless a float down option is available.

Planning for Future Payments

Rate locks can help borrowers plan their budget more effectively, providing predictability in monthly payments. This is especially advantageous for homeowners on fixed incomes or those managing tight financial situations.

Scenarios Where Locking in a Rate is Advantageous

Several scenarios highlight when locking in an interest rate on a home equity loan can be beneficial:

1. Rising Interest Rate Environment

If economic indicators suggest a trend of rising interest rates, locking in a rate can protect against future increases. For example, during periods of inflation, securing a lower rate while economic conditions remain stable can lead to substantial savings.

2. Loan Close Timeline

Borrowers expecting to close on their loan quickly should consider locking in a rate to avoid any fluctuations during the closing period. If a borrower is in a competitive housing market and requires quick funding, this can be crucial.

3. Stability in Financial Planning

For those with a set budget, locking in a lower rate provides certainty in financial planning. This is particularly useful for first-time home buyers or those purchasing a second property who want to ensure their monthly payments remain manageable.

4. Refinancing Existing Debt

If homeowners plan to refinance a higher-rate existing home equity loan or mortgage, locking in a lower rate can maximize savings, especially if they are currently subject to variable interest rates that may increase.A strategic approach to rate locks can significantly influence the financial outcome of a home equity loan, making awareness of these factors essential for any borrower.

Repayment Strategies

Repaying a 5-year home equity loan requires strategic planning to ensure that you minimize interest payments while managing your finances effectively. Implementing effective repayment strategies can help borrowers pay off their loans faster and with less financial strain.Making extra payments on your home equity loan can significantly reduce the overall interest paid over the life of the loan. By applying additional funds toward the principal balance, borrowers can shorten the loan term and decrease the total interest incurred.

This proactive approach not only accelerates repayment but also builds equity more rapidly.

Common Repayment Strategies

Understanding various repayment strategies can empower borrowers to choose the best approach for their financial situation. Below are some effective repayment strategies often utilized by borrowers:

Bi-weekly Payments

Instead of making monthly payments, consider making bi-weekly payments. This results in one extra payment each year, which can significantly reduce the loan term and total interest paid.

Lump-Sum Payments

Allocate any unexpected funds, such as tax refunds or bonuses, towards your loan principal. This can substantially decrease the outstanding balance and reduce overall interest.

Automated Payments

Setting up automatic payments can help ensure timely payments and avoid late fees. Many lenders offer a discount on interest rates for borrowers who enroll in autopay.

Refinancing Options

If interest rates decrease or your credit score improves, refinancing the loan may lead to lower monthly payments or a reduced interest rate.

Budgeting for Extra Payments

Adjust your monthly budget to include additional payments toward the loan principal. Even small amounts can accumulate and make a noticeable difference over time.

Use of Savings

If you have accumulated savings with a lower interest rate than that of your home equity loan, consider using some of those funds to pay down the loan. This tactic can save you money on interest in the long run.

Snowball Method

If you have multiple debts, focus on repaying the smallest debt first while making minimum payments on others. Once the smallest debt is cleared, redirect those payments to the next smallest debt, continuing this process. This method can provide psychological motivation and clarity in repayment.Implementing one or more of these strategies can lead to more efficient repayment of a 5-year home equity loan, resulting in financial savings and increased stability.

Borrowers should consider their personal financial situations and select the strategies that align best with their goals.

Risks and Considerations

Taking out a 5-year home equity loan can provide immediate financial relief or support for significant expenses. However, borrowers must also be aware of potential risks and financial implications associated with leveraging home equity. Understanding these risks is crucial for informed decision-making and effective financial planning.The primary risk associated with a 5-year home equity loan is the possibility of foreclosure.

Since the loan is secured by the home, failure to repay the loan as agreed may result in the lender having the right to foreclose on the property. Additionally, fluctuations in the housing market can impact the value of the home, potentially leaving homeowners with an under-collateralized loan. This situation may lead to negative equity, where the outstanding loan balance exceeds the home’s market value.

Financial Implications of Home Equity Loans

Home equity loans can significantly alter a homeowner’s financial landscape. Borrowers should evaluate the following implications:

- Debt-to-Income Ratio: Taking on additional debt can elevate a borrower’s debt-to-income ratio, which may affect their creditworthiness and ability to secure future loans.

