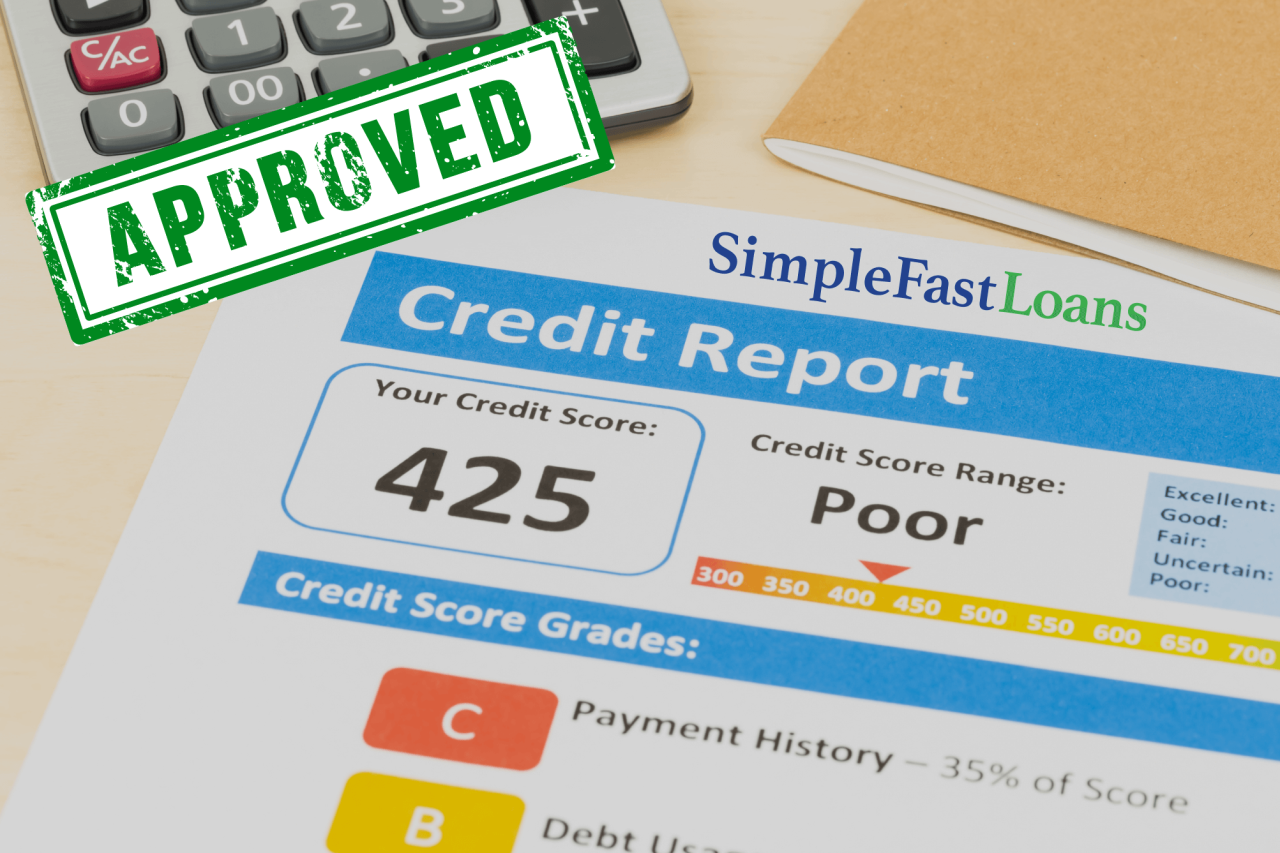

Fast Loans For Bad Credit offer a lifeline for individuals facing financial challenges due to poor credit scores. Unlike traditional loans that often have stringent eligibility requirements, fast loans are designed to provide quick access to funds with less emphasis on credit history. This makes them an attractive option for those who may have been turned away by conventional lenders.

These loans come with various features and benefits, such as expedited approval processes and flexibility in usage, which cater specifically to individuals seeking immediate financial relief. As we explore the landscape of fast loans, it is crucial to understand their types, application processes, and associated risks to make informed decisions.

