With Home Equity Loan Rates at the forefront, homeowners are presented with a unique financial tool that offers both flexibility and potential. These loans allow individuals to tap into the equity accumulated in their homes, opening doors to various possibilities such as home improvements, debt consolidation, or even investments. Understanding the nuances of home equity loans can be the key to making informed decisions that align with one’s financial goals.

In this discussion, we will explore the workings of home equity loans, the factors influencing their rates, recent trends, and strategies for securing the best possible terms. By examining these elements, homeowners can better navigate the lending landscape and utilize their home equity to achieve their aspirations.

Understanding Home Equity Loans

Source: hdnux.com

Home equity loans have become a popular financial tool for homeowners seeking to leverage the value of their property. By allowing individuals to borrow against the equity they have built in their homes, these loans provide a means to access funds for various purposes, including renovations, debt consolidation, and major purchases. Understanding how home equity loans function and their benefits is essential for homeowners considering this option.A home equity loan is a type of secured loan where the borrower uses the equity in their home as collateral.

Typically, the loan amount is determined by assessing the home’s current market value and the outstanding mortgage balance. The difference between these two figures represents the home equity available to the borrower. Home equity loans often come with fixed interest rates and require regular monthly payments over a set period, which can range from five to thirty years.

Comparison with Other Types of Loans

When evaluating home equity loans, it is beneficial to compare them with other common types of loans, such as personal loans and home equity lines of credit (HELOCs). This comparison highlights the unique features and advantages of home equity loans.Home equity loans are distinct from personal loans, which are typically unsecured and may have higher interest rates. Home equity loans, being secured by the home, often come with lower interest rates and larger borrowing limits.

Additionally, personal loans might require a good credit score for approval, whereas home equity loans can be more accessible to homeowners with some equity built up in their property.Another common alternative is the home equity line of credit (HELOC), which functions similarly but offers a revolving line of credit instead of a lump sum. While HELOCs provide flexibility in borrowing, they usually come with variable interest rates, which means payments can fluctuate over time.

Home equity loans provide more stability with fixed rates, making budgeting easier for homeowners.

Key Benefits of Home Equity Loans

Utilizing a home equity loan presents several key benefits that make it an attractive option for many homeowners. Understanding these advantages can assist in making informed financial decisions.One of the primary benefits is the lower interest rates associated with home equity loans compared to other borrowing options. This can lead to substantial savings over the life of the loan. In addition, the interest paid on home equity loans may be tax-deductible, further enhancing their appeal for certain borrowers.Another significant advantage is the potential for large borrowing amounts based on the equity accumulated in the home.

Homeowners can access substantial funds, making these loans particularly suitable for major expenses, such as home renovations or education costs.Furthermore, home equity loans can simplify debt consolidation efforts. By consolidating high-interest debts into a single loan with a lower interest rate, homeowners can improve their financial situation and reduce monthly payments.In summary, understanding home equity loans involves recognizing how they work, their advantages compared to other borrowing methods, and the potential financial benefits they offer to homeowners.

Factors Influencing Home Equity Loan Rates

The interest rates associated with home equity loans are influenced by a variety of factors that potential borrowers should understand. These factors not only determine the cost of borrowing but also affect the overall affordability of the loan. By recognizing these elements, homeowners can better navigate the loan process and make informed financial decisions.One of the primary factors influencing home equity loan rates is the borrower’s credit score.

Lenders use credit scores to assess the risk of lending money to individuals. Generally, a higher credit score indicates a lower risk, which may result in more favorable loan terms, including lower interest rates. For instance, a borrower with a credit score over 750 may qualify for a rate of 3.5%, while someone with a score below 650 might face rates upwards of 6% or more.

This significant difference illustrates how crucial it is to maintain a good credit score for obtaining better loan conditions.

