With Loans For Bad Credit at the forefront, many individuals find themselves seeking opportunities to regain control of their financial futures. Bad credit can often feel like an insurmountable barrier, but understanding the landscape of available loans can empower borrowers to make informed decisions. As we explore the various types of loans, eligibility criteria, and potential pitfalls, it becomes clear that there are paths to financial recovery even for those with less-than-perfect credit.

This discussion will delve into the intricacies of bad credit, shedding light on how it is defined and its far-reaching implications. By examining various loan options, assessing eligibility, and understanding the application process, readers will gain valuable insights into how to navigate the challenges posed by bad credit while also exploring effective strategies for improving their credit scores over time.

Understanding Bad Credit

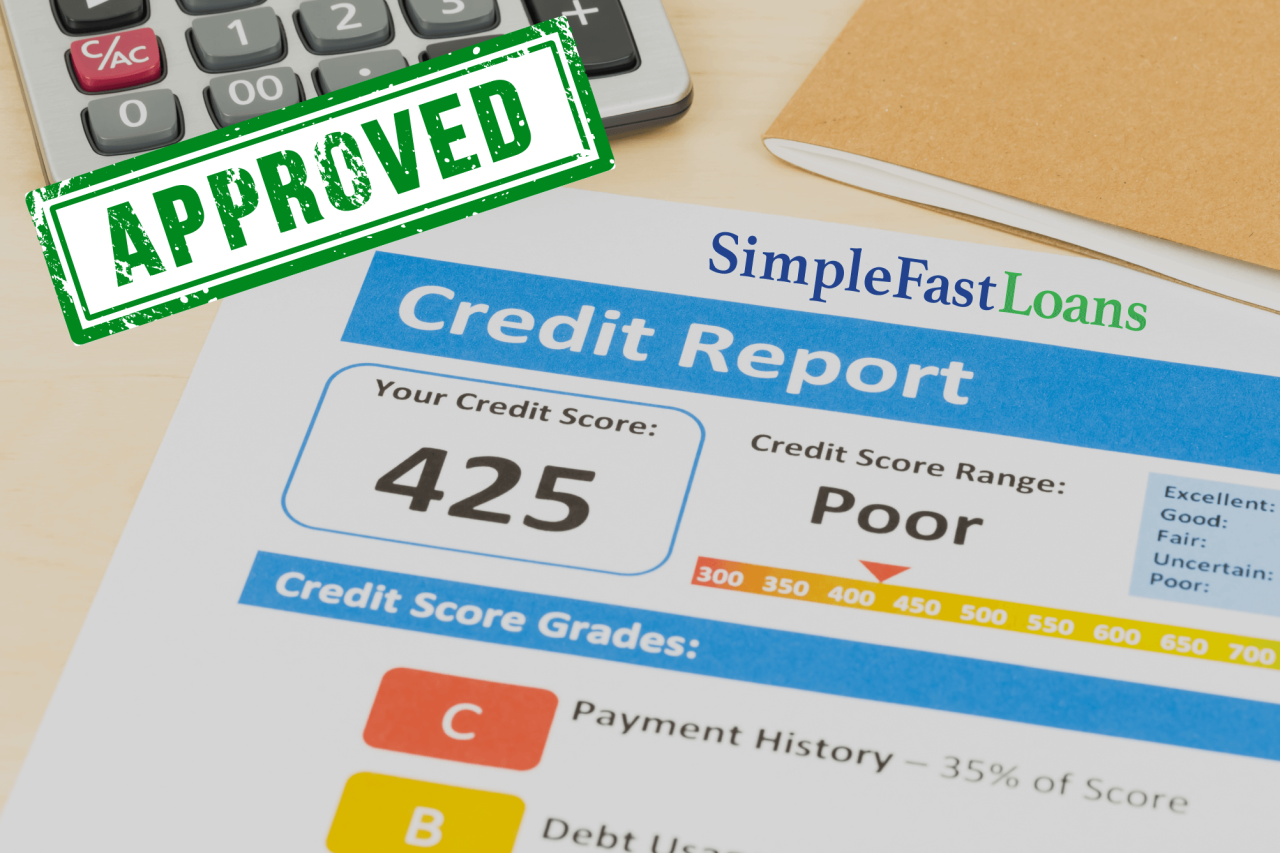

Bad credit is a term used to describe an individual’s poor creditworthiness as determined by their credit score. A credit score is a numerical representation of a person’s credit history and is derived from various factors including payment history, credit utilization, length of credit history, types of credit used, and new credit inquiries. A low credit score can significantly impact a person’s ability to secure loans, credit cards, and even housing, as it indicates to lenders a higher risk in extending credit.Credit scores typically range from 300 to 850, with scores below 580 usually classified as bad credit.