Understanding Fast Loans for Bad Credit

Source: bankrate.com

Fast loans for bad credit serve as a financial lifeline for individuals who may find themselves in urgent need of funds but have a less-than-ideal credit score. Unlike traditional loans, which often rely heavily on credit history and financial stability, fast loans are designed to provide quicker access to cash, even for those with poor credit ratings. This distinction makes them a viable option for many who are faced with unexpected expenses, such as medical bills, car repairs, or urgent household needs.Fast loans for bad credit typically feature several key characteristics that set them apart from conventional lending options.

These loans are often processed quickly, sometimes within hours, allowing borrowers to receive funds almost immediately. In addition, they may come with more flexible terms, allowing for a range of repayment options tailored to the borrower’s financial situation. The application process is generally straightforward, requiring minimal documentation, which further expedites access to funds.

Key Features and Benefits of Fast Loans

Fast loans for individuals with poor credit scores offer numerous advantages designed to help borrowers manage their financial situations effectively. Some of the notable features and benefits include:

- Rapid Approval Process: Many lenders provide quick approval, enabling applicants to access funds swiftly, often on the same day.

- Minimal Credit Checks: These loans focus more on current income and financial needs than on past credit history.

- Flexible Loan Terms: Borrowers may find varying repayment options, which can accommodate different financial circumstances.

- Accessible for Various Needs: Funds can be used for a variety of expenses, including medical emergencies, home repairs, or other unexpected costs.

The eligibility criteria for obtaining fast loans despite having bad credit typically include several straightforward requirements. While these may vary among lenders, common criteria include:

- Proof of Income: Borrowers must demonstrate a reliable source of income, such as employment, to ensure their ability to repay the loan.

- Age Requirement: Applicants need to be at least 18 years old to qualify for a loan.

- Identification: A valid government-issued ID is usually required to verify identity.

- Bank Account: Many lenders request a checking account for direct deposit of funds and automatic repayment.

“Fast loans for bad credit can empower individuals to address urgent financial needs without the burden of extensive paperwork or waiting periods.”

Types of Fast Loans Available

Individuals with bad credit often face challenges when seeking financial assistance. Understanding the various types of fast loans available can help borrowers make informed decisions that align with their needs. Fast loans typically cater to urgent financial requirements and come with specific terms that differ among lenders.One of the primary types of fast loans for those with bad credit includes payday loans.

These are short-term loans designed to cover immediate expenses until the next payday. Personal loans may also be accessible, offering a larger sum that can be repaid over a longer period. Installment loans are another option, allowing borrowers to repay the loan amount in fixed monthly payments over time. Each type of loan has its unique terms and conditions, making it essential to evaluate their advantages and disadvantages carefully.

Payday Loans

Payday loans are short-term loans that are typically due on the borrower’s next payday. These loans generally come with high-interest rates and are often easier to obtain for individuals with bad credit.Pros:

- Quick access to funds, often within 24 hours.

- Minimal credit checks, making them accessible for borrowers with poor credit scores.

Cons:

- High-interest rates can lead to a debt cycle if not managed properly.

- Short repayment period, often requiring full repayment in just a few weeks.

Personal Loans

Personal loans are unsecured loans that can be used for various purposes, including debt consolidation or emergency expenses. While they may require better credit scores than payday loans, some lenders specialize in offering personal loans to borrowers with bad credit.Pros:

- Larger loan amounts compared to payday loans, providing more significant financial relief.

- Longer repayment terms, which can help ease monthly financial burdens.

Cons:

- May involve higher interest rates compared to traditional personal loans.

- Approval can take longer, sometimes requiring several days to process.

Installment Loans

Installment loans allow borrowers to receive a lump sum and repay it in fixed installments over a predetermined period. This type of loan is often available for those with bad credit, though terms can vary based on the lender.Pros:

- Predictable monthly payments can facilitate better budgeting for borrowers.

- Typically lower interest rates than payday loans.