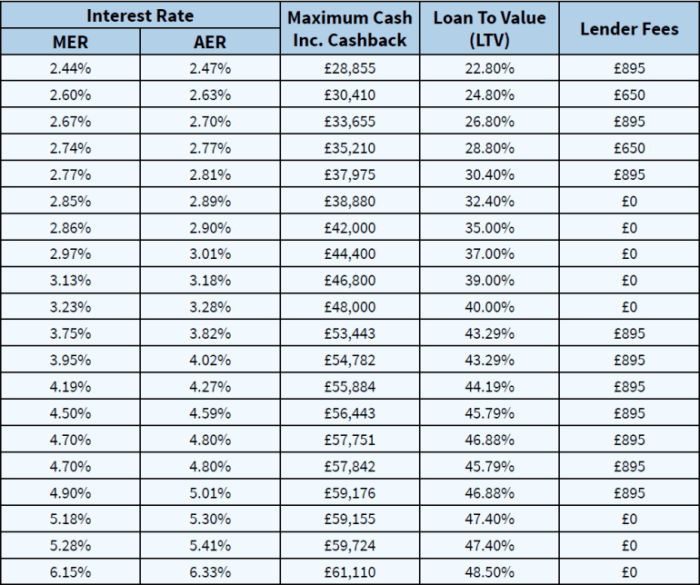

Impact of Loan-to-Value Ratios on Interest Rates

The loan-to-value (LTV) ratio is another critical factor that lenders consider when determining interest rates for home equity loans. The LTV ratio is calculated by dividing the total loan amount by the appraised value of the property. A lower LTV ratio suggests that the borrower has more equity in the home, which lowers the lender’s risk. Typically, an LTV ratio of 80% or lower is viewed favorably by lenders, often resulting in lower interest rates.High LTV ratios, conversely, signify that a borrower has less equity built up, which may result in higher rates.

For example, if a homeowner has a property valued at $300,000 and is seeking a home equity loan of $240,000, the LTV ratio would be 80%. In contrast, if that same homeowner were to seek a loan of $270,000, the LTV ratio would rise to 90%, potentially increasing the interest rate due to the higher perceived risk.

The relationship between credit scores, LTV ratios, and interest rates is crucial for borrowers to understand, as even small changes in these factors can significantly alter loan terms.

In summary, both credit scores and loan-to-value ratios play a pivotal role in determining the interest rates for home equity loans. By improving one’s credit standing and maintaining a lower LTV ratio, borrowers can enhance their chances of securing more favorable loan terms.

Current Trends in Home Equity Loan Rates

Home equity loan rates have experienced notable fluctuations over the past year, reflecting the broader economic landscape and shifting monetary policies. Recent statistics indicate that home equity loan rates have generally ranged from 5% to 8%, influenced by various factors including inflation and the state of the housing market. Understanding these trends is crucial for homeowners considering leveraging their equity for financial needs.The economic conditions significantly impact current home equity loan rates.

In the past year, the economy has navigated challenges such as inflationary pressures and changing employment rates. As consumer confidence and spending fluctuate, lenders adjust their rates to manage risks associated with lending. For instance, during periods of economic uncertainty, lenders may raise rates to hedge against potential defaults, while more stable conditions might see a drop in rates as competition increases among lenders.

Impact of Federal Interest Rate Changes

The federal interest rate plays a pivotal role in shaping home equity loan rates. When the Federal Reserve adjusts its benchmark rate, the ripple effects are felt across the financial landscape, including in home equity lending. A higher federal interest rate typically leads to increased borrowing costs, which can elevate home equity loan rates. Conversely, a reduction in the federal rate often results in lower loan rates, making it more attractive for homeowners to tap into their equity.Recent data indicates that since early 2023, the Federal Reserve has raised rates several times in response to persistent inflation.

As a result, home equity loan rates have followed suit, reflecting these changes. This upward trend means homeowners considering a home equity loan may face higher costs than they would have a year ago. However, the overall housing market still exhibits resilience, as many homeowners continue to see their property values increase, thereby maintaining a healthy equity cushion.

“As of late 2023, the average home equity loan rate stands at approximately 7.2%, significantly higher than the rates seen in early 2022, highlighting the influence of federal monetary policy.”

