Car Insurance Comparison is not merely a task; it is a vital step in securing your financial well-being on the road. By evaluating various insurance policies, consumers can navigate through a multitude of options to find the most suitable coverage for their needs. This process not only aids in protecting your vehicle but also enhances peace of mind, knowing that you have made an informed choice.

Understanding the nuances of car insurance is essential, as it equips individuals with the knowledge to make savvy decisions. From identifying key factors like driving history and vehicle type to exploring the diverse types of coverage available, a thorough comparison can yield significant financial benefits and improved protection for drivers and their passengers alike.

Importance of Car Insurance Comparison

Comparing car insurance options before making a purchase is essential for ensuring you select the most suitable coverage for your needs. With the vast array of policies available in the market, taking the time to evaluate different insurance providers can lead to better financial outcomes and increased peace of mind. The benefits of comparing car insurance options go beyond simply finding the lowest premium.

By analyzing various policies, consumers can identify the best coverage details that align with their driving habits and personal circumstances. This process not only helps in saving money but also enhances the overall protection provided by the chosen policy.

Financial Benefits of Selecting the Right Policy

Understanding the financial advantages associated with a thorough comparison of car insurance policies is crucial. The process can lead to significant savings, which can be allocated elsewhere in your budget. Some of the key benefits include:

- Lower Premiums: By comparing multiple quotes, you can find policies that offer competitive rates, saving you money on your monthly or annual premiums.

- Discount Opportunities: Many insurance companies provide discounts for safe driving, bundling policies, or maintaining a clean driving record, which may be revealed during the comparison process.

- Tailored Coverage: A well-researched comparison allows you to select coverage that specifically meets your needs, avoiding unnecessary costs associated with add-ons that you may not require.

“Effective comparison shopping can lead to premiums that are tens or even hundreds of dollars less per year.”

Enhanced Coverage Options and Peace of Mind

Choosing the best car insurance policy through comparison shopping not only affects your wallet but also the level of security you feel while driving. When evaluating options, you may uncover superior coverage features that add value to your policy. Important aspects to consider include:

- Comprehensive Coverage: Some providers offer packages that include coverage for events like theft, vandalism, and natural disasters, which can provide a greater sense of security.

- Higher Limits: It may be possible to find policies that offer higher liability limits for a similar price, thereby enhancing your protection in the event of an accident.

- Customer Service: Comparing reviews and ratings of different insurers can lead you to those with excellent customer support, ensuring that help is available when you need it most.

“Having the right coverage can significantly reduce financial stress in the event of an accident.”

Factors to Consider in Car Insurance Comparison

When comparing car insurance, several crucial factors can significantly influence the premiums and coverage you may receive. Understanding these factors allows consumers to make informed decisions that not only align with their budget but also ensure adequate protection for their vehicles. Essential elements such as driving history, location, and the type of vehicle play a pivotal role in determining insurance rates.A comprehensive understanding of the policy coverage details and limits is equally important.

Different insurers may provide varying definitions of coverage types, which can affect both claims and costs. By scrutinizing these details, policyholders can prevent unexpected gaps in coverage and ensure they are adequately protected in the event of an accident or loss.

Key Factors Influencing Insurance Rates

Several key factors influence car insurance rates, necessitating careful consideration during the comparison process:

- Driving History: A clean driving record, marked by few or no claims, typically results in lower insurance premiums. Conversely, a history of accidents or traffic violations can escalate rates significantly.

- Location: Where a driver resides can impact insurance costs due to varying rates of theft, vandalism, and accident frequency. Urban areas generally face higher rates compared to rural regions.

- Vehicle Type: The make and model of a vehicle affect insurance rates. High-performance vehicles, luxury cars, or those with higher theft rates usually incur higher premiums.

- Age and Gender: Younger drivers and male drivers often face higher rates due to statistical data showing a greater risk of accidents within these demographics.

- Credit Score: Many insurers consider a driver’s credit score, with better scores correlating to lower premiums, reflecting the perceived reliability of the driver.

Understanding these factors enables consumers to pinpoint areas where they can potentially reduce their insurance costs.

Importance of Understanding Policy Coverage Details

Differentiating between policies is essential, as coverage limits and the specifics of what is included can vary significantly among insurers. Key aspects to consider include:

- Liability Coverage: This protects against claims made by others for damage caused in an accident. Understanding state-required minimums versus recommended levels is vital.

