Renters Insurance Quotes are essential for safeguarding personal belongings and providing peace of mind for tenants. With a variety of coverage options and competitive pricing, securing the right policy can protect you from unforeseen events such as theft, fire, or water damage.

This introduction to renters insurance delves into its importance, typical coverage options, and common exclusions, equipping readers with the necessary knowledge to make informed decisions. By understanding how to obtain and evaluate quotes, as well as recognizing the factors that influence pricing, tenants can better navigate the insurance landscape.

Understanding Renters Insurance

Renters insurance is a vital policy for anyone who rents a home or apartment. It provides financial protection for personal belongings, liability coverage, and additional living expenses in case of certain losses. Understanding the purpose and importance of renters insurance ensures that tenants can safeguard their possessions and manage unexpected events effectively.Renters insurance primarily protects tenants from financial losses resulting from theft, fire, or specific disasters.

The importance of this coverage cannot be overstated, as it not only covers personal property but also shields against liability claims if someone is injured in your rented space. Most landlords require tenants to have renters insurance as a condition of the lease, reinforcing its significance in rental agreements.

Typical Coverage Options in Renters Insurance Policies

Renters insurance policies typically encompass several essential coverage options that protect tenants in various situations. Understanding these coverage options can help individuals select the most suitable policy for their needs.

- Personal Property Coverage: This is the core component of renters insurance, covering the loss or damage of personal belongings due to events like theft, fire, or vandalism. For example, if a tenant’s laptop is stolen, personal property coverage will help recover the cost of the device up to the policy limit.

- Liability Coverage: This protection is crucial for covering legal expenses if a tenant is found liable for injuries or damages to others. For instance, if a guest slips and falls in the rented property, liability coverage can help pay for medical bills and legal fees.

- Additional Living Expenses: If a rental unit becomes uninhabitable due to a covered loss, this coverage assists in paying for temporary housing and other related expenses, ensuring that tenants are not financially burdened during recovery.

Common Exclusions Found in Renters Insurance

While renters insurance offers essential protection, it is also important to be aware of common exclusions that may not be covered by standard policies. Understanding these exclusions helps tenants avoid surprises in the event of a claim.

- Natural Disasters: Many renters insurance policies do not cover damages from natural disasters such as floods or earthquakes. Tenants in these areas may need to purchase separate policies to ensure comprehensive coverage.

- Valuable Items: Certain high-value items, such as jewelry, art, or collectibles, may be excluded or have limited coverage. Tenants may need to add scheduled personal property endorsements for full protection.

- Negligence: Damages resulting from the tenant’s negligence, such as leaving a window open during a storm, may not be covered under renters insurance. It is crucial to maintain responsible habits to avoid such exclusions.

How to Obtain Renters Insurance Quotes

Gathering renters insurance quotes is an essential step in securing the right coverage for your needs. This process not only helps you understand the available options but also allows you to identify the most suitable policy at a competitive price. By following a systematic approach, you can ensure that you obtain comprehensive quotes from various insurance providers.The first step in obtaining renters insurance quotes involves researching different insurance companies that offer renters insurance.

It is beneficial to identify a diverse range of providers to ensure you receive a variety of quotes. Additionally, utilizing online platforms can streamline this process, allowing you to access multiple quotes quickly and efficiently.

Steps to Gather Renters Insurance Quotes

To facilitate the gathering of renters insurance quotes, it is important to follow a structured approach. The following steps Artikel the necessary actions to take:

- Identify Your Needs: Assess your personal belongings and determine the value of items you wish to insure. This will help you choose the appropriate coverage amount.

- Gather Information: Prepare relevant information that insurers will require. This includes details such as your address, rental history, any prior claims, and information about the security features of your residence.

- Research Providers: Look for reputable insurance companies that specialize in renters insurance. Read reviews and check ratings to ensure reliability.

- Request Quotes: Contact each provider to request quotes. Many companies offer online forms that can expedite this process.

- Compare Quotes: Once you have received multiple quotes, compare them carefully. Look beyond the price; consider the coverage limits, deductibles, and any additional benefits offered.

Comparing multiple quotes is crucial as it allows you to evaluate the differences in coverage and pricing effectively. It is commonplace for quotes to vary significantly based on the insurer’s underwriting process and the specific coverage options included. By examining several quotes, you can identify the policy that offers the best value for your needs.