Cons:

- Loan amounts may be limited based on the borrower’s credit profile.

- Longer repayment periods can lead to higher overall interest costs.

“Understanding the terms and conditions of each loan type can prevent borrowers from falling into a cycle of debt.”

By assessing these loan types, individuals with bad credit can identify which option meets their financial needs, ensuring they make sound fiscal decisions.

Application Process for Fast Loans

Source: debt.org

The application process for fast loans, especially for individuals with bad credit, can seem daunting but is often straightforward when approached methodically. Understanding the steps involved can significantly enhance your chances of approval and ensure a smoother experience.To secure a fast loan for bad credit, borrowers typically follow a structured application process that encompasses several key steps. Each step is critical in ensuring that your application is complete and increases the likelihood of a favorable outcome.

Step-by-Step Application Process

The application process generally involves the following stages:

1. Research Lenders

Begin by identifying lenders that specialize in fast loans for bad credit. It is essential to compare terms, interest rates, and fees to choose a lender that suits your financial needs.

2. Pre-qualification

Many lenders offer pre-qualification processes that allow you to assess your potential loan amount and terms without impacting your credit score. This step is optional but can provide useful insights.

3. Gather Required Documents

Preparing the necessary documentation is crucial for a smooth application process.

4. Complete the Application

Fill out the lender’s application form accurately. Most lenders have online forms, but you may also apply in person or over the phone.

5. Submit Your Application

Once completed, submit your application to the lender. This may include uploading documents electronically or providing them in person.

6. Loan Review Process

After submission, the lender will review your application, credit history, income, and other relevant factors to make a lending decision.

7. Receive Approval and Funds

If approved, you will receive a loan offer detailing the terms. Upon acceptance, funds are typically disbursed quickly, sometimes within a day.

Required Documents Checklist

Gathering the right documents is essential to expedite the loan application process. The following checklist Artikels common documents typically required:

Identification

A government-issued ID, such as a driver’s license or passport.

Proof of Income

Recent pay stubs, tax returns, or bank statements to verify income.

Employment Verification

A letter from your employer or recent employment contract.

Credit History

A credit report may be required, which you can obtain for free annually.

Bank Account Information

For direct deposit of loan funds, lenders usually require bank account details.

Proof of Residence

Utility bills or lease agreements that confirm your current address.

Tips for Improving Approval Chances

To enhance your chances of loan approval, consider the following strategies:

Check Your Credit Report

Review your credit report for errors or discrepancies and dispute any inaccuracies before applying.

Provide a Co-signer

Having a co-signer with better credit can significantly improve your chances of approval and may also lead to lower interest rates.

Demonstrate Stability

Lenders prefer applicants with stable employment and consistent income. Providing documentation that showcases job stability can be beneficial.

Limit Loan Amounts

Requesting a smaller loan amount can increase your chances of approval as it reduces the lender’s risk.

Maintain Open Communication

Be honest about your financial situation and communicate any challenges you may face. Lenders may be more willing to work with you if they understand your circumstances.

Avoid Multiple Applications

Submitting applications to multiple lenders at once can negatively impact your credit score. Instead, focus on one lender at a time.By following these steps and tips, you can navigate the application process for fast loans with bad credit more effectively, enhancing your likelihood of receiving the funds you need.

Interest Rates and Fees

Understanding the interest rates and fees associated with fast loans for bad credit is essential for borrowers to gauge the true cost of borrowing. These loans typically carry higher interest rates compared to conventional loans, reflecting the risk that lenders take on when working with individuals who have poor credit histories. Being informed about these costs helps borrowers make educated decisions and manage their finances effectively.The interest rates for fast loans for bad credit can vary significantly based on several factors, including the lender’s policies, the borrower’s credit score, and the loan amount.

Generally, interest rates for these loans can range from approximately 10% to 36% or even higher in some cases. It is crucial for borrowers to comprehend that these rates can substantially exceed those of loans available to individuals with good credit, which typically range from 4% to 8%. This difference underscores the importance of comparing options and searching for the most affordable lending solutions.