- Comprehensive and Collision Coverage: Knowing what damages are covered under these categories can prevent financial loss in various situations, from theft to accidents.

- Deductibles: The amount a policyholder pays out-of-pocket before insurance kicks in is crucial in shaping premium costs. A higher deductible often means a lower premium but can lead to larger expenses in the event of a claim.

- Policy Exclusions: Each policy may have specific exclusions that affect coverage, such as specific driving conditions or certain types of damage. Awareness of these exclusions can prevent unpleasant surprises during a claim.

Common Discounts Offered by Insurance Companies

Insurance companies often provide various discounts that can significantly lower premiums. Below is a table summarizing common discounts available:

| Discount Type | Description |

|---|---|

| Multi-Policy Discount | Discounts for bundling multiple insurance policies, such as home and auto insurance. |

| Good Driver Discount | For drivers who maintain a clean driving record over a specified period. |

| Low Mileage Discount | For drivers who drive fewer miles annually, representing a lower risk of accidents. |

| Safety Features Discount | For vehicles equipped with advanced safety features, such as anti-lock brakes and airbags. |

| Student Discount | For students maintaining a good academic record, often under a specified GPA. |

Being aware of these discounts and assessing eligibility can lead to substantial savings, making the insurance comparison process more beneficial.

Different Types of Car Insurance Coverage

Understanding the different types of car insurance coverage is crucial for making informed decisions about vehicle protection. Each type of coverage serves a unique purpose and addresses various risks associated with vehicle ownership. By knowing the distinctions, drivers can choose policies that align with their specific needs and circumstances.Car insurance coverage generally falls into three primary categories: liability, collision, and comprehensive coverage.

Each type plays a pivotal role in protecting drivers financially, depending on the nature of incidents they may encounter on the road. Below is an overview of each coverage type, along with examples highlighting their importance in practical scenarios.

Liability Coverage

Liability coverage is often a mandatory requirement for drivers, serving to protect against damages or injuries that you may cause to others in an accident. This coverage typically includes two components: bodily injury liability and property damage liability.

Liability coverage is essential for protecting your financial assets in the event of an accident.

For instance, if you are at fault in a collision that injures another driver and damages their vehicle, your liability coverage will help cover their medical expenses and repair costs. If you do not have sufficient coverage, you may face significant out-of-pocket expenses.

Collision Coverage

Collision coverage is designed to pay for damages to your own vehicle resulting from a collision, regardless of who is at fault. This type of insurance can be particularly beneficial for newer or more valuable vehicles.

Collision coverage safeguards your investment in your vehicle by covering repair costs after an accident.

For example, if you hit a guardrail or another vehicle, collision coverage allows you to get your car repaired without worrying about the costs incurred. It is especially useful in cases where repairing the vehicle can be significantly more expensive than the policy’s deductible.

Comprehensive Coverage

Comprehensive coverage provides protection against damages to your vehicle not involving a collision. This includes incidents such as theft, vandalism, natural disasters, and animal strikes.

Comprehensive coverage can be a lifesaver in unpredictable events that damage your vehicle.

For example, if a tree falls on your car during a storm, comprehensive coverage will cover the repair costs. Additionally, if your vehicle is stolen, this coverage would help you recover the losses associated with the theft.

Comparative Table of Coverage Types

To further illustrate the differences among the various types of car insurance coverage, the following table summarizes their features and average costs.

| Coverage Type | Features | Average Annual Cost |

|---|---|---|

| Liability Coverage | Protects against bodily injury and property damage to others. | $500 – $1,000 |

| Collision Coverage | Covers damage to your own vehicle in case of an accident. | $300 – $700 |

| Comprehensive Coverage | Protects against non-collision incidents like theft and natural disasters. | $200 – $600 |

