Lowest Home Equity Loan Rates have become a crucial consideration for homeowners looking to tap into their property’s financial potential. As home equity loans offer an effective way to finance significant expenses, understanding their mechanics, benefits, and the factors influencing rates is essential for making informed decisions. By leveraging the value of their homes, homeowners can secure funds for renovations, education, or debt consolidation, making it imperative to evaluate the most favorable loan options available.

This overview aims to clarify the nuances of home equity loans, the current lowest rates in the market, and the strategies for obtaining the best possible terms. By shedding light on eligibility criteria, market trends, and the overall loan application process, we provide valuable insights that equip readers with the knowledge to navigate their financing journey confidently.

Overview of Home Equity Loans

Home equity loans are financial products that allow homeowners to borrow against the equity they have built in their properties. These loans provide a lump sum of money that can be used for various purposes, such as home improvements, debt consolidation, or unexpected expenses. Understanding how home equity loans function and how they differ from other borrowing options is essential for homeowners considering tapping into their home’s value.A home equity loan typically involves borrowing a fixed amount of money, repaid over a set period with a fixed interest rate.

Homeowners take out these loans based on the equity they have in their property, which is calculated as the difference between the home’s current market value and the outstanding mortgage balance. Borrowers generally make monthly payments during the loan term, and failure to repay the loan can lead to foreclosure.

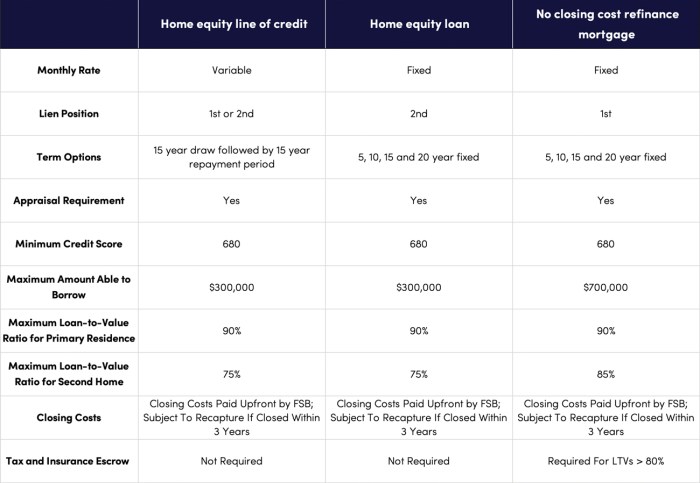

Differences Between Home Equity Loans and Home Equity Lines of Credit (HELOCs)

Home equity loans and HELOCs serve similar purposes but operate quite differently. Home equity loans offer a single lump sum, while HELOCs function more like credit cards, allowing homeowners to borrow up to a certain limit over a specified draw period. Understanding these differences is crucial for selecting the right option for your financial needs.Key differences include:

- Disbursement: Home equity loans provide a one-time payment, whereas HELOCs allow multiple withdrawals up to a credit limit.

- Interest Rates: Home equity loans have fixed rates, while HELOCs often have variable rates that can change over time.

- Repayment Structure: Home equity loans require fixed monthly payments, while HELOCs may have interest-only payments initially before transitioning to principal payments.

- Usage Flexibility: Home equity loans are ideal for one-time expenses, while HELOCs accommodate ongoing costs or projects.

Situations for Considering a Home Equity Loan

Homeowners may consider taking out a home equity loan for a variety of reasons, particularly when they need access to cash for significant expenses. Recognizing potential scenarios can help determine if this type of financing is appropriate.Examples where a home equity loan may be beneficial include:

- Home Renovations: A homeowner looking to update their kitchen or add an extension can leverage their equity to finance the project.

- Debt Consolidation: Individuals with high-interest debt may use a home equity loan to pay off their credit cards and other loans, consolidating them into a single lower-rate payment.

- College Expenses: Families planning for college tuition can use home equity loans to fund education costs, potentially saving on interest compared to student loans.

- Emergency Expenses: Unforeseen costs, such as medical bills or urgent repairs, can be addressed by borrowing against home equity.

“Home equity loans can provide essential financial support, transforming your home’s value into cash for various life needs.”

Determining Home Equity Loan Rates

The determination of home equity loan rates is a multifaceted process influenced by various factors, including both individual borrower characteristics and broader market trends. Understanding these elements can empower borrowers to make informed decisions regarding their home equity loans, leading to potentially significant savings.Several key factors influence home equity loan rates, which can significantly affect the overall cost of borrowing.