- Interest Payments: While some home equity loans offer lower interest rates compared to unsecured loans, the borrower is still responsible for interest payments, which may accumulate significantly over time.

- Impact on Monthly Budget: The monthly payment obligation can strain a homeowner’s budget, especially if unforeseen expenses arise.

In addition to these factors, borrowers should assess the cumulative cost of borrowing against their home equity. For instance, if a borrower takes out a $50,000 home equity loan at a fixed interest rate of 6% over five years, they would end up paying a total of approximately $60,000, including interest, over the life of the loan.

Comparison of Home Equity Loans and Unsecured Loans

When evaluating financing options, understanding the differences between home equity loans and unsecured loans is essential. Below is a comparative analysis that highlights key distinctions:

- Collateral: Home equity loans are secured by the borrower’s property, while unsecured loans do not require collateral, relying instead on the borrower’s creditworthiness.

- Interest Rates: Home equity loans typically offer lower interest rates compared to unsecured loans, which often involve higher rates due to the increased risk for lenders.

- Loan Amounts: Home equity loans generally allow for larger borrowing amounts, reflecting the equity available in the home, whereas unsecured loans usually provide smaller sums.

- Risk of Foreclosure: A significant risk of home equity loans is the potential for losing the home in case of default, whereas unsecured loans do not carry this risk, but they may result in other consequences, such as damage to credit scores.

Borrowers must weigh these factors carefully, considering their financial stability and long-term goals before committing to a loan type. By thoroughly understanding the risks and implications of borrowing against home equity, individuals can make more informed choices that align with their financial objectives.

Impact on Home Equity

A 5-year home equity loan can significantly influence your overall home equity, which is the portion of your home’s value that you truly own. This kind of loan allows homeowners to borrow against the equity they’ve built up, but it also presents important considerations regarding the preservation of that equity throughout the loan period.When a homeowner takes out a 5-year home equity loan, the immediate effect is an increase in liquidity as they receive a lump sum to use for various purposes such as home renovations, debt consolidation, or education expenses.

However, this borrowing effectively reduces the homeowner’s equity until the loan is paid down. Maintaining sufficient equity after borrowing is crucial, as it not only affects the homeowner’s financial health but also their ability to secure future loans or sell the property without incurring a loss.

Importance of Maintaining Sufficient Equity

Maintaining adequate home equity is essential for several reasons. First, a healthy equity level provides a financial cushion for emergencies or unexpected expenses. Second, it influences the homeowner’s creditworthiness, which lenders assess when considering future borrowing requests.For instance, if a homeowner has a property valued at $300,000 and takes out a $60,000 home equity loan, their equity would decrease to $240,000.

If the property’s value were to drop to $280,000, the homeowner would then face a situation where their debt exceeds their equity. Such scenarios can lead to negative equity, making it challenging to refinance or sell the home without incurring substantial losses.Case studies illustrate these principles in action. In one case, a homeowner used a 5-year home equity loan of $50,000 to remodel their kitchen, increasing the home’s value from $250,000 to $300,000.

This homeowner maintained strong equity throughout the loan period, which enabled them to successfully refinance later on at favorable terms.Conversely, another case involved a homeowner who borrowed $40,000 against a property valued at $200,000 to pay off credit card debt. Unfortunately, housing market fluctuations led to a property value drop to $180,000. As a result, the homeowner found themselves in a precarious financial position with limited options for refinancing or selling the home without facing significant losses.These examples highlight the critical importance of considering the long-term implications of borrowing against home equity and the necessity of maintaining sufficient equity levels to safeguard against market volatility and personal financial instability.

Future Trends

The landscape of home equity loan rates is continuously evolving due to various economic factors and shifting borrower preferences. Understanding these future trends can provide valuable insights for homeowners considering tapping into their home equity. The following discussion will explore these emerging trends, highlighting the potential economic influences on loan rates, as well as the changing preferences of borrowers regarding loan terms.