Understanding these trends allows homeowners to make informed decisions about when to secure a home equity loan, especially in a fluctuating economic environment. By staying attuned to the connection between federal interest rates and home equity loan rates, homeowners can better navigate their financial options and optimize their borrowing strategies.

How to Secure the Best Home Equity Loan Rates

Securing favorable home equity loan rates requires thorough preparation and a strategic approach. Not only can a good rate save you money, but it also enhances the overall experience of borrowing against your home’s value. By following a structured method and understanding the dynamics at play, borrowers can position themselves to receive the best possible rates.A solid preparation plan encompasses multiple steps, especially focusing on financial health and market research.

Begin with a careful assessment of your credit profile, as lenders prioritize applicants with higher credit scores. Additionally, evaluating multiple lenders and their offerings can lead to better terms. This process not only involves gathering necessary documentation but also actively managing financial factors that can influence the rates offered.

Preparation Steps for Home Equity Loan Application

Preparing for a home equity loan application involves several critical steps that can significantly affect the outcome. The following steps Artikel the necessary actions to enhance your eligibility:

- Review Your Credit Report: Obtain a copy of your credit report and verify that all information is accurate. Discrepancies should be addressed promptly.

- Calculate Your Home Equity: Determine the amount of equity in your home by subtracting the remaining mortgage balance from the current market value of your property.

- Gather Financial Documents: Compile necessary documentation such as proof of income, tax returns, and a list of assets and liabilities.

- Assess Your Debt-to-Income Ratio: Lenders will look at your debt-to-income ratio, which should ideally be below 43%. Lowering debts can improve your standing.

- Prepare to Provide Property Information: Be ready to supply details about your home, including the purchase date, value, and any renovations made.

Strategies for Improving Credit Scores

Improving your credit score prior to applying for a home equity loan can significantly increase your chances of securing a favorable rate. Here are effective strategies to enhance your credit profile:

- Pay Bills on Time: Consistently paying bills on time is one of the most effective ways to improve your credit score.

- Reduce Credit Card Balances: Aim to keep your credit card balances low, ideally below 30% of your total credit limit, which can positively impact your credit utilization ratio.

- Avoid Opening New Credit Accounts: Refrain from applying for new credit just before applying for a loan, as this can lead to hard inquiries that may lower your score temporarily.

- Keep Old Accounts Open: Maintain older credit accounts to improve the length of your credit history, which can bolster your score.

Importance of Shopping for Home Equity Loan Rates

Shopping around for different home equity loan rates and terms is essential for securing the best deal available. By comparing offers, borrowers can identify which lenders provide the most competitive rates and favorable terms. This process involves:

- Researching Multiple Lenders: Look beyond traditional banks and consider credit unions, online lenders, and other financial institutions.

- Getting Pre-Approved: Seek pre-approval from several lenders to understand how much you can borrow and the rates available to you.

- Comparing Total Costs: Assess the Annual Percentage Rate (APR), fees, and other costs associated with each loan offer to determine the true expense of borrowing.

- Negotiating Terms: Don’t hesitate to negotiate terms with lenders; showing that you have researched can leverage better offers.

“Securing the best home equity loan rates is not just about finding the lowest interest; it involves understanding your financial position and exploring all available options.”