Lenders typically consider the following when setting rates:

- Credit Score: A critical factor in determining loan rates, credit scores reflect a borrower’s creditworthiness. Higher scores often lead to lower interest rates, as lenders view these borrowers as less risky.

- Loan-to-Value Ratio (LTV): This ratio compares the amount of the loan to the appraised value of the home. A lower LTV signals less risk to lenders, which can result in better rates.

- Market Conditions: Economic factors, including interest rate trends and inflation, can influence overall lending rates. When the economy is strong, rates may rise, whereas they may decrease during economic downturns.

- Loan Amount: The size of the loan may also impact the interest rate. Higher loan amounts could potentially lead to lower rates, as lenders may be motivated to offer competitive terms.

- Borrower’s Financial Profile: Lenders assess overall financial health, including income, debt-to-income ratio, and employment stability, to gauge repayment ability.

Role of Credit Scores in Determining Loan Rates

Credit scores play a pivotal role in influencing the interest rates offered on home equity loans. These scores range from 300 to 850, with higher scores indicating better creditworthiness. Lenders typically categorize credit scores into several tiers, which directly correlate with the interest rates associated with loans.For instance, individuals with excellent credit scores (above 740) may qualify for rates as low as 3-4%, while those with scores in the fair range (580-669) may face rates significantly higher, often exceeding 6% or more.

This disparity highlights the importance of maintaining a good credit score, as even a slight difference in rates can lead to substantial savings over the life of the loan.

Improving your credit score by even a few points can often lead to better loan terms and lower interest rates.

Fixed vs. Variable Interest Rates

When obtaining a home equity loan, borrowers have the option to choose between fixed and variable interest rates. Each type carries distinct implications that borrowers should carefully consider.Fixed interest rates provide stability, as they remain constant throughout the loan term. This feature allows borrowers to predict their monthly payments, making financial planning more straightforward. Fixed rates are particularly advantageous in a rising interest rate environment, as borrowers are shielded from future rate increases.In contrast, variable interest rates fluctuate based on market conditions, typically tied to an index such as the prime rate.

While variable rates can start lower than fixed rates, they come with the risk of increasing significantly over time. This variability can lead to unpredictable monthly payments, making budgeting more challenging.

Choosing between fixed and variable rates requires careful consideration of your financial situation and market expectations.

In summary, the determination of home equity loan rates is influenced by various factors, with credit scores playing a crucial role. Furthermore, the choice between fixed and variable interest rates can significantly impact borrowers’ financial commitments.

Current Lowest Home Equity Loan Rates

As homeowners consider tapping into their home equity, understanding the current lowest home equity loan rates available is essential for making informed financial decisions. Home equity loans can provide valuable funding for various needs, from home renovations to debt consolidation, and securing a favorable interest rate can significantly impact overall loan costs.Currently, the home equity loan market offers a variety of competitive rates, influenced by factors such as credit scores, loan amounts, and the term of the loan.

Below is a table showcasing some of the lowest home equity loan rates currently available from various lenders, along with their terms and loan amounts.

Table of Current Home Equity Loan Rates

The following table illustrates the current offerings from different lenders, providing a clear comparison of rates and terms available in the market:

| Lender | Rate | Term | Loan Amount |

|---|---|---|---|

| ABC Bank | 3.25% | 15 years | $50,000 |

| XYZ Credit Union | 3.50% | 20 years | $30,000 |

| 123 Lending | 3.75% | 10 years | $25,000 |

| LMN Financial | 3.99% | 30 years | $75,000 |

In addition to these competitive rates, many lenders are currently offering promotional rates or discounts for new borrowers. For instance, some banks may waive certain fees or offer reduced interest rates for borrowers who opt for automatic payments. It’s important for potential borrowers to inquire about these promotional offers, as they can enhance the overall value of the loan package.

“Securing a low interest rate on a home equity loan can lead to significant savings over the life of the loan.”

How to Qualify for the Best Rates

Source: rate.com

Qualifying for low home equity loan rates requires a thorough understanding of the eligibility criteria and the steps one can take to enhance their chances of securing favorable terms. By preparing adequately and being aware of the key factors that lenders consider, prospective borrowers can position themselves for the best possible rates.To qualify for the best home equity loan rates, lenders typically consider several essential criteria.

These include credit score, loan-to-value ratio, income stability, and overall financial health. Maintaining a strong credit profile is particularly crucial, as it significantly influences the interest rates offered by lenders. A higher credit score usually correlates with lower rates, allowing borrowers to save money over the life of the loan.