Comparison of Fast Loans with Good Credit Loans

When comparing fast loans for bad credit with loans for borrowers with good credit, it is critical to consider the overall cost implications. The stark contrast in interest rates significantly impacts how much a borrower ends up repaying. Below is a detailed comparison of typical costs associated with both types of loans:

- Fast Loans for Bad Credit:

The average interest rate can range from 10% to 36% annually.

This results in higher monthly payments and more extensive fees, which can accumulate quickly over short loan terms.

- Good Credit Loans:

The average interest rate typically ranges from 4% to 8% annually.

Borrowers with good credit benefit from lower monthly payments and a reduced total repayment amount.

The difference in interest rates not only affects monthly payments but can also lead to a significant disparity in the total cost of the loan over its lifetime. For example, a $5,000 loan with a 36% interest rate over three years results in nearly $2,000 in interest, while a loan with a 6% interest rate would only accrue about $600 in interest over the same period.

Total Cost Calculation and Understanding APR

Calculating the total cost of a fast loan is vital for borrowers to assess their financial commitments accurately. The Annual Percentage Rate (APR) is a useful tool for understanding the complete cost of borrowing. The APR includes not only the interest rate but also any additional fees associated with the loan, providing a more comprehensive picture of what a borrower can expect to pay.To calculate the total cost of a fast loan, borrowers can use the following formula:

Total Cost = Loan Amount + (Loan Amount × Interest Rate × Loan Term) + Fees

This formula allows borrowers to estimate their total repayment amount. For instance, if a borrower takes out a $5,000 fast loan at a 30% interest rate over three years, they would calculate the interest as follows:

- Interest Amount = $5,000 × 0.30 × 3 = $4,500

- Total Repayment Amount = $5,000 + $4,500 + Fees (if any)

Being cognizant of APR and other fees enables borrowers to make informed decisions and potentially avoid costly mistakes. Therefore, it is advisable for individuals considering fast loans for bad credit to meticulously evaluate all the associated costs before proceeding.

Risks and Considerations

The decision to take out fast loans for bad credit comes with a number of risks and considerations that borrowers must carefully weigh. While these loans can provide immediate financial relief, they may also have long-term implications on one’s financial health and credit score. Understanding these risks is crucial for making informed decisions and for maintaining financial stability in the future.The potential risks involved with fast loans for bad credit often stem from high interest rates and fees that can exacerbate existing financial difficulties.

Borrowers may find themselves in a cycle of debt, as the urgency of needing funds can lead to borrowing amounts that may be unmanageable. This could result in late payments, additional fees, and further damage to their credit scores. Over-reliance on such loans can lead to a precarious financial situation, where quick solutions create long-term problems.

Impact on Long-Term Financial Health and Credit Scores

Fast loans for bad credit can significantly affect both long-term financial health and credit scores. The following points Artikel these impacts:

- High interest rates associated with fast loans can increase the overall cost of borrowing, making it difficult to repay the principal amount.

- Late or missed payments can lead to negative marks on a borrower’s credit report, further lowering their credit score.

- Increased debt levels may lead to a higher debt-to-income ratio, which can hinder future borrowing opportunities or lead to unfavorable lending terms.

It is essential to recognize that financial decisions made in urgency can have lasting repercussions. For instance, if a borrower takes out a fast loan at an annual percentage rate (APR) of 30% and defaults, the accumulating interest can lead to a total repayment amount that is substantially higher than the initial loan.

Strategies for Managing Debt After Obtaining a Fast Loan

Once a fast loan is secured, it is critical to implement effective strategies for managing the resulting debt. The following strategies can help maintain financial stability:

Create a Budget

Establish a detailed budget that accounts for loan repayments, ensuring that funds are allocated to cover these costs while maintaining essential living expenses.

Prioritize Payments

Focus on making timely payments to avoid additional penalties and interest increases. Setting reminders for due dates can be beneficial.

Consider Consolidation

If multiple loans are taken, exploring consolidation options could simplify payments and potentially lower interest rates.