Emerging Trends in Home Equity Loan Rates

Home equity loan rates are expected to be influenced by several emerging trends in the financial landscape. As economic conditions fluctuate, the Federal Reserve’s monetary policy plays a crucial role in determining interest rates. Currently, many economists foresee a gradual increase in rates as inflationary pressures persist. Borrowers are likely to encounter shifting rates that could affect their financing options.Key factors shaping future home equity loan rates include:

- Inflation Rates: Sustained inflation can lead to higher interest rates, as lenders adjust their rates to counterbalance the decrease in purchasing power.

- Housing Market Dynamics: Changes in the housing market, such as home price appreciation or depreciation, can directly impact the equity homeowners can leverage, consequently influencing loan demand and rates.

- Consumer Confidence: As consumer sentiment rises or falls, it affects borrowing behavior. Increased confidence may lead to higher demand for home equity loans, potentially putting upward pressure on rates.

- Regulatory Changes: Adjustments in lending regulations can affect lender risk assessment, influencing the terms and rates offered to borrowers.

Shifting Borrower Preferences Regarding Loan Terms

In recent years, borrower preferences have evolved, reflecting a desire for more flexible and accommodating loan options. Homeowners are increasingly interested in tailored loan products that align with their financial goals. This shift can be attributed to several factors:The willingness of borrowers to explore different loan terms is evident in the following preferences:

- Shorter Loan Terms: Many borrowers are showing a preference for shorter loan terms, such as 5 to 10 years, to minimize interest payments and achieve quicker repayment.

- Fixed vs. Variable Rates: A growing number of borrowers are leaning towards fixed-rate loans to avoid uncertainty in fluctuating rates, particularly amidst economic volatility.

- Flexible Repayment Options: Borrowers are increasingly seeking lenders that offer flexible repayment plans, including options for interest-only payments during the initial loan period.

- Integration with Digital Platforms: The rise of fintech has led to a preference for streamlined, digital application processes, allowing borrowers to manage their loans conveniently online.

As these trends continue to develop, it is essential for borrowers and lenders alike to stay informed about the changing landscape of home equity loan rates and the factors influencing them.

Final Review

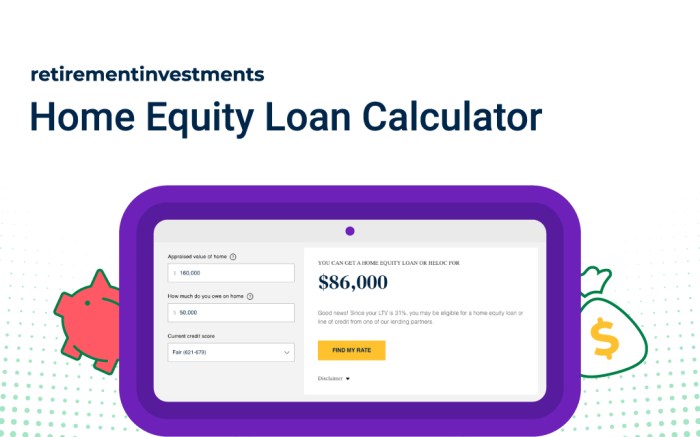

Source: retirementinvestments.com

In summary, a 5 year home equity loan presents a compelling option for homeowners seeking to tap into their home’s value while maintaining a shorter repayment timeline. By grasping the intricacies of loan rates, eligibility, and repayment strategies, borrowers can navigate their financial decisions more effectively. Ultimately, being well-informed about the current trends and considerations surrounding 5 year home equity loan rates will empower homeowners to make confident and beneficial financial choices.

Essential Questionnaire

What is the typical interest rate for a 5 year home equity loan?

The typical interest rate can vary based on credit score, market conditions, and lender policies, but as of now, average rates often fall between 5% to 7%.

Can I refinance my 5 year home equity loan?

Yes, refinancing is possible and may be beneficial if interest rates decrease or if your credit profile improves significantly.

What happens if I cannot repay my 5 year home equity loan?

If you cannot repay the loan, the lender may initiate foreclosure proceedings, as the loan is secured by your home.

Are there any penalties for paying off my loan early?

Some lenders may impose prepayment penalties, but this varies by institution, so it is advisable to check the loan agreement.

How does a home equity loan affect my credit score?

Taking out a home equity loan can impact your credit score positively if managed well, but missing payments can lead to negative effects.