Eligibility Criteria for Low Home Equity Loan Rates

Understanding the eligibility requirements is fundamental to successfully obtaining a home equity loan at lower rates. The following points Artikel the primary factors that lenders evaluate:

- Credit Score: Most lenders prefer a credit score of 700 or higher for the best rates. A strong credit history indicates responsible borrowing behavior, leading to more favorable terms.

- Loan-to-Value Ratio (LTV): A lower LTV ratio, typically under 80%, indicates that borrowers have significant equity in their homes, making them less risky to lenders.

- Income and Employment Stability: Consistent income and stable employment history assure lenders that borrowers can manage repayments effectively.

- Debt-to-Income Ratio (DTI): A DTI ratio below 43% is often viewed favorably, showing that borrowers are not over-leveraged.

Maintaining a good credit history is essential not only for qualifying but also for securing the most competitive rates available in the market.

Impact of Credit History on Loan Rates

The importance of credit history cannot be overstated, as it serves as a key indicator of financial responsibility. Lenders utilize credit reports to assess the risk associated with lending to an individual. A positive credit history reflects timely payments, responsible credit use, and minimal debt levels, which can lead to lower interest rates.

“A credit score is a reflection of your financial reliability; the higher it is, the more attractive you become to potential lenders.”

Documents Needed to Apply for a Home Equity Loan

When applying for a home equity loan, having the necessary documentation ready can streamline the process and improve the likelihood of approval. Essential documents typically required include:

- Proof of Identity: Government-issued identification such as a driver’s license or passport.

- Proof of Income: Recent pay stubs, tax returns, or W-2 forms to verify income.

- Home Ownership Documentation: Evidence of home ownership, which may include the mortgage statement or deed.

- Credit History: Lenders will obtain this themselves, but being aware of your credit report can help in discussions.

- Property Value Documentation: Recent property tax assessments or appraisals to establish current home value.

Being organized and prepared with these documents can facilitate a smoother application process and demonstrate to lenders that you are a serious borrower, potentially leading to better loan rates.

Strategies to Secure the Lowest Rates

Source: slideserve.com

Securing the lowest home equity loan rates is paramount for homeowners looking to leverage their property’s value. Employing effective strategies not only enhances the chances of obtaining favorable rates but also contributes to substantial savings over the lifetime of the loan. The following sections will discuss vital negotiating tips with lenders, methods to improve credit scores, and the significance of comparing offers from multiple lenders.

Negotiating Tips with Lenders for Lower Rates

Negotiating with lenders can significantly impact the interest rate on a home equity loan. Homeowners should approach lenders equipped with market knowledge and a clear understanding of their financial position. Here are some strategies to consider during the negotiation process:

- Research Comparable Rates: Before speaking with lenders, gather information on current home equity loan rates from various institutions. Having this data allows for informed discussions and strengthens your negotiating position.

- Highlight Your Financial Strength: Presenting a solid financial profile, including a good credit score, steady income, and low debt-to-income ratio, can persuade lenders to offer more competitive rates.

- Ask About Discounts: Many lenders offer discounts for various factors, such as setting up automatic payments or being a loyal customer. Inquire about any potential discounts that can lower your rate.

- Be Prepared to Walk Away: Demonstrating that you have options and are willing to seek better terms elsewhere can compel lenders to improve their offers.

Improving Credit Scores Prior to Application

A strong credit score is crucial in securing low home equity loan rates. Prior to applying, homeowners should consider the following methods to enhance their credit scores:

- Pay Bills on Time: Consistently paying bills on or before their due dates has a positive impact on your credit history and score.

- Reduce Outstanding Debt: Lowering credit card balances relative to your credit limits can improve your credit utilization ratio, a significant factor in credit scoring.

- Check Credit Reports: Review your credit reports from major credit bureaus for errors or discrepancies. Correcting inaccuracies can lead to a higher score.

- Avoid New Credit Applications: Minimize applying for new credit accounts shortly before applying for a loan, as each inquiry can slightly lower your score.

Advantages of Shopping Around and Comparing Offers

Shopping around for home equity loans is essential to finding the best rates. Homeowners benefit from evaluating multiple offers for several reasons:

- Increased Competition: When lenders know you are considering various options, they may be more willing to lower their rates to attract your business.

- Diverse Loan Terms: Different lenders may offer varying terms, including interest rates, repayment periods, and fees, providing opportunities for optimal loan structures.