Required Information for Requesting Quotes

When requesting renters insurance quotes, certain information is universally required by insurance providers to generate accurate and comprehensive estimates. Having this information ready can facilitate the process:

- Personal Information: Full name, date of birth, and contact details are typically required to create your profile.

- Property Details: Your rental address, type of dwelling (apartment, house, etc.), and any relevant details about the property itself.

- Insurance History: Information about any prior renters insurance policies held and any claims made in the past.

- Contents Value: An estimate of the value of your personal property, including furniture, electronics, and other belongings.

- Security Features: Details regarding security systems, smoke detectors, and other safety measures in place at the residence.

Providing complete and accurate information not only helps in receiving precise quotes but also ensures that you are presented with coverage options tailored to your specific situation. Engaging with multiple insurers allows for a thorough understanding of the market, empowering you to make an informed decision regarding your renters insurance needs.

Factors Influencing Renters Insurance Quotes

Renters insurance quotes can vary significantly based on a variety of factors. Understanding these elements is crucial for obtaining accurate quotes and making informed decisions regarding coverage. By recognizing the determinants that influence premium costs, renters can better assess their options and find the most suitable policy for their needs.One of the primary aspects affecting renters insurance quotes is the location of the rental property.

Different geographic areas present varying risks, which insurers evaluate when determining premiums. Factors such as local crime rates, weather patterns, and proximity to fire services all play a significant role in shaping insurance costs.

Impact of Location on Renters Insurance Quotes

The influence of location extends beyond mere geographic coordinates; it encompasses numerous risk factors associated with specific regions. Here are the key considerations:

- Crime Rates: Areas with higher crime rates often lead to increased premiums due to the greater likelihood of theft or vandalism.

- Natural Disasters: Locations prone to natural disasters, such as floods or earthquakes, may face higher insurance costs to account for the potential damage.

- Proximity to Emergency Services: Properties closer to fire stations or police departments may benefit from lower premiums, as swift response can mitigate damages during emergencies.

Benefits of Security Features in Rental Properties

Incorporating security features into a rental property not only provides peace of mind but also has a favorable impact on renters insurance quotes. Insurance companies view these enhancements as risk mitigators. The presence of security measures can lead to reduced premiums, as they decrease the likelihood of incidents such as theft or property damage.Key benefits associated with security features include:

- Alarm Systems: Properties equipped with alarm systems are often eligible for discounts on premiums, as they deter potential intruders.

- Secure Locks: High-quality locks and deadbolts can enhance security, potentially lowering insurance costs.

- Surveillance Cameras: The presence of surveillance cameras can deter criminal activity, leading insurers to offer better rates.

- Gated Access: Rental properties with gated access or controlled entry points are perceived as lower risk, often resulting in better quotes.

“Insurance companies reward proactive measures that reduce risk, translating to savings on premiums for the policyholder.”

Evaluating Renters Insurance Quotes

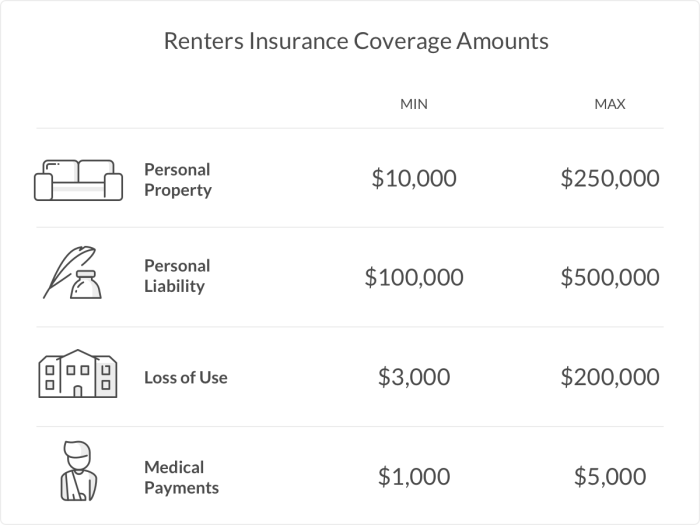

When considering renters insurance, understanding the various components of the quotes you receive is essential. Evaluating these quotes can help you make informed decisions about the coverage that best meets your needs. It involves analyzing coverage limits, comparing deductible options, and exploring available add-ons to ensure you are adequately protected without overspending.Analyzing the coverage limits presented in quotes is a critical step in the evaluation process.