Several implications arise from having bad credit, including higher interest rates on loans, difficulty obtaining new credit, and limited options in mortgage lending. A person with bad credit might find themselves paying significantly more in interest over the lifetime of a loan compared to someone with good credit.

Impact on Financial Opportunities

The implications of bad credit extend beyond just loan approvals and interest rates; they affect various aspects of financial life. Individuals with bad credit may face stringent conditions when applying for credit and, in some cases, may be entirely denied access to certain financial products. Some key impacts include:

- Higher Interest Rates: Lenders often charge higher interest rates for loans to individuals with bad credit, which can lead to substantially more money paid over time.

- Limited Lending Options: Many traditional lenders, including banks and credit unions, may refuse to offer loans to those with bad credit, forcing individuals to seek alternative options that might have unfavorable terms.

- Difficulty in Renting: Landlords often conduct credit checks, and a poor credit history may result in rejection for rental applications.

- Insurance Premiums: Some insurance companies use credit scores to determine premiums, so individuals with bad credit could face higher insurance costs.

Statistics reflect the prevalence of bad credit across various demographics, showing that it is a widespread issue. According to a recent report from Experian, approximately 16% of Americans have a credit score below 580. This demographic includes various age groups and income levels, indicating that bad credit is not confined to a specific segment of the population. For example, younger individuals, particularly those in their 20s and 30s, often struggle with credit scores due to limited credit history and higher levels of student debt.

“The consequences of bad credit can have long-lasting effects on an individual’s financial health and opportunities.”

Types of Loans for Bad Credit

Individuals with bad credit have access to various loan options tailored to their financial situations. Understanding these options is crucial for making informed decisions that align with one’s financial goals and needs. Different types of loans can significantly impact the borrower’s ability to manage debt effectively while rebuilding their credit score.One primary distinction in loans for bad credit is between secured and unsecured loans.

Secured loans require collateral, usually an asset like a house or car, which the lender can claim if the borrower defaults. In contrast, unsecured loans do not require collateral, making them accessible but often accompanied by higher interest rates due to the increased risk for lenders.

Comparison of Secured vs. Unsecured Loans

Both secured and unsecured loans have distinct characteristics that cater to different borrower needs. Here is a comparative overview:

- Secured Loans: These loans typically offer lower interest rates due to the collateral backing them. This reduces the lender’s risk and can make it easier for borrowers to obtain larger loan amounts. However, failure to repay can lead to the loss of the asset.

- Unsecured Loans: These loans are based entirely on the borrower’s creditworthiness and repayment ability. While they do not require collateral, they often come with higher interest rates and stricter payment terms, reflecting the lender’s increased risk.

The choice between secured and unsecured loans often depends on the borrower’s financial situation, available collateral, and urgency of funds.

Specialized Loan Options

Various specialized loan options cater to those with bad credit, each serving different needs and circumstances. Understanding these options can aid borrowers in selecting the most suitable loan for their situation.

- Payday Loans: These short-term loans provide quick access to cash, typically due on the borrower’s next payday. While they are easy to obtain, they often come with exorbitant interest rates and fees, making them a risky choice for long-term financial health.

- Personal Loans: Personal loans for bad credit can be obtained from traditional lenders, credit unions, or online platforms. While they may have higher interest rates, they offer more flexible repayment terms and can be used for various purposes, such as consolidating debt or covering unexpected expenses.

- Peer-to-Peer Lending: This modern lending model connects borrowers directly with individual lenders through online platforms. Borrowers can benefit from competitive rates and terms, although they must still demonstrate creditworthiness to some extent.