- Better Understanding of Market Rates: Comparing offers gives homeowners a clearer picture of average market rates, allowing for informed decisions.

- Potential for Finding Special Promotions: Financial institutions often run promotional offers that can include reduced rates or waived fees, which can be advantageous to borrowers.

Risks and Considerations

Source: five-starbank.com

Taking out a home equity loan can be a viable financial strategy for many homeowners, but it is crucial to be aware of the potential risks and considerations involved. Understanding these risks can help borrowers make informed decisions about whether a home equity loan is the right choice for their financial situation.The potential risks associated with taking out a home equity loan include the possibility of losing one’s home, fluctuations in interest rates, and the burden of additional debt.

It is essential for borrowers to evaluate their ability to repay the loan and the implications of financial changes in the economy.

Potential Risks of Home Equity Loans

Home equity loans can present a variety of risks that borrowers should carefully consider before proceeding. These risks can include:

- Home Foreclosure: Failing to make timely payments on a home equity loan can lead to foreclosure, as the loan is secured by the home itself. This means that if you default, the lender has the right to seize your property.

- Increased Debt Burden: Taking out a home equity loan increases overall debt levels. Borrowers must assess their financial capability to manage additional monthly payments without jeopardizing their other financial commitments.

- Market Fluctuations: The real estate market can be unpredictable. A decrease in home values could result in owing more on the loan than the home is worth, creating a situation known as being “underwater.”

Implications of Rising Interest Rates

Rising interest rates can significantly affect home equity loans, especially for those with variable interest rates. As the Federal Reserve adjusts rates to manage inflation and economic growth, borrowers may face higher monthly payments. With the potential for interest rates to increase, borrowers should keep the following considerations in mind:

- Higher Monthly Payments: As interest rates rise, so do monthly payment obligations, which can strain household budgets.

- Reduced Loan Affordability: Higher rates could limit the amount of equity that can be borrowed, making it more difficult for homeowners to access funds for necessary expenses.

- Impact on Refinancing: Should interest rates rise significantly, refinancing existing home equity loans may not be feasible, locking borrowers into higher payment plans.

Consequences of Failing to Repay a Home Equity Loan

Failing to repay a home equity loan can have severe financial and legal repercussions. The immediate consequence is the risk of foreclosure, but borrowers face additional challenges as well:

- Credit Score Damage: Missed payments can lead to a significant decline in credit scores, making it more difficult to secure favorable loan terms in the future.

- Legal Action: Lenders may pursue legal action to recover debts, leading to further financial strain and potential court costs.

- Loss of Home Equity: Defaulting on a home equity loan not only puts the home at risk but also results in a loss of the equity built up through mortgage payments.

Alternatives to Home Equity Loans

Homeowners often seek financing options beyond home equity loans, especially when they need cash for renovations, debt consolidation, or other expenses. Understanding these alternatives can provide valuable insights into making informed financial decisions.Several financing options are available for homeowners besides home equity loans, each with unique characteristics, advantages, and disadvantages. Exploring personal loans, cash-out refinancing, and government programs can help borrowers find the most suitable option for their financial needs.

Personal Loans

Personal loans are unsecured loans that do not require collateral, allowing borrowers to access funds for various purposes. These loans typically have fixed interest rates and repayment terms ranging from one to seven years.

Pros

No collateral required, minimizing the risk of losing property.

Quick funding process, often providing access to cash within days.

Flexible usage for any purpose, from home improvements to debt consolidation. –

Cons

Higher interest rates compared to home equity loans due to the absence of collateral.

Shorter repayment terms might lead to higher monthly payments.

Credit score heavily influences rates and approval amounts, making it challenging for those with lower credit.

Cash-Out Refinancing

Cash-out refinancing involves replacing an existing mortgage with a new, higher-value mortgage, allowing homeowners to receive the difference in cash.

Pros

Potentially lower interest rates than personal loans due to mortgage lender competition.

Extends the mortgage term, possibly reducing monthly payments.

Can be used for significant expenses like home improvements or education costs. –

Cons

Extending the mortgage may increase the total interest paid over the loan’s life.

Closing costs can be substantial, adding to the initial expenses.

Risk of foreclosure if unable to meet mortgage payments, as the home serves as collateral.

Government Programs

Various government programs, including FHA loans and VA loans, offer alternative financing options for eligible homeowners. These programs typically come with favorable terms and benefits.

Pros

Lower down payment requirements and competitive interest rates.

Assistance available for first-time homebuyers or veterans.