Coverage limits define the maximum amount your insurance policy will pay for covered losses. Each quote may present different coverage amounts for personal property, liability, and additional living expenses. It is advisable to assess your personal belongings’ value and ensure that the coverage limits in the quotes adequately reflect your needs.

Comparison of Deductible Options

Comparing deductible options is also vital since it directly influences your premium costs. A deductible is the amount you must pay out of pocket before your insurance coverage kicks in. Generally, higher deductibles lead to lower premium rates, while lower deductibles result in higher premiums. Evaluating your financial situation and risk tolerance can guide your decision on which deductible option to choose.

For instance, if you can comfortably cover a higher deductible in case of a claim, opting for a higher deductible could save you money on premiums over time.

Available Add-Ons for Renters Insurance Policies

Many renters insurance policies offer add-ons that can enhance your coverage. These additional options can provide vital protection depending on your lifestyle and needs. Below is a table listing common add-ons available with renters insurance policies:

| Add-On | Description |

|---|---|

| Replacement Cost Coverage | Covers the cost to replace items at current market value without depreciation. |

| Personal Liability Coverage | Protects against legal claims and expenses if someone is injured in your rented property. |

| Additional Living Expenses | Covers costs for temporary housing if your rental becomes uninhabitable due to a covered loss. |

| Identity Theft Protection | Offers assistance and coverage related to identity theft incidents. |

| Pet Damage Liability | Covers damages caused by pets to the rental property. |

Common Misconceptions About Renters Insurance

Source: savingfreak.com

Many individuals hold misconceptions regarding renters insurance, which can ultimately deter them from obtaining this essential coverage. Understanding these myths is crucial for potential renters to make informed decisions about their personal property protection. This section aims to clarify these misconceptions, highlighting the importance of renters insurance even for those with seemingly low-value possessions.One widespread belief is that renters insurance is unnecessary for individuals with low-value possessions.

This misconception can lead to significant financial repercussions, as the cumulative value of personal items can exceed expectations. For example, while one may perceive their furniture, clothing, and electronics as low-value, the potential costs of replacing these items can be substantial in the event of theft or damage.

Real-life Scenarios Demonstrating the Need for Renters Insurance

Considering the potential risks, it is essential to recognize instances where renters insurance has provided invaluable assistance. Here are scenarios that illustrate the critical nature of having this coverage:

- A young professional experiences a fire in their apartment, resulting in the loss of furniture, clothing, and personal electronics. While the total cost of these items was believed to be minimal, the real expense amounted to over $15,000. Renters insurance covered the replacement costs, alleviating financial strain.

- A college student’s apartment is burglarized during the summer break, leading to the theft of a laptop and various personal belongings. The total loss was estimated at $3,000. The student’s renters insurance policy provided the necessary funds to replace the stolen items, allowing them to continue their studies without significant interruption.

- A family in a rental home experiences water damage due to a burst pipe, damaging their electronics and furniture. Despite believing they could manage the repairs and replacements themselves, the financial burden exceeded $10,000. Renters insurance stepped in to cover the cost of repairs and replacements, showcasing its vital role in financial security.

“Renters insurance is not just about protecting high-value items; it’s about safeguarding your peace of mind and financial stability.”

Tips for Lowering Renters Insurance Quotes

Source: einsurance.com

Renters insurance is an essential safeguard for protecting personal belongings and providing liability coverage. However, insurance premiums can vary significantly based on several factors. To help you reduce your renters insurance quotes, a few strategies can be employed that not only lower costs but also enhance your overall coverage.

Increasing Deductibles to Reduce Premiums

One effective strategy for decreasing renters insurance premiums is to opt for a higher deductible. A deductible is the amount you agree to pay out-of-pocket before your insurance coverage kicks in. By choosing a higher deductible, you can lower your monthly premium significantly. For example, if you increase your deductible from $250 to $500, you might see a reduction in your premium by 10% to 20%.

This approach works best if you have the financial capacity to cover the higher deductible in case of a claim.

“Opting for a higher deductible can lead to lower monthly premiums, but ensure you can cover the amount in the event of a claim.”

Bundling Renters Insurance with Other Insurance Policies

Bundling multiple insurance policies with the same provider often results in substantial discounts. Many insurers offer reduced rates for customers who choose to combine renters insurance with auto, life, or other types of insurance. This strategy not only simplifies your insurance management—having a single point of contact for all policies—but also allows you to take advantage of savings typically ranging from 5% to 25%.

“Bundling policies can lead to significant savings, enhancing both affordability and convenience.”