Understanding the various types of loans available to individuals with bad credit is vital in navigating financial challenges. By carefully considering the options and their implications, borrowers can make informed choices that promote better financial management and credit rebuilding efforts.

Eligibility Criteria for Loans

Source: amazonaws.com

Obtaining a loan with bad credit can be challenging, but understanding the eligibility criteria is essential for prospective borrowers. Lenders assess multiple factors to determine whether an applicant qualifies for a loan, and being informed can enhance the chances of securing financial assistance.When applying for a loan with bad credit, lenders typically consider a range of criteria. These criteria help them gauge the risk associated with lending to individuals with a less-than-ideal credit history.

The key factors influencing the assessment include credit score, income, employment stability, and existing debt levels. Each of these elements plays a crucial role in the decision-making process.

Typical Eligibility Requirements

It is vital for borrowers to be aware of the common requirements they may need to meet when seeking loans with bad credit. Understanding these requirements not only helps in preparing the application but also allows borrowers to identify potential areas for improvement.

- Minimum Credit Score: Many lenders have a minimum credit score requirement, often ranging from 500 to 600. However, some lenders specialize in loans for those with even lower scores.

- Proof of Income: Borrowers must provide documentation of their income, which can include pay stubs, tax returns, or bank statements, to demonstrate their ability to repay the loan.

- Employment Verification: Lenders may require proof of stable employment, often necessitating a minimum duration of employment with the current employer.

- Debt-to-Income Ratio: A low debt-to-income ratio, typically below 40%, indicates that borrowers can manage their existing debts alongside new loan obligations.

- Bank Account: Some lenders require borrowers to have an active bank account where funds can be deposited and payments can be withdrawn.

Factors Influencing Loan Assessment

When evaluating loan applications, lenders analyze several key factors that contribute to the risk profile of the borrower. Recognizing these factors can assist applicants in presenting a stronger case for loan approval.

- Credit History: An applicant’s credit history demonstrates their repayment behavior and overall credit management. Negative marks, such as late payments or defaults, can significantly impact the outcome.

- Current Financial Obligations: Lenders review existing debts and monthly obligations to assess whether the borrower can handle additional financial commitments.

- Loan Purpose: The intended use of the loan can influence lender decisions; personal loans may have different criteria compared to loans for debt consolidation or emergencies.

- Collateral Availability: Secured loans, where assets are pledged as collateral, may have different eligibility standards than unsecured loans, potentially allowing borrowers with bad credit to qualify more easily.

Loan Eligibility Checklist

To facilitate the loan application process, potential borrowers can utilize a checklist to evaluate their eligibility. This checklist serves as a useful tool to identify areas that may need attention before applying for a loan.

- Check your credit score and report for accuracy.

- Gather proof of income documentation.

- Calculate your debt-to-income ratio.

- Ensure stable employment history is documented.

- Evaluate the purpose of the loan and ensure alignment with lender requirements.

- Consider the availability of collateral if applying for a secured loan.

“Being prepared with the right documentation and understanding your financial position can significantly improve your chances of securing a loan, even with bad credit.”

Loan Application Process

When applying for a loan with bad credit, understanding the process is crucial for improving your chances of approval. A structured approach ensures you are fully prepared, which can make a significant difference in getting the funds you need, even with less-than-ideal credit circumstances.The loan application process for bad credit typically involves several key steps. These steps ensure that both the borrower and lender are clear about the terms, requirements, and expectations involved.

Below is a comprehensive overview of the application process along with preparation tips for necessary documentation.

Step-by-Step Loan Application Process

The loan application process can be broken down into several critical steps, which are as follows:

- Research potential lenders: Begin by identifying lenders that specialize in offering loans to individuals with bad credit. This includes banks, credit unions, and online lenders.

- Check eligibility requirements: Review each lender’s eligibility criteria to determine if you meet their requirements. This may include income, employment status, and credit score thresholds.

- Gather necessary documentation: Collect important documents which may include proof of income, bank statements, identification, and any other information the lender requires.

- Complete the application: Fill out the loan application accurately, providing all requested information and ensuring there are no errors or omissions.