Seek Financial Counseling

Engaging with a financial advisor or credit counselor can provide personalized strategies and resources to improve financial health.Implementing these strategies can mitigate the risks associated with fast loans and aid in maintaining one’s financial well-being. Being proactive about loan management can greatly reduce the chance of falling into a debt cycle and improve overall financial literacy.

Alternatives to Fast Loans

For individuals facing bad credit, fast loans might seem like the only solution to immediate financial needs. However, there are several alternatives that can provide assistance without the burden of high interest rates or unfavorable terms. Exploring these options can lead to more sustainable financial health and stability.One notable alternative to fast loans is credit counseling. This service offers professional guidance to individuals struggling with debt management.

Credit counselors work with clients to create budgets, provide financial education, and negotiate with creditors for better repayment terms.

Credit Counseling Services

Credit counseling services can assist individuals in understanding their financial situation and developing a pathway towards debt relief. The benefits of engaging with credit counseling include:

- Professional Guidance: Experienced counselors help create personalized budgets and debt repayment plans.

- Negotiation with Creditors: Counselors can negotiate lower interest rates or monthly payments on behalf of the client.

- Financial Education: Clients learn valuable skills in money management and budgeting that promote long-term financial stability.

To access credit counseling, individuals should seek out reputable nonprofit organizations that offer these services. They can often be found through local community centers or online platforms. It is essential to check for accreditation from organizations such as the National Foundation for Credit Counseling (NFCC) to ensure quality service.

Peer-to-Peer Lending Platforms

Peer-to-peer (P2P) lending has emerged as an alternative financial solution where individuals can borrow money from other individuals, bypassing traditional financial institutions. This approach can be especially beneficial for those with bad credit, as P2P lenders often consider factors beyond credit scores.The advantages of peer-to-peer lending include:

- More Flexible Approval Criteria: Many P2P platforms assess creditworthiness through a broader lens, potentially allowing borrowers with poor credit to qualify.

- Competitive Interest Rates: Interest rates on P2P loans can be more favorable compared to traditional loans, depending on the borrower’s profile.

- Direct Access to Funds: The process is typically faster than traditional lending, granting quicker access to funds for urgent needs.

To effectively access peer-to-peer lending, individuals can start by researching various P2P platforms, such as LendingClub or Prosper. After selecting a platform, users can create an account, submit an application, and provide necessary documentation. It is crucial to review the loan terms and conditions carefully before proceeding.

“Exploring alternatives to fast loans can lead to better financial health and potentially lower costs in the long run.”

Customer Experiences and Testimonials

Source: amazonaws.com

The experiences of individuals who have sought fast loans for bad credit provide valuable insights into the practical implications of this financial option. Many borrowers share their journeys, revealing both the challenges and advantages they faced while navigating this lending landscape. Through these narratives, potential borrowers can gain a clearer understanding of what to expect and how to make informed decisions.Real-life testimonials from customers often highlight a mix of positive and negative outcomes.

For some, fast loans served as a crucial lifeline during emergencies, while others encountered difficulties that left them questioning their choices. Common themes emerge in these accounts, reflecting the diverse nature of borrowers’ experiences.

Positive Experiences with Fast Loans

Many borrowers express gratitude for the swift access to funds, which often helped them overcome immediate financial challenges. Positive testimonials frequently mention the following aspects:

- Quick Approval and Disbursement: Many customers appreciate the rapid application process, with funds being deposited into their accounts within hours or the same day. This speed is often described as essential during emergencies.

- Ease of Application: The simplicity of the application process is frequently highlighted, allowing borrowers to complete it online without extensive paperwork.

- Supportive Customer Service: Positive interactions with customer service representatives are often noted, with many borrowers praising the guidance provided throughout the borrowing process.

- Improvement in Financial Situation: Several testimonials indicate that fast loans enabled borrowers to pay off urgent bills, thus stabilizing their financial standing and avoiding further debt.

Negative Experiences with Fast Loans

Conversely, some customers have shared cautionary tales regarding their experiences with fast loans. Common negative themes include:

- High Interest Rates: Many borrowers expressed concern over the steep interest rates associated with fast loans, which often lead to significant repayment amounts compared to traditional loans.