Safety Measures for Discounts

Implementing safety measures in your rental property can qualify you for various discounts on your renters insurance premiums. Insurers often reward policyholders who take proactive steps to enhance security. Here are some common safety measures that may lead to potential discounts:

Smoke Detectors

Installing smoke detectors can reduce risks of fire damage and qualify you for discounts.

Security Systems

A monitored security system can deter theft and may provide substantial discounts on your premiums.

Deadbolt Locks

Upgrading to deadbolt locks enhances security and may qualify you for lower rates.

Fire Extinguishers

Having fire extinguishers readily available can demonstrate your commitment to safety, possibly lowering your premium.

Surge Protectors

Using surge protectors can safeguard electronic devices and may qualify for discounts related to electrical safety.Investing in these measures not only protects your belongings but also instills confidence in your insurance provider, translating into lower premiums.

“Implementing safety measures can lead to discounts, reflecting your proactive approach to protecting your property.”

The Claims Process for Renters Insurance

Filing a claim with renters insurance is a critical process that provides financial protection in times of loss or damage. Understanding the steps involved and being prepared can make the experience smoother and less stressful for policyholders. Below are the essential steps to follow when filing a claim, along with common reasons claims may be denied and tips for documenting losses effectively.

Steps for Filing a Claim

Initiating a claim may seem daunting, but breaking it down into manageable steps can simplify the process. Here are the key actions to take when filing a claim with renters insurance:

- Contact Your Insurance Provider: Report the incident to your insurance company as soon as possible, either by phone or online. Make sure to provide all necessary details.

- Gather Information: Collect relevant information related to the claim, including your policy number, date of the incident, and a description of what happened.

- Document the Damage: Take clear photographs or videos of any damage or loss. This visual evidence will be crucial for your claim.

- Submit the Claim: Complete the claim form provided by your insurance company, attaching all required documentation, such as photos and receipts.

- Follow Up: After submission, maintain communication with your insurance adjuster to ensure that your claim is being processed in a timely manner.

Common Reasons for Claim Denials

Being aware of potential pitfalls in the claims process can help policyholders avoid disappointment. Understanding common reasons for claim denials can prepare individuals for a smoother experience.

- Policy Exclusions: Claims may be denied if the incident falls under a specific exclusion in the policy, such as certain types of natural disasters.

- Insufficient Documentation: A lack of adequate evidence, such as missing receipts or photographs, can lead to denied claims.

- Failure to Report Timely: Most insurance policies require that claims be reported within a specific timeframe. Delaying reporting can result in denial.

- Non-Payment of Premiums: If premiums have not been paid, the policy may be deemed inactive at the time of the claim, leading to denial.

Effective Documentation for Claims

Proper documentation is vital in supporting a claim and ensuring a favorable outcome. Here are some effective strategies for documenting losses:

Thorough documentation not only strengthens your claim but also expedites the process.

- Maintain an Inventory: Keep a detailed inventory of your personal belongings, including photos, descriptions, and purchase dates. This can help substantiate claims for stolen or damaged items.

- Compile Receipts: Save receipts for valuable items, as they serve as proof of ownership and value.

- Record Witness Statements: If applicable, document statements from witnesses that can support your claim regarding the incident.

- Keep a Journal: Write a detailed account of the incident, including dates, times, and any conversations with your insurer or witnesses.

Final Summary

Source: lemonade.com

In conclusion, Renters Insurance Quotes serve as a crucial tool for tenants to safeguard their possessions and financial well-being. By assessing various quotes, understanding coverage limits, and debunking common misconceptions, individuals are empowered to make choices that best suit their needs. Ultimately, renters insurance is not just a financial product; it is a vital component of responsible renting.

FAQ Summary

What is renters insurance?

Renters insurance is a type of policy that protects tenants’ personal belongings within a rental property from risks such as theft, fire, or water damage.

Is renters insurance mandatory?

No, renters insurance is not mandatory by law, but many landlords require it as a condition of the lease.

How much coverage do I need?

The amount of coverage needed typically depends on the value of your personal belongings, so it’s advisable to conduct a home inventory to assess this.

Can I get renters insurance with a pet?

Yes, many renters insurance policies cover pet-related damages, but some providers may impose restrictions or additional premiums based on the type of pet.

How often should I review my renters insurance policy?

It is recommended to review your renters insurance policy annually or whenever significant changes occur, such as acquiring new valuables or moving to a new location.