Methods for Comparing Car Insurance Quotes

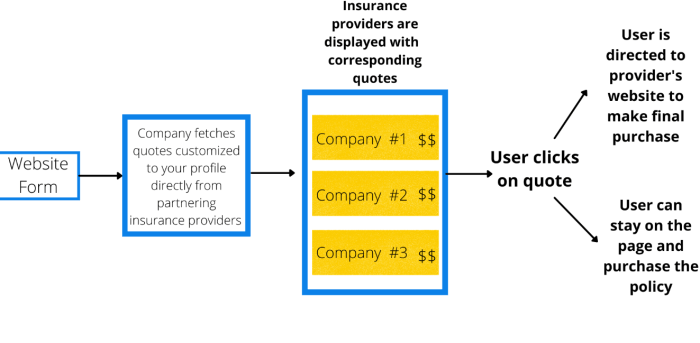

Source: laffaz.com

Obtaining and comparing car insurance quotes is an essential step in finding the right coverage at the best price. This process involves gathering information from multiple insurance providers to ensure that you make an informed decision. Understanding the various methods available for comparing quotes can help streamline your search and maximize your savings.The first step in obtaining car insurance quotes is to gather relevant information about your vehicle and personal driving history.

This includes details such as your car’s make, model, year, your driving record, and any previous insurance claims. Once you have this information ready, you can either visit the websites of individual insurance companies or utilize comparison tools designed to simplify the process.

Steps for Obtaining and Comparing Quotes

To effectively compare car insurance quotes, follow these systematic steps:

1. Gather Necessary Information

Collect all required details about your vehicle and driving history, including mileage, location, and coverage needs.

2. Research Insurance Providers

Identify reputable insurers in your area. This can include both local companies and national brands known for competitive rates.

3. Use Online Comparison Tools

Leverage online platforms that allow you to input your information once and receive multiple quotes from various insurers.

4. Request Quotes Directly

You can also visit individual insurance company websites to request quotes directly. This may provide additional options or exclusive discounts.

5. Review and Compare Quotes

Carefully analyze the different quotes, focusing on coverage limits, deductibles, and premiums.

6. Consider Customer Reviews

Research customer feedback and ratings for each insurer to assess their reliability and customer service quality.

7. Choose the Best Option

Based on your research and comparisons, select the insurance policy that best meets your needs and budget.

Online Tools and Resources for Car Insurance Comparison

A variety of online tools and resources can assist in comparing car insurance quotes efficiently. These platforms offer user-friendly interfaces and can save time while providing access to multiple quotes.

Comparison Websites

Websites like NerdWallet, The Zebra, and Compare.com allow users to compare multiple insurance quotes based on the information they provide.

Insurance Company Websites

Many insurers, such as GEICO and Progressive, offer online quote tools that can give potential customers quick estimates.

Mobile Applications

Apps like Gabi and Insurify facilitate easy comparison and customization of insurance policies right from your smartphone.

Consumer Reports

This resource provides in-depth reviews and comparisons of insurance companies, aiding in the selection of reliable providers.

Benefits of Using an Insurance Broker

Utilizing an insurance broker can present several advantages over direct comparison methods. While online tools provide a wealth of information, brokers offer personalized service and expertise.

Personalized Assistance

Brokers take the time to understand your individual needs, ensuring you receive tailored recommendations.

Access to Multiple Options

Brokers often have access to a wider range of insurers and exclusive deals that may not be available through online platforms.

Claims Support

In the event of an accident or claim, brokers can assist in navigating the complexities of the claims process and advocate on your behalf.

Time Savings

Brokers can significantly reduce the time spent on research and comparison by providing quotes from multiple insurers in one conversation.Using these methods and resources will help you navigate the car insurance market effectively, ensuring you find the best coverage at a price that fits your budget.

Common Mistakes to Avoid in Car Insurance Comparison

When navigating the complex landscape of car insurance, individuals often make mistakes that can lead to inadequate coverage or unnecessary expenses. Understanding these common pitfalls is essential for ensuring that you make the most informed decisions possible when comparing various insurance options. By being aware of these errors, you can better prepare yourself to secure the best policy for your specific needs.One of the frequent mistakes made during car insurance comparison is overlooking the importance of the fine print in insurance policies.

Many individuals focus primarily on the premium costs without thoroughly understanding the coverage details, exclusions, and conditions stated in the policy. Neglecting to read the fine print can result in unexpected out-of-pocket expenses when filing a claim, as certain situations may not be covered as one might assume.

Importance of Reading the Fine Print

The fine print in an insurance policy holds critical information regarding the terms of the coverage. It often Artikels exclusions, limitations, and requirements that could impact the claim process. Failing to comprehend these details can lead to significant challenges later on. A few key aspects typically found in the fine print include:

- Coverage Exclusions: Specific circumstances or types of damage that are not covered by the policy.