- Submit the application: Send your application through the lender’s preferred method, whether online or in person, and ensure you keep copies for your records.

- Await lender’s decision: After submission, the lender will review your application and may contact you for additional information if necessary.

- Receive the loan offer: If approved, you will receive a loan offer outlining the terms, interest rates, and repayment schedule. Review these carefully before acceptance.

- Accept the loan and receive funds: Upon acceptance of the loan offer, you will finalize the documentation, and funds will be disbursed as agreed.

Preparation of Documentation and Financial Information

Proper preparation of documentation can significantly streamline the loan application process. The following tips can help you effectively organize your financial information:

- Gather recent pay stubs or proof of income to demonstrate your ability to repay the loan.

- Prepare bank statements for the past few months to provide insights into your financial stability.

- Compile identification documents such as a driver’s license or passport for verification purposes.

- Include tax returns for the last two years, as they can be an important indicator of your financial situation.

- Review your credit report to understand your credit standing and prepare to discuss any discrepancies with the lender.

Common Lenders Offering Loans for Bad Credit

Below is a table listing common lenders that provide loans specifically tailored for individuals with bad credit, along with their requirements and interest rates. This information serves as a preliminary guide to help you identify suitable options.

| Lender | Requirements | Interest Rates |

|---|---|---|

| Avant | Minimum credit score of 580, regular income | 9.95% – 35.99% |

| OneMain Financial | No minimum credit score, secured loans available | 18% – 35.99% |

| Upstart | Minimum credit score of 580, income verification | 6.76% – 35.99% |

| Peerform | Minimum credit score of 600, no bankruptcies | 5.99% – 29.99% |

| BadCreditLoans.com | No minimum credit score, must be 18 years old | 5.99% – 35.99% |

By following these structured steps and preparing your documentation thoroughly, you can enhance your chances of securing a loan even in the face of bad credit.

Risks and Considerations

Taking out loans for bad credit can be a viable option for those in need of immediate financial relief, but it is essential to recognize the potential risks involved. Borrowers may face higher interest rates, unfavorable loan terms, and the possibility of falling deeper into debt if not managed properly. Understanding these risks can help individuals make informed decisions and navigate the loan landscape more effectively.When considering loans for bad credit, borrowers must be aware of common pitfalls that could exacerbate their financial situation.

It is crucial to approach the application process with a clear understanding of the associated risks, which can include predatory lending practices, hidden fees, and the impact of missed payments on credit scores. Here are some critical considerations to keep in mind:

Common Pitfalls in Borrowing

The process of obtaining a loan with bad credit can be fraught with challenges. Recognizing these pitfalls is vital to ensure responsible borrowing. The following list highlights common issues that borrowers should avoid:

- Ignoring the terms and conditions: Many borrowers overlook the fine print, which can contain important details about fees, interest rates, and repayment terms. Understanding these details is essential.

- Falling for predatory lenders: Some lenders target individuals with bad credit, offering loans with exorbitant interest rates and hidden fees. It is important to research lenders thoroughly before committing.

- Over-borrowing: Taking out a loan that exceeds one’s repayment capacity can lead to financial strain. Assessing personal finances realistically helps in determining the right loan amount.

- Missing payments: Failing to make timely payments can lead to increased debt and further damage to credit scores. Setting up automatic payments or reminders can help manage this risk.

Managing Loan Repayments Effectively

Effective management of loan repayments is essential for avoiding further credit damage. Establishing a solid repayment plan can mitigate the risks associated with bad credit loans. Consider the following strategies:

- Create a budget: Developing a detailed monthly budget allows borrowers to allocate funds for loan repayments while managing other expenses efficiently.

- Prioritize debt repayment: Focus on paying off high-interest loans first. This approach minimizes the overall interest paid and helps maintain a healthier credit profile.

- Communicate with lenders: If financial difficulties arise, reaching out to lenders for assistance or to negotiate payment terms can prevent missed payments and penalties.

- Consider debt consolidation: For those with multiple loans, consolidating debt into a single loan with a lower interest rate can simplify repayment and reduce monthly obligations.

“Maintaining open lines of communication with lenders and adhering to a well-structured repayment plan are key to rebuilding credit health.”