Comparing Home Equity Loan Offers

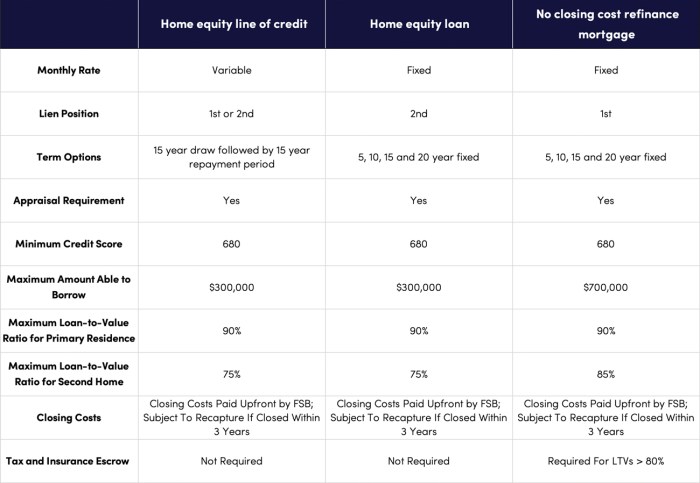

Source: five-starbank.com

When considering a home equity loan, it is essential to compare offers from various lenders to ensure you select the most favorable terms. Each lender may present different rates, fees, and conditions that can significantly impact the overall cost of borrowing. A thorough comparison allows you to identify the loan that best suits your financial situation and goals.Understanding the terms and conditions associated with each loan offer is crucial.

This knowledge goes beyond the interest rate, as additional factors such as closing costs, origination fees, and penalties for early repayment can substantially affect the total cost of the loan. It is important to evaluate these aspects to gain a comprehensive view of what each loan entails.

Home Equity Loan Rate Comparison Table

The following table summarizes the home equity loan rates and terms from several prominent lenders. This comparison will help you assess which offers align best with your financial objectives.

| Lender | Interest Rate | Loan Term | Closing Costs | APR |

|---|---|---|---|---|

| Lender A | 4.50% | 15 years | $1,200 | 4.75% |

| Lender B | 4.25% | 10 years | $1,500 | 4.50% |

| Lender C | 4.75% | 20 years | $900 | 5.00% |

| Lender D | 4.00% | 15 years | $1,000 | 4.25% |

It is essential to delve into the details of each loan offer. Borrowers should consider the following factors in addition to the interest rate when evaluating total costs:

Factors Impacting Total Cost Evaluation

To accurately assess the total cost of a home equity loan, consider the following components:

- Interest Rate: The base rate that determines your monthly payments and overall cost.

- Loan Term: The length of time to repay the loan, affecting the total interest paid over its lifetime.

- Closing Costs: Fees incurred at the loan’s inception, which can vary significantly among lenders.

- Prepayment Penalties: Charges for paying off the loan early, which can impact your ability to refinance or pay off the loan sooner.

- Annual Percentage Rate (APR): A broader measure that reflects the total cost of borrowing, including the interest rate and other fees.

By evaluating these components, you can arrive at a well-informed decision regarding which home equity loan offer provides the best financial advantage.

The total cost of a home equity loan is not merely defined by the interest rate; it includes all associated fees and charges throughout its duration.

Common Mistakes to Avoid with Home Equity Loans

Navigating the landscape of home equity loans can be complex, and many borrowers fall into common traps that can lead to financial strain. Understanding the pitfalls associated with these loans is essential for making informed decisions. By recognizing these mistakes, borrowers can avoid costly errors and secure a loan that best fits their financial needs.

Borrowing More than Needed

One of the most prevalent mistakes homeowners make is borrowing more than they actually need. While it might be tempting to access the maximum equity available, this practice can lead to significant financial burdens in the long run. Borrowing excessive amounts increases monthly payment obligations and can lead to difficulties in managing debt. It is crucial to assess needs accurately and only borrow what is necessary for the intended purpose.

Common Misconceptions about Home Equity Loans

Several misconceptions surround home equity loans that can mislead borrowers. One common belief is that all home equity loans come with the same terms and rates. In reality, rates and terms can vary significantly based on the lender and the borrower’s financial situation. Another misconception is that these loans are always tax-deductible; however, this is only true if the funds are used for home improvements.

Understanding these and other misconceptions can help borrowers make more informed choices.

Avoiding High Fees and Unfavorable Terms

When applying for a home equity loan, borrowers must be vigilant about fees and loan terms to prevent unexpected costs. Lenders may charge various fees, including application fees, appraisal fees, and closing costs. It is important to request a detailed breakdown of all fees associated with the loan. Additionally, examining the loan terms is crucial; borrowers should be wary of adjustable-rate loans that may lead to higher payments down the line.

Consider the following tips to minimize fees and secure favorable terms:

- Shop around and compare offers from multiple lenders to find the best rates and terms.