- Debt Cycle Challenges: Some individuals report falling into a cycle of debt, where the need to take out additional loans to cover previous loans became a recurring issue.

- Lack of Transparency: A number of customers voiced frustration over unclear terms and conditions, finding themselves unaware of the total costs until after the loan was secured.

- Impact on Credit Score: Negative experiences also include scenarios where delayed repayments adversely affected borrowers’ credit scores, further complicating their financial situations.

These narratives illustrate that while fast loans can provide quick relief, they also come with potential pitfalls. The collective experiences of borrowers emphasize the importance of thorough research and understanding of one’s financial capacity before committing to such loans. Overall, customer testimonials serve as both cautionary tales and encouraging success stories, guiding future borrowers in their decision-making processes.

Legal and Regulatory Considerations

Understanding the legal and regulatory framework surrounding fast loans for bad credit is essential for both consumers and lenders. This framework not only protects the rights of borrowers but also ensures that lenders operate within the boundaries set by law. By familiarizing oneself with these regulations, borrowers can make informed decisions and avoid falling victim to predatory lending practices.Lenders offering fast loans for bad credit are required to adhere to various federal and state regulations designed to protect consumers.

These regulations typically govern the lending process, including advertising, loan terms, and collection practices. Compliance with these laws is crucial in promoting fair lending and preventing abusive practices that can lead to significant financial distress for borrowers.

Overview of Key Regulations

Several key regulations govern fast loans for bad credit, which can have significant implications for borrowers and lenders alike. Awareness of these laws is vital in safeguarding consumer rights and ensuring fair lending practices. The following highlights some of the most critical regulations:

- The Truth in Lending Act (TILA): This federal law requires lenders to disclose the terms and costs of loans clearly. Borrowers must be informed about the annual percentage rate (APR), total loan costs, and repayment terms before agreeing to a loan.

- The Fair Lending Act: This act prohibits discriminatory lending practices and ensures that all borrowers have equal access to credit, regardless of race, color, religion, sex, or national origin.

- State Usury Laws: Many states have implemented laws that limit the interest rates lenders can charge on loans. These laws vary by state and are designed to protect borrowers from excessive fees and interest rates.

- The Fair Debt Collection Practices Act (FDCPA): This federal law regulates the behavior of debt collectors, prohibiting abusive, deceptive, or unfair practices during the collection of debts. It also provides consumers with the right to dispute debts.

“Being aware of these regulations is essential for borrowers to ensure they receive fair treatment while navigating the lending process.”

Regulations not only protect consumers but also establish accountability for lenders. Borrowers must remain vigilant about the terms of their loans and ensure they are not being subjected to unfair practices. Understanding these legal aspects is a powerful tool in making informed financial decisions and shielding oneself from potential financial pitfalls associated with fast loans for bad credit.

Ultimate Conclusion

In conclusion, while Fast Loans For Bad Credit can provide much-needed financial assistance, it is essential to approach them with caution and awareness of the potential risks involved. Evaluating various options, understanding the application process, and considering alternatives can empower borrowers to make wiser financial choices. By being informed, individuals can navigate their financial journeys more effectively and secure a better financial future.

FAQ Section

What are the typical interest rates for fast loans?

Interest rates for fast loans can vary widely, typically ranging from 10% to 400%, depending on the lender and borrower’s credit status.

How quickly can I receive funds after approval?

Funds from fast loans can often be disbursed within a few hours to a couple of days after approval.

Can I apply for a fast loan with no credit check?

Many lenders offering fast loans do not conduct traditional credit checks but may consider alternative credit assessment methods.

What should I do if I cannot repay my fast loan?

If you are unable to repay your fast loan, it is advisable to communicate with your lender immediately to explore options such as payment plans or extensions.

Are there any hidden fees with fast loans?

Borrowers should be cautious, as some fast loans may include hidden fees such as processing fees, late payment penalties, or prepayment penalties.