- Deductibles: The amount you are required to pay out-of-pocket before the insurance kicks in for a claim.

- Policy Limitations: Maximum amounts the insurer will pay for certain types of claims.

- Additional Requirements: Conditions that must be met for coverage to be valid, such as regular maintenance requirements.

Understanding these elements can help you avoid purchasing a policy that appears to offer great value but ultimately leaves you underinsured.

Checklist Before Finalizing Car Insurance Decision

Before making a commitment to a car insurance policy, a thorough review of the following items is crucial. This checklist ensures that you are not only getting the best rate but also the most suitable coverage for your circumstances:

- Compare Similar Coverage Levels: Ensure that you are comparing policies with the same limits and deductibles to get an accurate cost comparison.

- Evaluate Customer Service Ratings: Research reviews and ratings of insurers to gauge their customer service and claims handling reputation.

- Check for Discounts: Inquire about available discounts for which you may qualify, such as safe driver discounts, multi-policy discounts, or loyalty rewards.

- Review Policy Terms: Look for any unusual terms or conditions that could adversely affect your coverage or claims process.

- Understand Payment Options: Clarify whether the insurer offers flexible payment options that suit your financial situation.

By following this checklist, you can avoid common mistakes and ensure that your car insurance decision is well-informed and aligned with your needs.

The Role of Technology in Car Insurance Comparison

The advent of technology has significantly transformed the landscape of car insurance comparison, enabling consumers to make more informed decisions with greater ease. With the proliferation of digital platforms, comparing insurance options has become faster, more straightforward, and increasingly tailored to individual needs. Technological advancements have revolutionized the way consumers access and evaluate car insurance options. The rise of mobile applications and comparison websites allows users to gather information rapidly and efficiently.

These platforms aggregate data from various insurers, enabling consumers to compare quotes, coverage options, and policy features side by side, all from the convenience of their personal devices.

Impact of Mobile Apps and Comparison Websites

The widespread use of mobile apps and comparison websites has reshaped consumer behavior in the insurance market. These tools offer a range of benefits that lead to better-informed purchasing decisions:

Convenience and Accessibility

Consumers can easily access multiple insurance providers and their offerings at any time, eliminating the need for extensive phone calls or in-person visits.

Instant Quotes

Many apps and websites provide instant quotes based on user input, allowing for real-time comparisons that enhance decision-making speed.

Customized Recommendations

These platforms often use algorithms to present options that align closely with individual preferences, driving a more personalized experience.

User Reviews and Insights

Access to customer reviews and ratings on various policies adds transparency, helping consumers gauge the reliability and effectiveness of insurance providers.Emerging technologies are continually influencing the insurance industry, further enhancing the process of car insurance comparison.

Emerging Technologies Influencing the Insurance Industry

Several innovative technologies are at the forefront of transforming car insurance comparison processes. Understanding these developments is crucial for consumers seeking competitive quotes:

Artificial Intelligence (AI)

AI algorithms analyze vast amounts of data to predict pricing models and enhance risk assessments, making recommendations more tailored and accurate.

Big Data Analytics

The use of big data allows insurers to evaluate consumer behavior, market trends, and risk factors more effectively, leading to better pricing structures and customized policies.

Machine Learning

As machine learning technologies evolve, they enable insurers to refine their offerings based on historical data, improving the accuracy of quotes provided to consumers.

Blockchain Technology

Blockchain can enhance transparency and security in transactions, potentially streamlining the claims process and reducing fraud, which indirectly influences insurance comparisons by building consumer trust.The integration of these technologies not only facilitates a more informed comparison process but also promotes a competitive marketplace that benefits consumers through better pricing and services. As technology continues to advance, its role in car insurance comparison will likely expand, offering even more sophisticated tools and options for consumers.

Case Studies of Effective Car Insurance Comparisons

Source: uspace.id

In today’s competitive insurance market, many individuals have successfully reduced their car insurance costs through diligent comparisons. These case studies illustrate the processes undertaken by real people who made informed decisions that led to significant savings. By analyzing their experiences, potential policyholders can glean valuable insights into the advantages of thorough car insurance comparisons.

Real-Life Examples of Savings

Examining specific instances can provide a clearer understanding of how effective car insurance comparisons operate. Below are two notable case studies illustrating the process and its benefits.