Potential for flexible credit requirements. –

Cons

Limited to specific eligibility criteria and property types.

Application process can be lengthy and complicated.

May require mortgage insurance, impacting overall costs.

In summary, while home equity loans remain a popular choice for accessing home equity, alternatives like personal loans, cash-out refinancing, and government programs provide options worth considering, depending on individual circumstances and financial goals. Evaluating these alternatives can empower homeowners to find the best financial solution for their needs.

The Application Process

The application process for a home equity loan involves several key steps that borrowers must navigate to secure funding. Understanding the timeline and expectations during this process is essential for a smooth experience. This section Artikels the steps involved in applying for a home equity loan, the approval timeline, and important associated fees.

Steps Involved in Applying for a Home Equity Loan

The application process typically follows a structured sequence. Here are the main steps you can expect:

1. Assessment of Home Equity

Begin by determining your home equity. This can be calculated by subtracting your outstanding mortgage balance from your home’s current market value.

2. Research and Compare Lenders

Investigate various lenders to find competitive rates and terms. Consider factors such as customer service, reputation, and flexibility in loan options.

3. Gather Necessary Documentation

Prepare required documents such as proof of income, tax returns, credit reports, and details on the property.

4. Submit Application

Complete and submit the loan application with your chosen lender. This may involve an online form or paper submission.

5. Loan Processing

Once submitted, the lender will review your application, perform a credit check, and assess your financial history.

6. Appraisal

The lender may require an appraisal of your property to confirm its current market value.

7. Underwriting

In the underwriting stage, the lender evaluates all gathered information and makes a decision regarding loan approval.

8. Closing

If approved, you’ll receive a closing disclosure detailing the loan’s terms. You will then sign the closing documents and receive your funds.

The typical timeline for this process may vary, but generally, it can take anywhere from two to six weeks from application to closing, depending on the lender and the complexity of your financial situation.

Timeline for the Approval Process

The approval process consists of several stages, each with specific timeframes. Here is what you can typically expect:

| Stage | Expected Duration | Details |

|———————-|——————|—————————————————————————————————|

| Application Submission| 1-2 days | Complete and submit your application online or via paper.

|

| Processing | 3-5 days | Lender reviews documents and performs a credit check.

|

| Appraisal | 1-2 weeks | An appraiser evaluates your property and submits a report to the lender.

|

| Underwriting | 3-7 days | The underwriter analyzes the application and makes a decision. |

| Closing | 1 day | Finalize the loan, sign documents, and receive funds.

|

This timeline may vary based on lender workloads and individual circumstances.

Common Fees Associated with Home Equity Loans

When applying for a home equity loan, borrowers should be aware of various fees that may apply. Understanding these fees is essential for budgeting and financial planning.

Here is a table summarizing common fees associated with home equity loans:

| Fee Type | Amount | Who Pays | Notes |

|---|---|---|---|

| Application Fee | $0 – $500 | Borrower | Charged for processing the loan application. |

| Appraisal Fee | $300 – $600 | Borrower | Covers the cost of property valuation. |

| Origination Fee | 1%

|

Borrower | Fee for processing the loan and preparing documents. |

| Closing Costs | 2%

|

Borrower | Includes various fees such as title insurance and recording fees. |

Understanding these fees helps borrowers prepare for the total cost of obtaining a home equity loan, ensuring there are no surprises during the closing process.

Wrap-Up

In summary, understanding the Lowest Home Equity Loan Rates enables homeowners to make well-informed financial decisions that can significantly impact their futures. By being aware of the current market landscape and employing strategies to secure the best rates, individuals can maximize their home equity and achieve their financial goals. Whether considering a home equity loan or exploring alternative financing options, knowledge is the key to unlocking opportunities and ensuring a successful borrowing experience.

FAQ Explained

What is the difference between a home equity loan and a HELOC?

A home equity loan provides a lump sum with a fixed interest rate, while a HELOC allows for borrowing against home equity as needed, often with a variable interest rate.

Can I use a home equity loan for any purpose?

Yes, homeowners can use a home equity loan for various purposes, such as home renovations, debt consolidation, or funding education.

How does my credit score affect my home equity loan rate?

A higher credit score typically results in lower interest rates, as it indicates to lenders a lower risk of default.

Are there any fees associated with home equity loans?

Yes, common fees may include application fees, appraisal fees, and closing costs, which vary by lender.

What happens if I cannot repay my home equity loan?

Failing to repay a home equity loan can lead to foreclosure, as the loan is secured by your home.