- Negotiate fees where possible; some lenders may waive certain fees to secure your business.

- Read the fine print with attention to detail, especially regarding prepayment penalties and interest rate changes.

- Seek advice from a financial professional if uncertain about any terms or conditions presented by lenders.

“A well-informed borrower is an empowered borrower.”

Practical Applications of Home Equity Loans

Home equity loans serve as a versatile financial tool for homeowners, allowing them to leverage the value of their property for various purposes. By tapping into the equity built up in their homes, individuals can finance projects, consolidate debts, or invest in opportunities that may enhance their financial standing. Understanding the practical applications of these loans can help homeowners make informed decisions that align with their financial goals.Home equity loans can be utilized for several purposes, with notable applications including home renovations, debt consolidation, and educational expenses.

Homeowners often pursue renovations to increase their property value and improve living conditions. Debt consolidation enables borrowers to merge high-interest debts into a single, lower-interest loan, potentially reducing monthly payments and overall interest costs.

Home Renovations

Home renovations represent one of the most common and effective uses of home equity loans. By funding improvements to their property, homeowners can significantly increase the market value of their homes. For instance, a kitchen remodel or bathroom upgrade not only enhances livability but can also yield substantial returns on investment when it comes time to sell.Consider the case of a homeowner who utilized a home equity loan of $50,000 to renovate their outdated kitchen.

After a two-month renovation, the home was appraised, revealing an increase in value by approximately $80,000. This demonstrates the potential financial benefit of using home equity for home improvements.

Debt Consolidation

Debt consolidation through home equity loans can provide relief for individuals facing high-interest debts. By consolidating multiple debts into a single loan with a lower interest rate, homeowners can simplify their financial obligations and often save money in interest payments.For instance, a homeowner with $30,000 in credit card debt with an average interest rate of 18% might opt for a home equity loan with a 6% interest rate.

Over a five-year period, this switch could save the individual thousands of dollars in interest payments.

Educational Expenses

Home equity loans can also be leveraged for educational expenses, such as financing college tuition. Given the rising costs of education, using home equity can make higher education more accessible for families without incurring exorbitant interest rates typically associated with student loans.

Investment Opportunities

Investing in real estate or other ventures using home equity loans can also be a viable option. However, homeowners should be cautious as this approach carries inherent risks. The value of the investment may not always appreciate, and failure to manage the investment properly can lead to financial strain.A homeowner who borrowed $100,000 through a home equity loan to invest in a rental property hopes to generate passive income.

If the rental market fluctuates or the property does not appreciate as expected, the homeowner may find themselves struggling to pay the loan while also managing the property’s expenses.

The decision to use home equity loans for investments should be made with careful consideration of the potential risks and rewards.

In conclusion, home equity loans offer various practical applications, from home improvements to financial restructuring and investment opportunities. However, homeowners must be vigilant about the associated risks and ensure that their decisions align with long-term financial stability.

Ending Remarks

Source: co.uk

In conclusion, understanding Home Equity Loan Rates not only empowers homeowners but also provides them with the necessary insights to maximize their financial potential. By staying informed about current trends, knowing how to improve credit scores, and comparing offers from various lenders, individuals can make educated choices that suit their financial needs. Home equity loans can be a powerful ally when used wisely, paving the way for new opportunities and financial security.

Questions Often Asked

What is the typical range for home equity loan rates?

Home equity loan rates typically range from 3% to 10%, depending on factors such as credit score and market conditions.

Can I use a home equity loan for any purpose?

Yes, homeowners can use home equity loans for various purposes including renovations, debt consolidation, or financing education.

How does my credit score affect my home equity loan rate?

A higher credit score generally qualifies you for better interest rates, while a lower score may lead to higher rates or denial.

Are there fees associated with home equity loans?

Yes, there can be fees such as appraisal, closing costs, and origination fees, which vary by lender.

What happens if I cannot repay my home equity loan?

If you fail to repay, the lender can initiate foreclosure on your home, as it serves as collateral for the loan.