Case Study 1: Sarah’s Savings

Sarah, a 30-year-old marketing professional, was dissatisfied with her annual car insurance premium of $1,

200. She decided to compare car insurance quotes from various providers. The steps she took included

- Researching online comparison tools to gather quotes from multiple insurance companies.

- Reviewing the coverage details to ensure she was comparing similar policies.

- Contacting customer service representatives to clarify any doubts about the policies.

- Considering customer reviews and claim settlement ratios to gauge reliability.

After thorough comparisons, Sarah switched to a new insurer, resulting in her premium dropping to $900 annually. This change saved her $300, which she allocated towards a vacation.

Case Study 2: John and Emily’s Family Savings

John and Emily, a married couple with two young children, were paying $1,500 per year for their family car insurance. Concerned about their rising costs, they engaged in a detailed comparison process. Their approach included:

- Utilizing a spreadsheet to track different quotes and the coverage offered by each provider.

- Identifying discounts for bundling their car insurance with homeowners’ insurance.

- Evaluating the cost-benefit of increasing their deductible to lower their premium.

- Seeking personalized recommendations from friends who had recently switched insurers.

Through their diligent efforts, John and Emily transitioned to a new insurer with a premium of $1,100, saving them $400 annually. This savings allowed them to invest in a family outing.

Cost Comparison Table

To visualize the savings achieved through these case studies, the following table summarizes the premiums before and after their respective comparisons:

| Individual/Family | Before Comparison | After Comparison | Savings |

|---|---|---|---|

| Sarah | $1,200 | $900 | $300 |

| John and Emily | $1,500 | $1,100 | $400 |

These examples illustrate not only the potential savings that can be realized through diligent car insurance comparisons but also the processes that lead to informed choices. By following similar steps, consumers can optimize their insurance costs while ensuring they maintain appropriate coverage levels.

Legal Considerations in Car Insurance

Understanding the legal landscape surrounding car insurance is crucial for vehicle owners. Different regions and states enforce distinct requirements for car insurance, which can significantly influence a driver’s insurance choices. Being aware of these legal stipulations helps ensure compliance and aids in selecting the most suitable coverage options.

Legal Requirements for Car Insurance by Region

Car insurance requirements can vary dramatically across states and countries, affecting what coverage is mandatory. In the United States, most states require drivers to carry a minimum level of liability insurance, which covers damages to other people or property in the event of an accident you cause. For instance, states like California mandate a minimum liability coverage of $15,000 for bodily injury per person and $30,000 per accident, along with $5,000 for property damage.It’s essential to comprehend local laws regarding insurance, as this knowledge will impact the type of coverage you choose.

In some states, additional coverage like uninsured/underinsured motorist protection is also required, while others may have no-fault insurance laws that dictate how claims are handled following an accident.

Understanding Local Laws and Insurance Choices

Awareness of local insurance laws can greatly affect which insurance options are available to you and how much you pay. For instance, states with higher uninsured motorist rates may encourage additional coverage for protection against uninsured drivers. Conversely, in areas with lower accident rates, drivers might opt for minimal coverage to save on premiums.Understanding the requirements and nuances of your local laws can help in avoiding penalties and ensuring sufficient protection.

Resources to Verify Legal Insurance Requirements

Consumers seeking to verify their state’s legal insurance requirements can utilize various resources. Here is a list of reliable platforms that provide comprehensive information on insurance laws across different regions:

- National Association of Insurance Commissioners (NAIC): A resource for state-specific insurance laws and regulations.

- Insurance Information Institute (III): Offers guidelines and educational resources about various types of insurance and requirements.

- State Department of Motor Vehicles (DMV): Each state’s DMV website provides legal requirements and information on car insurance.

- Consumer Financial Protection Bureau (CFPB): This bureau provides resources about auto insurance and consumer rights.

- Local Insurance Agents or Brokers: Engaging with professionals can provide tailored advice based on state-specific requirements.

Future Trends in Car Insurance Comparison

As the car insurance industry evolves, several emerging trends are expected to reshape the landscape of insurance policies and comparison methods. These developments will not only enhance the experience for consumers but will also lead to more personalized and efficient insurance solutions. Understanding these trends is crucial for both insurers and consumers as they navigate the complexities of car insurance.Technological advancements and changing consumer behavior are set to significantly influence the future of car insurance comparison.