Improving Credit Score

Improving your credit score is a critical step in securing loans, especially for those with bad credit. A higher credit score can open doors to better loan terms, lower interest rates, and increased borrowing capacity. Understanding the strategies to enhance your credit score can greatly influence your financial future and loan opportunities.Effective credit repair is essential for individuals seeking to improve their creditworthiness.

By addressing negative items on your credit report and adopting sound financial practices, you can significantly impact your ability to secure loans. Improving your credit score not only boosts your chances of loan approval but can also lead to more favorable lending conditions.

Strategies for Improving Credit Scores

Implementing strategic actions is vital for enhancing your credit score. Below are key strategies that individuals can adopt to gradually improve their credit profile:

1. Review Your Credit Report

Regularly obtain copies of your credit report from all three major credit bureaus—Equifax, Experian, and TransUnion. Check for inaccuracies and promptly dispute any errors you find.

2. Pay Bills on Time

Establish a consistent payment schedule to ensure all bills, including credit cards, utilities, and loans, are paid on time. Late payments can negatively impact your credit score.

3. Reduce Credit Card Balances

Aim to keep credit card balances below 30% of your total credit limit. Paying down existing debts can have a positive effect on your credit utilization ratio.

4. Avoid Opening New Accounts Frequently

Each time you apply for credit, a hard inquiry is made, which can lower your score. Be judicious about applying for new accounts.

5. Establish a Positive Credit History

Consider secured credit cards or credit-builder loans if you have limited credit history. These tools can help demonstrate responsible credit use.

6. Negotiate with Creditors

If you have outstanding balances, contact your creditors to negotiate payment plans or settlements. Successfully managing these debts can improve your credit standing.

Importance of Credit Repair

Credit repair plays a crucial role in enhancing your financial opportunities. By actively working to improve your credit score, individuals can experience:

Better Loan Approval Rates

Lenders are more likely to approve loans for those with higher credit scores, as they are deemed less risky.

Lower Interest Rates

A good credit score can qualify borrowers for lower interest rates, resulting in substantial savings over the life of a loan.

Increased Confidence in Financial Management

Successfully improving your credit score can foster a sense of financial responsibility, encouraging better financial habits in the future.

Timeline for Enhancing Credit Score

Creating a timeline can help in systematically improving your credit score. Here is a suggested timeline with actionable steps:

| Time Frame | Action Steps |

|---|---|

| Month 1 | Obtain credit reports and dispute any inaccuracies. |

| Months 2-3 | Set up automatic payments for bills and reduce credit card balances. |

| Months 4-5 | Monitor credit utilization and avoid applying for new credit. |

| Month 6 | Assess your progress and adjust strategies as needed. |

| Ongoing | Continue practicing responsible credit habits and regularly review your credit report. |

By following this structured approach, individuals can witness gradual improvements in their credit scores, enhancing their prospects for obtaining loans with better terms in the future.

Alternatives to Traditional Loans

Source: badcredit.org

Individuals with bad credit often find themselves excluded from traditional lending options due to their credit history. However, there are various alternative financing options that can provide necessary assistance without the stringent requirements of conventional loans. Understanding these alternatives can help individuals make informed decisions and find appropriate financial support tailored to their needs.One viable option to consider are community resources, credit unions, and nonprofit organizations that provide financial assistance.

These organizations often have more flexible criteria for lending and focus on supporting community members rather than solely prioritizing profit.

Community Resources and Financial Assistance Options

Community resources can play a pivotal role in offering financial support to those with bad credit. They are often more approachable and understanding of individual circumstances. Below are some key players in this space:

- Credit Unions: These member-owned financial institutions typically offer lower interest rates and more flexible lending criteria compared to banks. They often provide personal loans and credit-building products specifically designed for individuals with lower credit scores.

- Nonprofit Organizations: Various nonprofit organizations offer financial assistance programs or emergency funds for individuals facing financial hardship. They may also provide financial counseling, helping borrowers improve their financial literacy and credit scores.

- Peer-to-Peer Lending Platforms: These platforms connect borrowers directly with individual investors willing to lend money. They often have less stringent credit requirements, making it easier for individuals with bad credit to receive funding.