The integration of artificial intelligence (AI), big data analytics, and mobile applications is poised to streamline the comparison process, making it faster and more accessible. Additionally, as consumers become more aware of their options and the importance of tailored coverage, their behavior is likely to shift toward seeking personalized insurance solutions that cater to their specific needs.

Expected Innovations in the Car Insurance Market

The car insurance market is on the brink of transformative innovations that will enhance how consumers approach insurance comparison. Understanding these innovations can help consumers make informed decisions when selecting insurance coverage. Below is a list of expected trends that are likely to emerge:

- Usage-Based Insurance (UBI): Policies that adjust premiums based on actual driving behavior, promoting safer driving habits.

- Telematics Technology: Devices that monitor vehicle usage and driving patterns, enabling more accurate risk assessments and better pricing models.

- AI-Driven Comparison Tools: Enhanced algorithms that provide real-time, personalized insurance quotes based on individual consumer data.

- Blockchain Technology: Increased transparency and security in transactions, simplifying claims processing and reducing fraud.

- Mobile App Integration: User-friendly applications that allow consumers to compare quotes, manage policies, and file claims seamlessly.

- On-Demand Insurance: Flexible policies that provide coverage for specific duration or occasions, catering to consumers’ varying needs.

- Increased Customization: More options for consumers to tailor coverage, including add-ons for unique risks or lifestyle factors.

These expected innovations reflect a shift towards more consumer-centric products, driven by advancements in technology and changing expectations. As the market adapts, consumers will be empowered to make better choices that suit their individual circumstances and preferences.

Outcome Summary

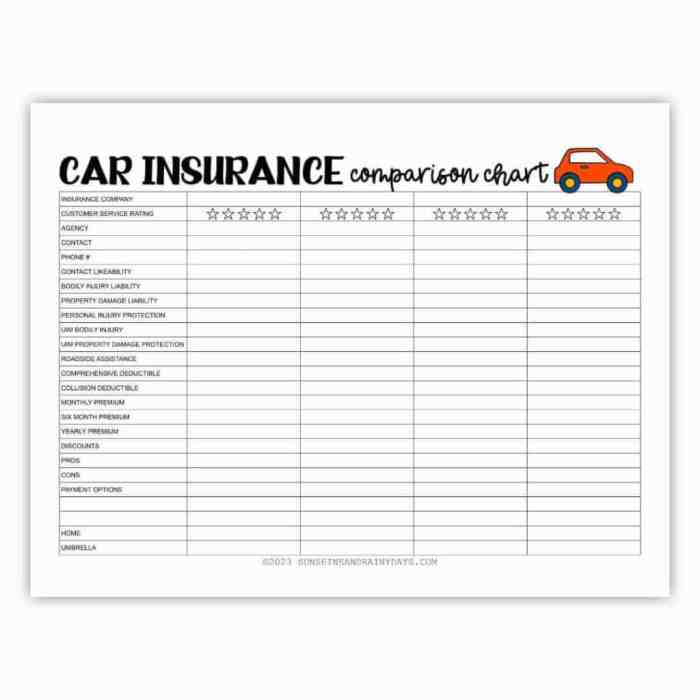

Source: sunshineandrainydays.com

In conclusion, Car Insurance Comparison is an indispensable tool that empowers consumers to make enlightened decisions regarding their insurance needs. By carefully weighing options, understanding coverage types, and avoiding common pitfalls, individuals can not only save money but also ensure they are adequately protected on the road. Embracing the advancements in technology further simplifies this process, paving the way for a future where informed choices lead to enhanced safety and satisfaction.

Top FAQs

What is the best way to compare car insurance rates?

The best way to compare car insurance rates is to gather quotes from multiple insurance providers, using online comparison tools or consulting with an insurance broker.

How often should I compare car insurance?

It is advisable to compare car insurance rates annually or whenever there is a significant change in your circumstances, such as a new vehicle or a change in driving habits.

Are online car insurance quotes accurate?

Online car insurance quotes are generally accurate, but it is important to provide precise information to receive the most reliable estimates.

Can I negotiate my car insurance premium?

Yes, many insurers are open to negotiation, especially if you present comparisons and highlight your loyalty or safe driving record.

What factors can lower my car insurance premium?

Factors that can lower your car insurance premium include maintaining a good driving record, bundling policies, and taking advantage of available discounts.