- Government Assistance Programs: Many local and state governments offer assistance programs aimed at helping low-income individuals or those with poor credit histories. This can include grants, subsidized loans, or emergency funds.

Understanding the pros and cons of traditional loans versus alternative options can further guide individuals in making informed choices. Below is a comparison chart that Artikels the advantages and disadvantages of each.

| Type of Loan | Pros | Cons |

|---|---|---|

| Traditional Loans |

|

|

| Alternative Loans |

|

|

“Exploring alternatives to traditional lending can unlock pathways to financial support that are often overlooked, especially for individuals with bad credit.”

Understanding these alternatives not only broadens the financial options available but also empowers individuals to seek assistance that aligns with their unique situations.

Real-life Success Stories

In the realm of financial lending, stories of individuals overcoming bad credit challenges offer hope and inspiration. These success stories provide tangible evidence that securing a loan, despite poor credit history, can lead to significant life changes. By examining these journeys, we can better appreciate the profound impact that financial opportunities can have on people’s lives.

Case Study: Sarah’s Journey to Homeownership

Sarah, a single mother of two, faced significant obstacles due to a credit score of 580, primarily stemming from medical bills and past due accounts. Despite her challenges, Sarah was determined to secure a stable home for her family. Through perseverance and research, she discovered a lender specializing in loans for individuals with bad credit. The lender offered her a subprime mortgage with a higher interest rate but favorable repayment terms.

Sarah utilized a portion of the loan to pay off her existing debts, thus improving her credit score to 620 within a year. Sarah’s successful home purchase not only provided her family with security but also motivated her to develop better financial habits, leading to a more stable future.

Testimonial: Mark’s Business Breakthrough

Mark, an entrepreneur with a credit score of 590, found it challenging to secure funding for his small business. After being rejected by traditional banks, he applied for a personal loan from a peer-to-peer lending platform that catered specifically to individuals with low credit scores.With the funds he received, Mark was able to invest in essential equipment and marketing for his business.

Over the next two years, his business flourished, leading him to pay off the loan ahead of schedule. Mark’s story highlights the potential for loans to act as a catalyst for not only personal but also professional growth and recovery.

Success Story: Lisa’s Debt Consolidation

Lisa had accumulated various debts, resulting in a credit score of 570. Overwhelmed by high-interest rates from multiple sources, she sought a way to consolidate her debt. Finding a credit union willing to work with her, Lisa secured a debt consolidation loan aimed at individuals with bad credit. This loan provided her with a single monthly payment at a lower interest rate, facilitating easier management of her finances.

Through disciplined budgeting and the support of financial counseling, Lisa improved her credit score to 650 within a year, demonstrating how strategic financial products can lead to recovery and empowerment.

These real-life examples illustrate that with determination and the right financial products, individuals with bad credit can turn their situations around and achieve their goals.

Ending Remarks

Source: firstquarterfinance.com

In summary, while Loans For Bad Credit may present unique challenges, they also offer potential avenues for financial recovery and growth. By being aware of the application process, understanding the risks involved, and exploring alternatives, individuals can make educated choices that align with their financial goals. Ultimately, with patience and determination, it is possible to overcome the hurdles of bad credit and pave the way towards a brighter financial future.

Key Questions Answered

What is considered bad credit?

Bad credit is generally defined as a credit score below 580, indicating a higher risk to lenders.

Can I get a loan with no credit history?

Yes, some lenders offer loans specifically for individuals with no credit history, often with higher interest rates.

Are interest rates higher for loans with bad credit?

Yes, loans for bad credit typically come with higher interest rates to compensate for the increased risk to lenders.

How long does it take to improve my credit score?

Improving a credit score can take several months to years, depending on individual financial behavior and actions taken.

Can I negotiate the terms of a loan for bad credit?

Yes, borrowers can sometimes negotiate terms with lenders, especially regarding interest rates and repayment options.

What happens if I default on a loan for bad credit?

Defaulting can severely impact your credit score and may lead to legal action by the lender to recover funds.

Are there government programs to assist with bad credit loans?

Yes, some government programs and nonprofit organizations offer financial assistance and resources for individuals with bad credit.